Steemit Crypto Academy Season 4 Week 1 - Homework Task for @awesononso | The Bid-Ask Spread

Image created by me using canva

Hello everyone, I hope you're all doing fine. The same goes for me.

In this post, I'll be posting a homework task for crypto professor @awesononso.

This homework post will cover the topics related to Bid-ask spread. I'll explain in every possible detail what it means and illuminate other aspects related to it. We'll discuss terms like Ask price and bid price, slippage and its types and calculate some spreads from certain cryptocurrencies using examples.

I'll explain these terms, their uses and examples, and many other aspects using fully referenced and markdown images from various sources present on the internet. Also, the post is optimised for mobile devices and Pcs running on Windows and Macs systems only, which use (1388X768)resolutions and for a bit higher. In case of any irregularity, please consider switching devices. In any case of problems and issues, you can also reach out to me in the comment section.

Properly explain the Bid-Ask Spread.

Bid-Ask Spread, as the name suggests. It consists of 3 components Bid price, Asks Price and Spread. I'll be explaining these in detail.

Basically, the whole term gives the difference between the bid price and the ask price for a crypto asset or a cryptocurrency. We can say that the term "Bid" shows the amount of demand of the crypto asset or the currency, and the term "Ask" shows the supply for the same. Now, what are Bid prices and Ask prices? What's their impact on the trading systems? Let's see.

Bid price is the maximum cost of a crypto asset that a buyer is willing to pay for that asset.

For example, buyer A wants to buy a crypto asset named X, and the amount he's willing to pay for the asset X will be called the Bid price. Let me tell you one thing: it does not depend on the market price or any other price. It's just the maximum quoted price from the buyer's side.

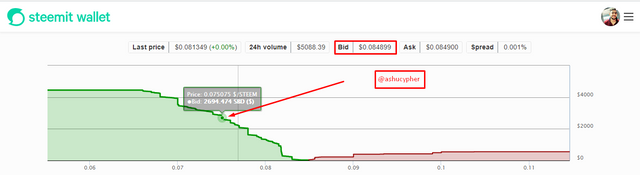

In crypto graphs, we can easily see the bid prices in the image below.

- As I've used steemit, it shows the Bid price for the stem cryptocurrency. The one on the left side in green colour is the bid price for steem.

According to the screenshot from above, the current Bid Price is: $0.084899.

It is the minimum amount or price a seller is willing to take in exchange for his asset. In other words, it is the minimum amount that a seller can quote for a crypto asset in his possession, and it is the lowest price at which the seller accept for trade.

For example, let us consider a seller named Y holding a crypto asset, namely B. now, the Lowest price he'll take for his asset is $100.The lowest price means that the price cannot be decreased or bargained from this point, and he'll only sell the asset for a minimum of $100.The price of $100 is the ask price here from the seller.

Now, if the buyer offers an amount bigger than $100, then it's a profit, and the seller will go for it. But if another buyer offers a $99 sum for the same asset, then the seller will not trade with him as his minimum price is $100.

This minimum price is called the Ask price.

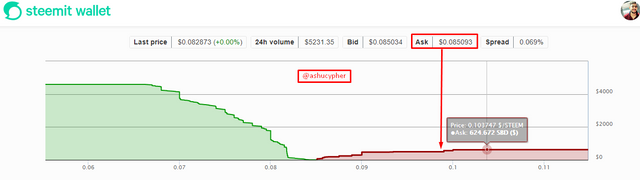

Below is the picture from steemit, which shows the ask price for steem crypto assets with SBD Exchange.

The graph shows The Ask price is on the right side in red colour.

- For this current graph, the Ask price for the crypto asset steem is: $0.085093.

- As I've explained above the Bid and Ask prices, The Bid-Ask spread is the difference between those two prices. The word Spread means the difference and is used to identify the liquidity of the crypto asset. The Bid-Ask spread shows the price differences between the Miinumum ask price and the Maximum bid price for a crypto asset.

We can arrange these theoretical data in mathematical form as:-

And to find the percentage spread, we can use the formula:-

- The Bid-Ask spread arises because there are many negotiations and bargaining in crypto markets. Buyers and sellers create rifts in prices and hence create spreads. The spreads are between bids and Ask prices; hence they're called as Bid-Ask Spread.

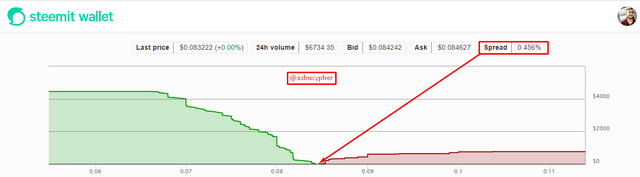

- The image above shows the spread between the Ask price, which is red in colour and located at the right side of the chart and the Bid Price, which is green in colour and located at the left side of the chart.

According to the chart above, the current spread of the STEEM is 0.456%.

Why is the Bid-Ask Spread important in a market?

We already know that the Bid-Ask spread shows the price difference between Ask and Bid prices, but it also indicates the liquidity of the same crypto asset.

Liquidity means the ease by which a crypto coin or asset can be converted to another or can easily be purchased or sold. In simple words, we can say that it's the potential or ability of a crypto asset to be converted into traditional currency quickly.

The liquidity of a crypto asset is inversely proportional to the Bid-Ask spread. The asset which shows a large spread have low liquidity levels and vice versa. Thus we can say that the Bid-Ask spread indicates the liquidity levels of a certain crypto asset.

For example, the two crypto assets, P and Q, have spread as 2.64% and 3.19%, respectively. Here, we can clearly see that the asset Q has a higher spread, and I've explained above that the Liquidity is inversely proportional to the Bid-Ask spread. So, using this statement, we can say that asset Q will have low liquidity levels as compared to asset P.

