Steemit Crypto Academy Season 2 Week 2 Homework Post for @kouba01

Dear Steemians,

I am pleased to be part of this week's lesson. I thank professor @kouba01 for giving us this excellent lecture on Cryptocurrency Contracts For Difference (CFDs) Trading.

In his lecture, Professor @kouba01 talked a lot about cryptocurrency Contracts For Difference (CFDs) Trading, which he explained in depth.

After going through the notes and researching what I was taught, I have decided to review what I have learned in my homework task.

What is a cryptocurrency CFD?

Before we look at what cryptocurrency CFD is, I want us to first look at what cryptocurrency is,

Cryptocurrency is a digital currency that uses a decentralized system called the blockchain network to carry out highly secured financial transactions. Unlike the traditional banks, where the central body of the bank control all transactions, with cryptocurrency, you have access to your asset at any time you want, and you can also choose what to do with it later.

Transferring crypto to someone online does not need any go-between agent. Currently, there are a lot of cryptocurrencies available. Some of them are Steem, BTC, ETH, and many more are.

CFD is a trading technique in which a trader goes into a contract with a CFD broker rather than directly purchasing the underlying asset. The two parties have to agree on the market condition before accepting the contract.

Cryptocurrency CFDs are a complex financial method of trading where a trader goes into a contract with a broker to trade and invest in an asset without buying it directly from the market.

CFDs are generally offered with leverage, requiring you to put down part of the investment's total value. However, leverage also has a significant impact on the price changes on both profits and losses. This clearly shows that you can profit when the price goes in favor of you; likewise, you can also lose if the price fluctuates.

Cryptocurrencies are not issued or backed by a central bank or government, and their price volatility for the past years makes their price increase or decrease at any time.

Cryptocurrency CFDs are a very high-risk, speculative investment. You should be informed of the risks involved and thoroughly analyze whether investing in cryptocurrency CFDs is suitable for you.

Advantages of cryptocurrency CFDs

With CFDs, the trader does not have to go through the tedious process of buying or securing digital coins.

Fiat currencies can be used to trade the cryptocurrencies using the underlying CFDs.There is a high chance of gaining profit when the value of the assets rise.

A trader can capitalize on the leverage and margin to trade a huge amount of money.

Disadvantages of cryptocurrency CFDs

There will be a great loss if the margin trading and its effect are poorly managed.

At times, the amount of financial fees exceeds the profits made through the contract period.

The is a High of great loss if a trader does not have sufficient funds in your trading account during the marginal and market changes of the asset.

How do I determine if cryptocurrency CFDs are suitable for my trading strategy?

Because of how volatile the cryptocurrency is, sometimes it is not easy to predict what will happen to the price change in the next couple of minutes, hours, or even days; this is why one needs to be analytical in his or her strategy to minimize losses and maximize gains.

We all have our trading strategy; that is why you should consider some factors before going into cryptocurrency CFDs.

Some of the factors to consider to know if a particular cryptocurrency CFD is best for your trading technique.

The crypto space is very volatile; anything can happen anything; this is why investors need to have a short-term plan for their trading strategy. This one can prevent huge losses.

Every Cryptocurrency CFDs has its strategy; this is why an investor needs to check if their cryptocurrency CFDs are suitable for their trading strategy.Buying cryptocurrency is quite expensive for the associate; that is one thing an investor has to know. This will help you know what you are dealing with and know if your cryptocurrency CFDs are best for your trading strategy.

Going in for small and winning is better than going for extensive and losing. Focusing on winning small price changes is the first thing an investor should consider. This will help one to know if his cryptocurrency CFDs best suit his trading strategy.Trading with parties that provide a secure trading environment through regulated CFD brokers is one investor's need. With this, investors can know if the cryptocurrency CFDs are suited to their trading strategy.

Are CFDs risky financial products?

An investor can deposit a small amount and make a considerable profit; that is the same way he can also incur losses.

Despite the numerous benefits of trading cryptocurrency CFDs, some disadvantages also involve, which make it risky.

Every trading involves risk, not only CFD trading. CFDs are highly leveraged, leading to more significant profit on smaller deposits; likewise, it is also possible to incur losses more than your initial deposit.

