{Steemit Crypto Academy - Season 2, Week 8} The Wyckoff Method - El Método Wyckoff

1.Share your understanding on "Composite Man" and the fundamental laws. What's your point of view on them?By using Composite Man So instead of losing hopes and leaving the market with a loss we can actually dig in deeper, enter the market, identify the directions and movements and come out with profits,The answer was given to us by MR Richard Wyckoff in the form Wyckoff Method and Now what is The Wyckoff Method, how do we apply it and how do we use it to get quick profits.

The composite man lures the traders to invest in an asset in which he Composite man has already stockpiled lots of shares by already investing in them, thus displaying his assets by creating an appearance of a broad market

The composite man is a theory proposed by Wickoff that tells us the important manipulation by the theory composite man and about the movements that occur in market prices, and the idea of to always carry out the movements according to the movements made by the man compound theory, because if we understood this, every time the compound man wins, you will also win, on the contrary, if you do not understand the compound man's method, by performing your movements different from those of the compound man, he will win and you will lose.

Wholesale investors like big investors or wales normally aim to make investments in which they multiply their cryptocurrency or any other market, on many occasions it happens to small investors that there are almost always upward or downward trends of what we invest or simply due to the volatility of the currency to be invested, there are losses or the expected profits are not given, this is due to the way of operating that is often not the most appropriate, An easier way to understand the method is as follows, suppose that there are very wealthy investors, and they carry out trading with the purpose of obtaining large sums of profits, through the accumulation and distribution of shares, in this case, we call these large investors the composite man, although this figure is imaginary, the behavior of the market will make us see the behavior of this composite man, seeing the appropriate signals and being attentive to the movements made by these large investors will make us prosperous as long as the Wickoff method is followed.

The composite man could be said to be an imaginary representation of a single person, where in reality there are many people with different investment power acting in the same way following a pattern. which is sometimes dictated by the most powerful of all.

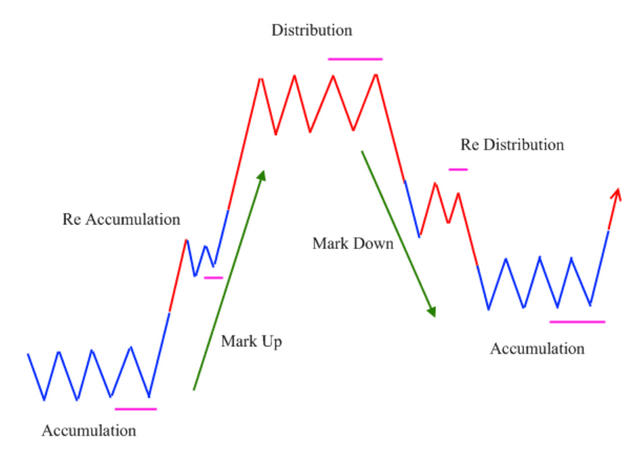

In the Composite Man performs there 4 phases.- Accumulation

The composite man tries to seize the largest number of assets, that is, the big one is at its precise moment to gain authority, in this case of the cryptocurrency that is being bought with the purpose of being one of the largest holders of the same before it is acquired by the rest of the small investors, in this phase the volume and the price do not suffer many variations and The Composite man will attract the investors and tempt them to buy the assets at a lower price that he has been gathering the assets on.

- Bullish trend

A common concept of supply/demand in any market or in the cryptocurrency market. If a Crypto trader or any other trader has accumulated all the assets, a scarcity is meant to take place. The Composite man will basically control the prices and make them go up. When investors notice a rise in the price of any particular assets they surely will be tempted and will buy the cryptocurrency this increasing the demand in the market which will make the trend go uptrend, The currency's escalation begins and this is given to the amount of demand for it, the purpose of the composite man is to make the price rise and with this the number of new investors, in this uptrend phase It can be noticed in some cases, that there are reaccumulation processes, this usually has volume peaks, although it must be clear that not necessarily all upward trends must be accompanied by a greater volume of negotiation, it must be clear that the difference between accumulation and reaccumulation is that the first one begins by stopping a downward movement while the second one begins after the stop of an upward movement

- Distribution

The process of sale and distribution of cryptocurrency by the composite man takes place in this scenario, and it is there where the bears try to regain authority through the purchase of the cryptocurrency, the composite man already takes a step forward why It sells at a slightly higher price than it initially bought, Like the accumulation process in the price action of the charts is flat, and in the Distribution phase, we will once again observe the sideways movement of the chart, that is because the composite man will start selling the cryptocurrency at the highest prices possible before a downtrend or before the market goes down gets started as the demands till then would have been completely met.

- Bearish trend

This is where the Composite man will force the market towards a bearish trend meaning downtrend, the price will be lowered which will leave the investors in a position where they will try to exit the market without having losses. All the investors in the market will sell their owned cryptocurrency or stock which will increase the supply and we will see a huge downtrend it becomes the market fall of that asset or cryptocurrency or stock, a bear market Bearish trend tells us that the downtrend begins after the distribution process, in this phase the supply is higher than the demand and the composite man will try to do everything possible to make the downtrend appear, that is where the euphoria of the small investors why their cryptocurrency or stock are practically sinking, the downtrend has no going back.

This picture that will further clarify the explanation that we all need this picture reference is taken by the professor @fendit post.

source

So in short, we have to completely analyze the market. Understand all 4 phases of the Wyckoff Method and take assistance from the indicators, and you'll have a higher chance of profits. before jumping into the market for trading.