Why Liquidity is Inversely proportional to Bid-Ask Spread? - small Bid-Ask spreads indicate that the Bid price and the Ask price don't have much difference due to which the trading of a certain crypto asset can be done very easily as there are no skyrocketing prices from sellers and low paying buyers. And as the asset can be easily sold, it promotes and affects the liquidity levels.

In a situation where the buyer and the seller are fixated on their prices, they block the liquidity pool by not purchasing and selling the asset due to zero negotiation factor. If Both parties are fixated on the price, there will be no asset trade, which triggers less liquidity.

- When the spread is low in the market, one can find the best price for a certain asset and a reverse case.- It also helps the trader to understand when to buy or sell the asset. i.e. if the spread grows larger or higher, then the order should be limited carefully due to less liquidity and loss factors.

If Crypto X has a bid price of $5 and an ask price of $5.20,

a.) Calculate the Bid-Ask spread.

b.) Calculate the Bid-Ask spread in percentage.

Solution:

a) The Bid Price = $5

The Ask Price = $5.20

Bid-Ask Spread = Ask price - Bid price

= $5.20 - $5

= $0.20

Hence, the Bid-Ask spread for the crypto Asset X is $0.20.

Now, calculating the %Spread.

b) %Spread = (Spread/Ask price) x 100

= (0.20/5.20) x 100

= 0.03846 x 100

= 3.85%

If Crypto Y has a bid price of $8.40 and an ask price of $8.80,

a.) Calculate the Bid-Ask spread.

b.) Calculate the Bid-Ask spread in percentage.

Solution:

a) The Bid Price = $8.40

The Ask Price = $8.80

Bid-Ask Spread = Ask price - Bid price

= $8.80 - $8.40

= $0.40

Hence, the Bid-Ask spread for the crypto Asset Y is $0.40.

Now, calculating the %Spread.

b) %Spread = (Spread/Ask price) x 100

= (0.40/8.80) x 100

= 0.04545 x 100

= 4.54%

In one statement, which of the assets above has the higher liquidity and why?

The asset x has higher liquidity due to its low Bid-Ask spread. I've already explained above that the bid-ask spread is inversely proportional to the liquidity. So, the asset which has the lowest spread will show higher trading volume and liquidity.

Explain Slippage.

Slippage is the condition when an order from the trader is executed at a different price other than the requested or quoted price. As -the markets and prices of these crypto-assets are highly volatile and always changing, that means they can show sudden ups and downs in prices in a very short amount of time, slippage happens.

It also depends on whether the order is a buy order or a sell order.- Slippage generally occurs when there are high spreads and low trading volumes. Due to low volume, the price will change, and the trader will get an apparent quotation price for his asset.

The slippages can be avoided by using high liquidity assets, which show low price variations and do not show sudden changes. For this, a user should always keep an eye for the market trend and apply take profits and stop loss barriers accordingly.

There are types of slippage:

Positive slippage

Negative slippage

Explain Positive Slippage and Negative slippage with price illustrations for each.

- Positive slippage is the type of slippage in which the order placed by the trader was executed on a price that is comparably higher than the requested price. In this kind of slippage, the trader will have a greater amount or part of the asset, which shows a profit. That's why it's called positive slippage. The price moved but in an upwards direction due to an increase in the ask price and a decrease in the bid price.

Price illustration

- Let us consider a hypothetical situation where a trader purchases a position of a crypto asset R. The current market price when the buyer requested the trade was $100.but due to some decrement in the bid price, the trade was executed at a price of $98.now the price for the asset is changed, and the buyer will receive a gain :

$100-$98 = $2

Here, $2 is the gain/profit.with this gain, and we can say that a positive slippage has occurred in the trade.

- now, for a sell trade, A positive slippage will occur when the trade was performed at a price of $100, but the trade is executed at a price of $101.

Now, the $101-$100=$1 will be the positive slippage, representing the gain/profit of $1.

- Negative slippage is the type of slippage in which the order placed by the trader is executed at a lower price than the originally expected price. In this kind of situation, the trader will have a loss which enlightens the concept of negative slippage. It occurs due to a sudden increment in the Bid price and a decrement in the ask price.

Price illustration

- Let us consider the same hypothetical situation that we've seen above, positive slippage. The same crypto-asset R was purchased by the trader at a price of $100 at the time of order, but at the time of execution, the price topped $102.In this situation, a negative slippage has occurred. And the buyer will have to take a loss of $2.

$102-$100=$2, which is a loss.

- now, for the sell trade, the ask price was set to $100, but at the time of execution, the order was executed at a price of $97.in this situation, a negative slippage has occurred at the seller's end.

$100-$97=$3, here $3 is the loss due to negative slippage.

Bid-Ask spread is a very crucial part of the cryptocurrency world as it shows the difference between ask and bid prices which a trader can use to get an idea of the liquidity and trading volume of the asset that he's planning to invest on. Using this, the trader can predict the price movement and make buying and selling decisions accordingly.

We've also learned about the slippages and how they affect the trade which a trader executes. How the prices can change is just a little bit of time, causing a positive or negative slippage. As the positive slippage is a gain, it's allowed. Still, for the negative slippage, one should know how to avoid them using high trading volume markets and no sudden price changes Currencies to avoid loss scenarios.

Being able to gather such knowledge, I am truly blessed and wanted to thank professor @awesononso to deliver such an amazing task.

That'll be all from my side.

Thank you for reading

Hello @ashucypher,

Thank you for taking interest in this class. Your grades are as follows:

Feedback and Suggestions

You are clear in your explanations and your arrangement is also good. Good job on those.

I just expected some more points on the second and sixth question.

Thanks again as we anticipate your participation in the next class.

Thank you, professor.