Due to market gapping, one will not be assured and will not always be filled at the level he requested in volatile markets. Many CFD providers have a commission charge. This is why Investors should have to look at the price of commissions.

As with any product or trading that involves cryptocurrency, CFDs are very risky.

Do all brokers offer cryptocurrency CFDs?

No, the crypto space has made it possible to make transactions without a broker. People can easily make transactions without paying any fees to a "middle man" or an agent.

This is why not all brokers provide cryptocurrency CFDs.

eToro, TIO, Market, BitMEX, XBTFX, etc., are some examples of brokers who offer CFD cryptocurrency trading.

Explain how you can trade with cryptocurrency CFDs on one of the brokers (Using a demo account).

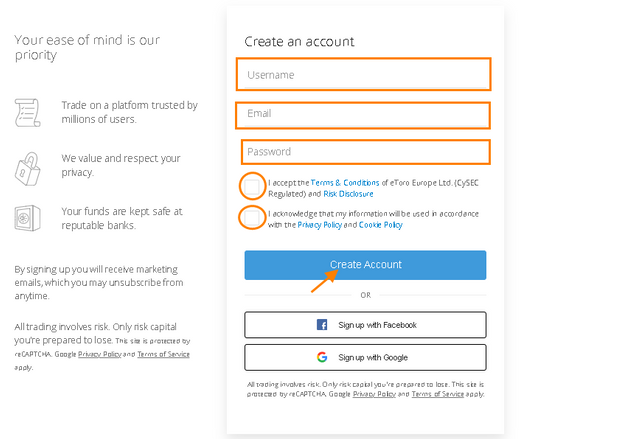

To trade cryptocurrency CFDs on eToro using a demo account, You have first to create an account.

Click on the link https://www.etoro.com/ to the official website and

Fill in your particulars and create an account.

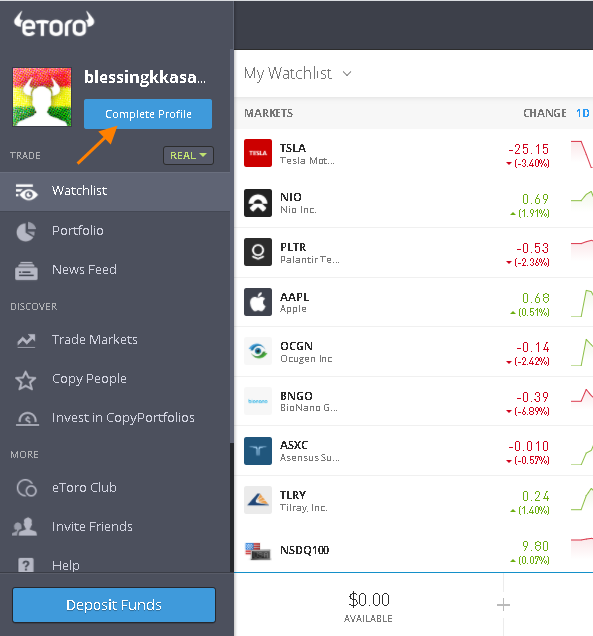

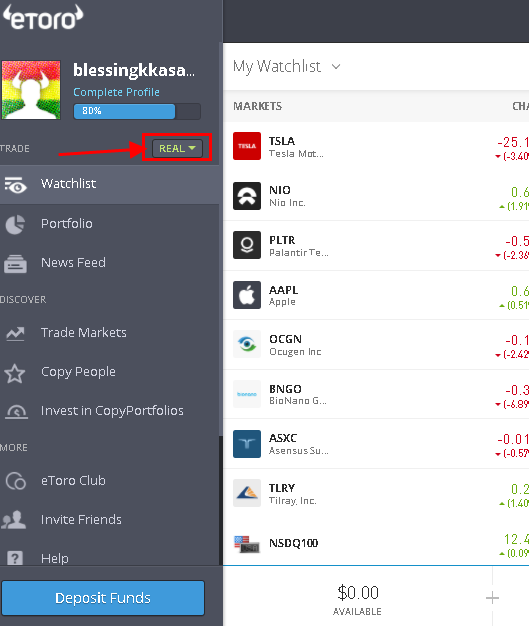

You need to complete your profile before proceeding and on that and do so

Click on that and change from real to virtual.

