[Technical Indicators] - Crypto Academy / S4W2- Homework Post for @reminiscence01

.png)

Hello everyone, I am happy to be in Season 4 of Crypto Academy. Let's continue to work together to improve this community.

In this assignment, I will explain Technical Indicators and talk about the aspects that will help us when analyzing the cryptocurrency exchange. I wish you pleasant reading.

a)In your own words, explain Technical indicators and why it is a good technical analysis tool.

b) Are technical indicators good for cryptocurrency analysis? Explain your answer.

c) Illustrate how to add indicators on the chart and also how to configure them. (Screenshot needed).

a) Explain the different categories of Technical indicators and give an example of each category. Also, show the indicators used as an example on your chart. (Screenshot needed).

b) Briefly explain the reason why indicators are not advisable to be used as a standalone tool for technical analysis.

c) Explain how an investor can increase the success rate of a technical indicator signal.

1. a) In your own words, explain Technical indicators and why it is a good technical analysis tool.

Future price movements in the cryptocurrency market can be predicted with some mathematical calculations, as they may occur in a similar structure to their past prices. Some indicators are used as an auxiliary tool to calculate the direction of the price and whether the trend structure will continue. That's why technical indicators are one of the most important (be not indispensable) helpers for a trader.

Technical indicators are useful for predicting future prices. If a trader develops his strategy on that indicator after finding the most suitable one out of hundreds of indicators, he is likely to make a successful trade. A trader is free to make faster and more accurate price and trend predictions by using some of the technical indicators in concert with each other.

Technical indicators can be used to determine the volume of the asset, predict trend formations, identify overbought and oversold zones, and create support and resistance zones.

Technical Indicators have different branches as Oscillators and Indicators.

- Oscillators generally have a zero line that generates certain signals.

- In Indicators, Mathematical calculations of past price movements are made, and certain averages are taken and future price predictions are created.

1. b) Are technical indicators good for cryptocurrency analysis? Explain your answer.

Although there are recessions in the cryptocurrency market from time to time, prices are in a constant state of fluctuation. Ups and downs indicate that the price is in a constant fluctuation. That's why technical indicators are very important tools for the trader to make price predictions. Because using some indicators together with technical analysis to make a good price analysis will increase the success rate of the result. So, in my opinion, the benefits of technical indicators for the cryptocurrency market are undeniable.

For example; A chart with support and resistance levels is a chart that has been studied with technical analysis. If approval is obtained from auxiliary indicators on top of this analysis, it will be less risky to enter the trade and the exit point of the trade will be determined more easily since the price movement that will occur can be predicted.

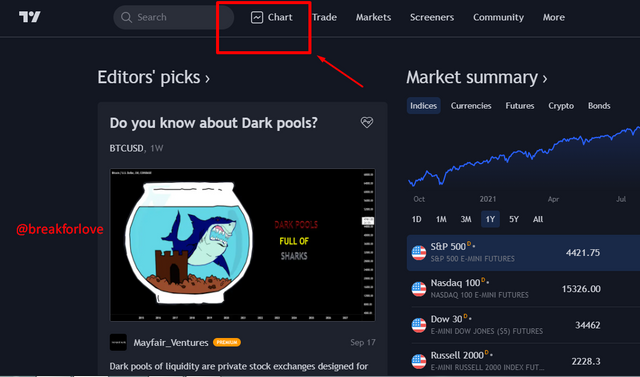

1. c) Illustrate how to add indicators on the chart and also how to configure them.

Now I will give you tips on how to add indicators on Tradingview

- After logging into Tradingview, we click on the Chart section of the screen that appears.

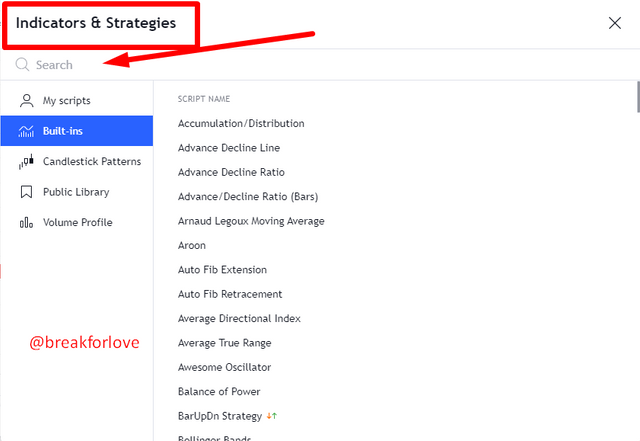

- As the next action, we click on the area that says Fx.

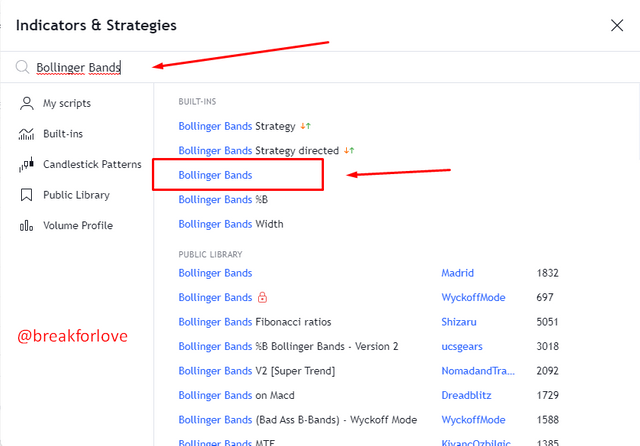

- A page called Indicators & Strategies appears us. Here we write the name of the indicator we want to use in the Search section.