The fundamental laws that govern the Composite ManThere are three fundamental are in Composite Man

- supply and demand

- Cause and effect

- effort vs Result

Let us see the 3 fundamental law of Composite Man one by one

1.supply and demand

For example, just Imagine a new cryptocurrency has released spread out in a particular market to buy that cryptocurrency need to stay another cryptocurrency. The demand for that cryptocurrency skyrockets. Everyone wants to have that cryptocurrency and in no time there's a shortage of cryptocurrency. Now, what happens when there's a scarcity of some item and it's in huge demand, the price of that cryptocurrency goes up. If one market has that cryptocurrency that market will charge more money than its original price, taking advantage of that situation, The demand for cryptocurrency causes an uptrend as more and more people want to invest in them. Now when everyone has the cryptocurrency, and it is easily available, a downtrend starts taking place, When there is an equal amount of supply and demand the price of the cryptocurrency will be static and no sudden uptrends or downtrends will take place.

we must mention the importance of the prices movements due to supply and demand in the market, when supply is above demand the price will fall, on these circumstances, if the demand is above the supply the price will go up meaning of uptrend, it is like saying that if people see something cheap they want to buy it, but being highly bought it tends to rise in price. When it rises in price, those buyers become sellers simply everything will be reversed,

2.Cause and effect

Every cause results in an effect, and the greater the cause, the greater the effect, that is, cause and effect go hand in hand with accumulation and distribution, Accumulation leads to an increase and the price will increase, and distribution leads to a decrease and the price, in this case, will decrease. Reading the cause and effect will make the process of understanding the method easier for us movie in market.

Nothing happens without a reason. Everything leaves an effect like that Similarly in the cryptocurrency market it is connected. This law is connected to the previous and The effect is directly proportional to the cause. A large cause will result in a large effect and a small cause will produce a small effect, The accumulation and the distribution phases design the cause and the effect, and the Effect of the market results in an uptrend or a downtrend

3.Law of effort vs result

The effort of large investors is determined by their purchase and sale operations and it is there mainly where the volume is reflected. The volume tells us that large investors or what is the same, the composite man are waiting for a result. The absence or decrease in volume is indicative that the necessary effort is not being made, and for this reason, the result will not be the same. But if the effort produces the expected result, the market is said to move in harmony, The effort of an asset is its volume, The volume moves the price of the asset upwards or downwards respectively. When there is an increased amount of volume along with the buy orders, the market trend moves in an upward direction. Similarly, when there is an increased volume of the sell orders, the market tends to move in the downward direction, High Volume = Big, effort, Low Volume = Small effort

This means that there is a force that is driving the market to raise the price that is not natural, and thus with the speed that this price rises At the same speed, the price will fall, which is why it is important to read the charts well and pay attention to the volume of buying and selling.

What's your point of view on them?From my point of view, this method is very logical and practical, since it is based on fundamental laws of the market and gives a better understanding of the movement of said market, imagining that the market, in general, is being controlled by a single person, makes us act in a more logical way to situations since if many people are buying or are driving the price of an asset by logic and to get more benefit we must act the same, such as when a massive sale of the asset occurs in the Redistribution phase, and we as passive players in this large market must notice these signals to ride the same wave and get off at the right time.

I would use it as long as I put it through a prolonged test period to see if my expectations are met. Now the composite man will be engraved in my mind for the rest of my investments, of that there is no doubt.

2.Share a chart of any cryptocurrency of your choice (BTC or ETH won't be taken into account for this work) and analyze it by applying this method. Show clearly the different phases, how the volume changes and give detail of what you're seeing.For this question, I will be demonstrating an example of the chart from my Binance account

In these above examples, I have marked all the phases of the Wyckoff's cycle

You can clearly observe that the price of the asset is sidewards in this phase and the movement of volume is also stable

Accumulation.

In the screenshots can be seen and if you observe it's quite symmetrical traders have started investing uptrend.

The market gets stable for some time and the supply from this point increasing as the investors start selling which will lead to a downtrend Distribution.

The price falls and there was a small one re-distribution phase in the screenshot which you can see as I have marked them. The supply increases thus the price falls Downtrend.

The currency used was LTC, an accumulation can be seen in the graph, and although not much volume is initially observed, the first phase of the Wickoff method begins, the process has already begun, the first uptrend is presented, although this has been a So slight, the rise in volume is noticeable at the point that the accumulation ends and the upward trend begins, and this process is evident again in the scenario in which the first upward trend ends and the reaccumulation begins, it is there where a second upward trend, in which the price and volume have increased considerably, to the point that is convenient for the composite man, when presenting its highest level, the distribution process begins since the price has reached its peak.

This process occurs in a prolonged period of time until the large investors have left all their assets and acquired large profits, thus giving way to the beginning of the slight downtrend, in the graph, although it does not indicate it, a phase can be seen of redistribution so that in this way the curve continues to decline and the downtrend is observed and the method is completed.

Conclusionsfirst of all, thank you for sharing a wonderful lesson with us professor and this theory was very useful for traders.

Thank you for being part of my lecture and completing the task!

My comments:

Nice work on the explanations, but the chart's not that clear.

The uptrend has many lows that are high in volume and what you showed as redistribution wasn't right either. Also, the analysis could have been better and more in-depth.

Overall score:

5/10