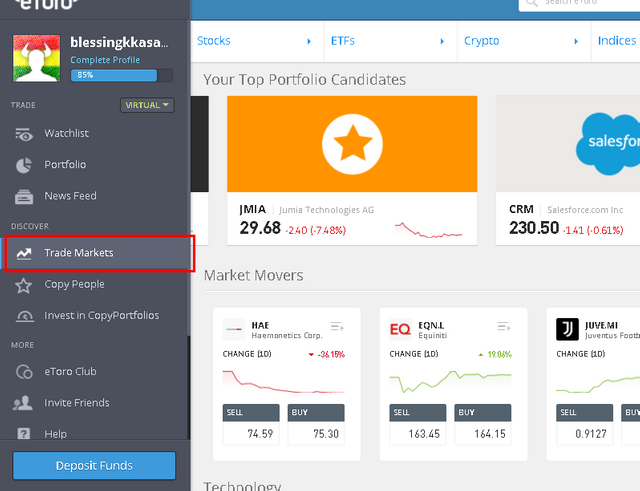

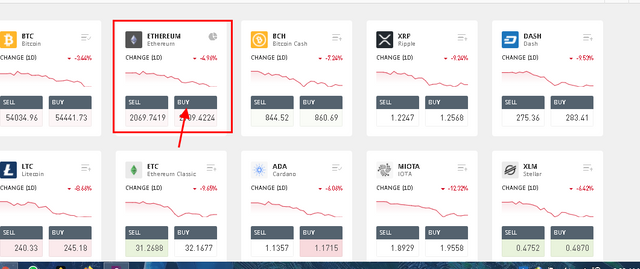

Go to trade markets and select any coin that you want to use.

For this illustration, I am using ETH.

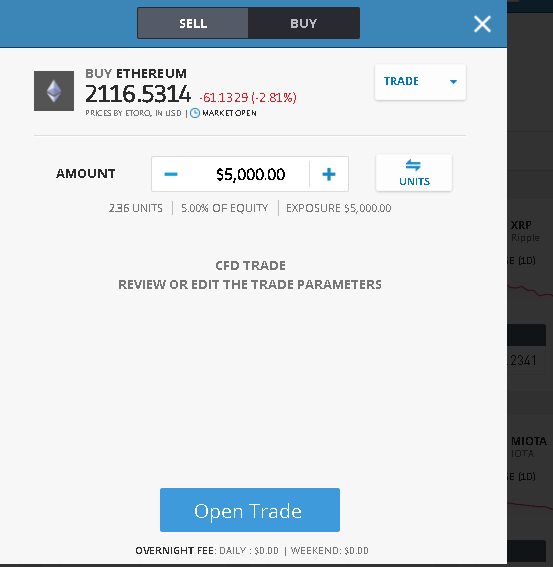

Click on "Open trade" to proceed.

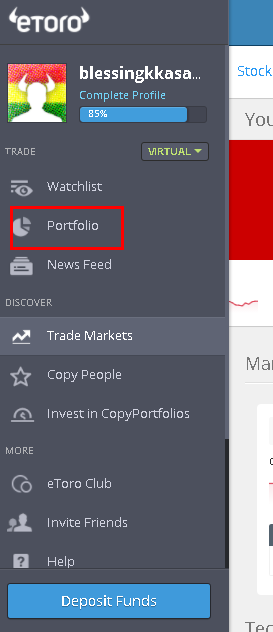

Go to portfolio

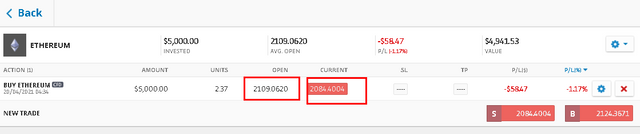

From the below, I bought 2109.0620ETH for 5000Dollars but currently the price around 2083.4004ETH.

If the price exceeds our available price, then we have made some profit.

Conclusion

Anyone who wants to go into Cryptocurrency CFDs trading should consider all the possible risks. This is good for those who have less capital but wants to make more money within a short time.

This comes with carefulness, and it is advisable to consult any experts for technical advice before starting.

Thank you for reading

Hi @blessingkasabe

Thanks for your participation in the Steemit Crypto Academy

Feedback

This is good work. well done with your research study on Cryptocurrency CFDs

Homework task

7