Crypto Academy week 12 - Homework post for @fendit

INTRODUCTION

As said many times, trading is a risky game. The volatility of the crypto markets has scared a lot of people away while keeping others on their toes. A lot of money has been made off cryptocurrencies and in the same fashion, a lot of money has been lost. Either scenario affects people psychologically leading to greed and panicking respectively.

The lesson by professor @fendit was innovative as she explained how emotions interfere with trading. I’m just going to get right into the assignments given...

What I would do if I bought BTC and it dipped

In a case where I bought BTC at 62k and it began to dip, there are specifically three things I would have done:

- I would have kept the coin because this is BTC. As the first official crypto, BTC has a strong backing by investors, companies and international organizations. My mindset is that the coin will always rise and go beyond 62k. Sentiments also play a roll in this decision as a lot of top individuals have said that BTC would climb really great heights.

- We all know the popular strategy of “buying the dip”. That’s exactly what I would have done. With the price lower, I would buy more of the coin cheaper so as to improve my position when it starts to rise.

- The crypto market has evolved over the years giving us the opportunity to earn in bearish conditions. Seeing BTC drop, I would normally purchase a leveraged token or head over to binance futures to take advantage of the market. This decision would normally be hasteful and I won’t be calm throughout the trading process.

What I would do after reading the class

- Emotional control has been a huge problem for me since day 1 of trading. First thing I would do is take a deep breath and analyze the situation. At this point, it’s bad but I can stop it from getting worse the right way. Which would bring us to what I would next...

- In order to avoid anymore major losses, I would set a stop loss.

People have started to accept cryptocurrencies more than ever so the chances of BTC going back to $3k is not that high. However, we can never predict what can happen. Nobody expected BTC to go so low but it did after Joe Biden proposed new tax structures.

This reinforces the fact that the crypto market is a very risk filled place. So, a stop loss is very important and this is how I would place it:

The stop loss would be placed right at USDT 51496.

My experiences when it comes to making mistakes in trading

As with a lot of traders, I’ve made a number of mistakes while trading. These type of situations hurt but they definitely make us stronger and smarter. I’m going to talk about three mistakes I have made while trading...

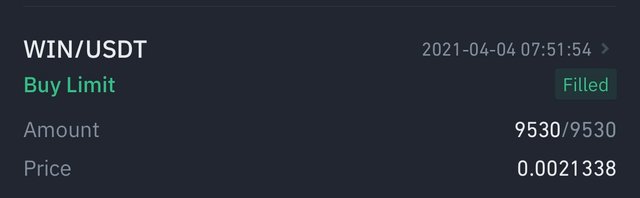

I FOMOed into WIN

On the 4th of April, I bought WIN at 0.0021338 USDT.

There was a lot of hype around the WIN coin and a lot of my friends had it and were bragging about it. So what did I do? I FOMOed into the market without any analysis and with money I needed. I watched the coin rise up to 0.0029 USDT so I held on to it. But it all went south when the coin started to drop and drop without recovery. I had to sell it off at 0.001948 USDT because I didn’t know what would have happened next.

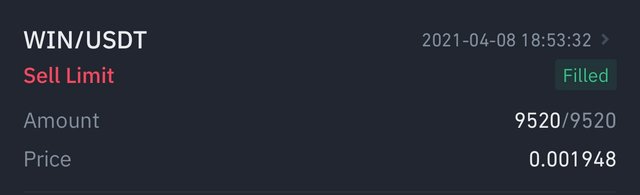

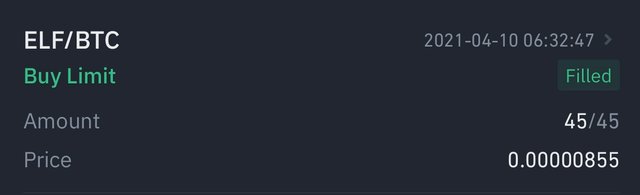

My ELF story

I’ve had my eyes on ELF for quite a while. I talked about it in a few other assignments because I feel it has potential. So, on the 10th of April, I decided to buy some of the coins at 0.00000808 BTC.

I watched the coin go up to 0.00000855. With my eyes on a bigger target, guess what I did ladies and gentlemen, I bought more coins.