- When you click on the indicator, you will see that it has been added to your chart.

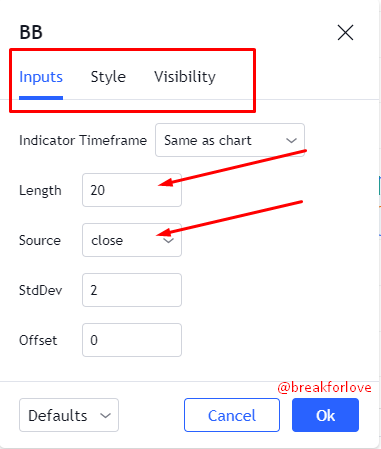

- If you want to adjust the settings of your indicator according to your own strategy, click on the Settings section on the left side where your indicator is located.

2. a) Explain the different categories of Technical indicators and give an example of each category. Also, show the indicators used as an example on your chart.

There are many types of technical indicators. In general, there are 3 major types of indicators. Some are used to determine the trend, some to determine the volume of the price, and some to show a trend reversal signal. Now I will talk about some types of indicators.

Trend indicators show market movements within a particular trend. Thanks to these indicators, the direction of the trend is determined and the course of the market is predicted. Some values are formed as high and low values and are helpful in entering the trade. Some of these indicators are:

- Moving Averages

- Parabolic SAR

- Average Directional Index ( ADX)

- Ichimoku Kinko Hyo

Volatility indicators are important indicators used in price analysis. Because on the chart, prices move in certain waves. If volatility is low, pattern formations are delayed, taking risks impatiently to take a position. But volatility is one of the most important tools for a trader. The up and down movements of the price during its volatility are supported by some indicators, giving the opportunity to enter the trade. But volatility does not predict the course of the price, you only predict the price range. Some volatility indicators are;

- Bollinger Bands

- Average True Range (ATR)

- Ichimoku Clouds

If you are in this market, you know that prices will not always be on the rise or fall. Prices move in certain waves and tend to fall when they get too high. Likewise, a price that has fallen too low will necessarily rise. Here, momentum indicators show whether the price will reverse or continue its current trend. It allows you to understand if the price has reached the saturation point. So you can catch highs and lows in price. In addition, overbought zones are suitable for selling, and oversold zones are suitable for buying. Some important momentum indicators are:

- Relative Strength Index (RSI)

- Stochastic

- Moving Average Convergence Divergence (MACD)

- Rate of Change

2. b) Briefly explain the reason why indicators are not advisable to be used as a standalone tool for technical analysis.

Basic indicators are only auxiliary tools. Transactions in the crypto and other markets are markets with certain risks, with plenty of profit, but with losses at the same time. That's why every trader should open trades according to his risk threshold. Despite all these risks, it is extremely wrong to open trades only according to technical indicators and can cause great losses if applied. Because these indicators never have 100% accuracy. There are margins of error. Therefore, it will be more beneficial if a trader combines the indicators he will use with his technical and fundamental analysis and uses them as auxiliary signals. In fact, sometimes using a few indicators as an aid can pave the way for more profitable transactions.

2. c) Explain how an investor can increase the success rate of a technical indicator signal.

In order to increase the success rate of an investor, he must learn the indicator he will use well. In addition, since the accuracy of the signals given by the indicators is not certain, it will be useful to combine them with several indicators. First of all, the tricks of the indicator should be researched. It is wrong to use an indicator with only heard information without learning how it works.

Let's take the MACD indicator for example. Suppose the trader sees a buy signal from the upper band of the 0 line. However, although this buy signal is confirmed for a short time, it may not be a strong buy signal. A buy signal that creates an uptrend in the lower band of the 0 line on the MACD indicator and a buy signal in the upper band may not be the same.

Let's give another example over the RSI indicator. Seeing a buy signal while there is more to the RSI 30 levels where excessive selling pressure is seen does not indicate that the price will definitely go up from there. It is expected to go further below 30 levels for certainty. In other words, the investor should also analyze the indicator he will use well and experience it by making a few tries.

Technical indicators are one of the biggest helpers of an investor. Investors are free to find and use the most suitable indicator for them. Some use the super trend, some trade with the RSI and MACD indicators. The indicators that I would call indispensable are RSI and Volume. I have learned the tricks of these indicators by analyzing them well, and I always use them as an aid in chart analysis. But that doesn't mean I just open trades with them. We must account for margins of error and never, ever fully trust. Also, we don't have to use all the indicators. This method may increase the risk of error due to the differences and inaccuracies of the signals. The important thing is to find the one that fits your strategy.

Thank you for reading.

CC: @reminiscence01

Hello @breakforlove, I’m glad you participated in the 2nd week Season 4 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Observations:

This is correct.

Recommendation/Feedback:

This was a Superb content. Keep up the good work

Thank you @reminiscence01,

I'll do my best on coming courses as well