I watched the coin break a resistance and surge all the way to 0.00001176 BTC. I still had my eyes on bigger things so I kept it till it started to fall. It fell all the way to 0.00000838 BTC before I sold it. Although I made some profit from my initial investment, I lost from my second investment.

The 400 USDT squander

On the Easter weekend, my friends and I went out to celebrate a little. We returned home late at night. My friend and I decided to make a trade before heading to bed. We had been lucky all day and so we decided to keep it going.

We started the trade with about 326 USDT and were able to grow it to 400 USDT. Instead of going to bed, we decided to put the 400 USDT on the line too. Long story short, we got the margin call and lost everything that night.

Mistakes I made from the above and what I learned

- FOMOing in: In the case of WIN, I had let sentiments get the best of me so I didn’t want to be left out on the big win. I FOMOed into the market. I have learned not to let sentiments get to me.

- No analysis: I bought the ELF and WIN just because. I just went in blindly into the market. I have learned to always study charts to find best entry moments so as to minimize losses.

- I used money I needed: This happened to me in all three of the mistakes and I suffered for it. The worst part about committing a lot of money into a risky venture is that emotions will likely take over reasoning. I have learned not to commit a lot of money in these uncertain markets.

- Greed: This is something I really need to deal with. In the case of ELF, I saw the coin going up so I tried to increase my stake but lost money from that. In the 400 USDT case, my friend and I weren’t content with the initial profit of 400 USDT so we went for more but instead we lost it all. I hope I have learned to be content with “small” wins.

- No stop loss: In all the cases mentioned above, I didn’t place any sort of stop loss. If I did, especially in the third case, the losses wouldn’t have been so much. I have really learned to use the stop limit feature on binance since these experiences. Now, I always set a stop loss.

- Trading without focus: This happened in the third case and is something a lot of traders do. After that experience, I realized the importance of not-trading with sleepy eyes.

The strategy that is most useful to me

All the strategies mentioned are really helpful. However, the strategies I find most helpful are:

Don’t let greed and fear take over

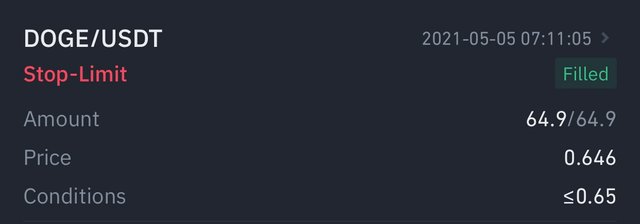

Like I said earlier, the greed problem is really real for me. I need to learn to be more content and take profit when I can. I already did this in the case of DOGE which pumped for a few days before correcting.

I took profit at 0.646 USDT. Although the coin moved up in price a bit, I didn’t get into the market. My self-control payed off because as you can see from the chart above, DOGE has started to correct.

Do not let your emotions control you

I have FOMOed in a number of times. I did so in the case of XRP and my gamble paid off. This hasn’t always been the case. I lost money because I FOMOed into the WIN market. Ever since then, I have tried to learn as much as I can about technical analysis. Thanks to the crypto academy, I have learnt a lot in just a few weeks.

What I would do in the situation below:

What I would have done before the lesson:

Whales have the power to move markets in any direction. We have seen Elon Musk do this with a grass-to-grace effect on DOGE. If I had seen this tweet, normally I would have hurried to buy BTC disregarding any technical analysis because, well, this is Elon Musk and BTC will likely pump.

What I would do after the lesson:

- Analyze the market: Yes Elon Musk’s tweets move the markets. But just going in head straight isn’t the best thing to do. I would first of all watch the charts and establish the best entry point instead of FOMOing in.

- Widen my view: BTC normally takes time to respond to market movements but other coins don’t. BTC is a coin of coins - it moves other coins. If I see a tweet like this, I would widen my view by looking at Altcoins that might potentially go up.

- Set a stop loss: Last but most importantly, I will surely set a stop loss to mitigate any losses that might arise.

CONCLUSION

The crypto markets are really attractive to people around the world. The quest to make money off the volatility of cryptocurrencies has brought a lot of people into the markets. However, ignorance, emotions and wrong info have caused losses and pain.

Special thanks to @fendit

Thank you for being part of my lecture and completing the task!

My comments:

Vert nice work!!

All tasks were nicely explained, I really liked that you developed so much your experience and putting so much effort into your tasks!!

Overall score:

8/10

Thank you professor!