Steemit Crypto Academy Contest / S16W5: Navigating the STEEM Token

Hello everyone! I hope you are all doing well and enjoying life with the blessings of Allah Almighty. I am happy to take part in the exciting challenge hosted by SteemitCryptoAcademy community . So, without any further delay, let's dive right in! Shall we ? ........, Okay , Okay😊! .

Steem, the digital token used on the Steemit platform, is like a hot topic in a neighborhood gossip circle. When people talk about it on social media platforms like Twitter, Reddit, and Steemit itself, they're actually giving hints about how they feel about Steem.

It's like when neighbors chat about a new restaurant in town – if they're excited, more people might try it out, but if they're not impressed, others might stay away.

We may acquire an understanding of the community's sentiment towards Steem by scrutinizing these discussions, which is akin to listening in on those friendly discussions. If everyone is giddy with enthusiasm and optimism, this might be excellent news for Steem's price since more people may want to purchase it. However, if there's a lot of doubt or pessimism around, that may be a sign of problems since people might be selling their Steem, which would down the price.

It's not only about what people say; it's also about how they say it. If the mood is generally optimistic and positive, it can be a sign of increased faith in Steem's future. On the other hand, if there's a lot of frustration or disappointment in the air, it might suggest concerns about Steem's direction.

We must, of course, treat it with caution, just like any other gossip. On social media, not every viewpoint represents the entire community, and occasionally people merely want to stir things up for amusement.

However, by observing these discussions and patterns, we can have a better understanding of Steem's potential market direction, much to how listening to local rumors can provide you with insider information about events taking place in the area.

A popular topic in the local community is Steem, the digital token used on Steemit. Discussing it on Reddit or Twitter feels like being in on the newest thing going on in the community. We are able to learn about everyone's opinions regarding Steem through these discussions.

It is possible that more individuals may want to purchase Steem if they are enthusiastic and upbeat. Negativity, on the other hand, may indicate that users are liquidating their Steem holdings, which would lower the price.

Talk is important, but so is the manner in which it is said. It may indicate that people are optimistic about Steem's future if the tone is positive. However, a high level of annoyance could indicate issues with Steem's

But, we must exercise caution when it comes to gossip—not every online viewpoint represents the entire community. People occasionally just enjoy causing trouble. However, by keeping an eye on these patterns, we may have a clearer understanding of where Steem might wind up in the market—it's like having a firsthand look at local events before the general public.

Comprehending sentiment analysis in addition to technical indicators might increase the efficacy of trade signals related to STEEM. Traders can purchase and sell STEEM with greater knowledge if they combine traditional market analysis tools with insights from social media discussion.

- Sentiment analysis

Sentiment analysis is the process of looking at the feelings and viewpoints that people post on social media sites like Reddit and Twitter. Through monitoring both good and negative attitudes surrounding STEEM, traders are able to determine the general tenor of the community. While negative sentiment may portend future market downturns, positive sentiment may herald bullish trends.

- Technical Indicators

Traders utilize technical indicators as tools to examine price changes and spot market trends. Bollinger Bands, relative strength index (RSI), & moving averages are examples of common indicators. Based on past data and market activity, these indicators offer to the traders insightful information about STEEM's price trends and assist them in forecasting future price moves.

- Integration

Trading signal accuracy can be improved by traders by combining sentiment analysis with technical indicators. For instance, traders may feel more confident purchasing or keeping STEEM if sentiment analysis reveals a resoundingly positive mood towards STEEM on social media and technical indicators also point to bullish tendencies. On the other hand, traders can think about selling or shorting STEEM if sentiment analysis shows negativity and technical indicators support bearish indications.

The digital currency used on Steemit, called Steem, is quite the talk in the community. It's like hearing the newest craze in town when people discuss it on Reddit or Twitter. Through these discussions, we can learn more about everyone's opinions regarding Steem. More individuals may want to purchase Steem if they are enthusiastic and upbeat. However, if there is a lot of negativity, it might indicate that users are selling their Steem, which would lower the price.

Sentiment analysis is the study of feelings and ideas shared on Reddit and Twitter, among other social media sites. Traders are able to determine the general attitude of the community by monitoring both positive and negative opinions toward Steem.

TradingView TradingView |

|---|

The body of the Steem candle on the TradingView chart between 2023 and 2024 showed a bearish trend, suggesting a decline in price. However, as news of the 2024 Bitcoin halving surfaced, this pattern changed to a bullish trend.

As news of the halving circulated, the price pattern of Steem became bullish. In 2023, Steem's price ranged from $2.00 to $2.50, but after the Bitcoin halving, the market became more optimistic, & the price of the cryptocurrency shot up to $3.34 to $4.00, with some significant swings within this range.

This demonstrates how trading decisions can be influenced by sentiment analysis as well as technical indicators, particularly on noteworthy occasions like the Bitcoin halving.

Binance Binance |

|---|

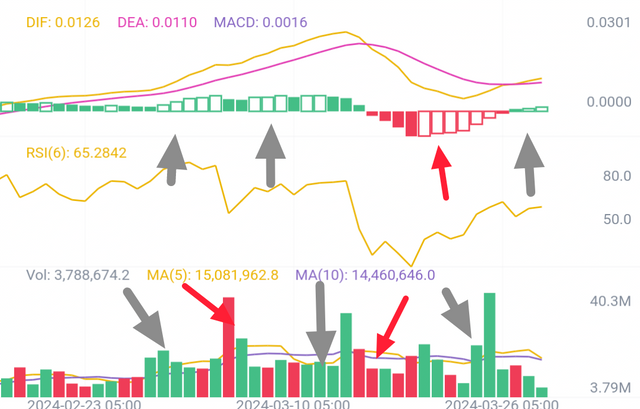

A bullish pattern is visible in the Binance daily chart, indicated by a grey arrow. This pattern aligns with the optimistic feeling over the previously mentioned Bitcoin halving. But there are other situations where selling pressure happened, as seen by the red arrows.

These swings highlight how crucial it is to use technical indicators and sentiment analysis in order to make well-informed trading decisions in the Steem market.

Binance Binance |

|---|

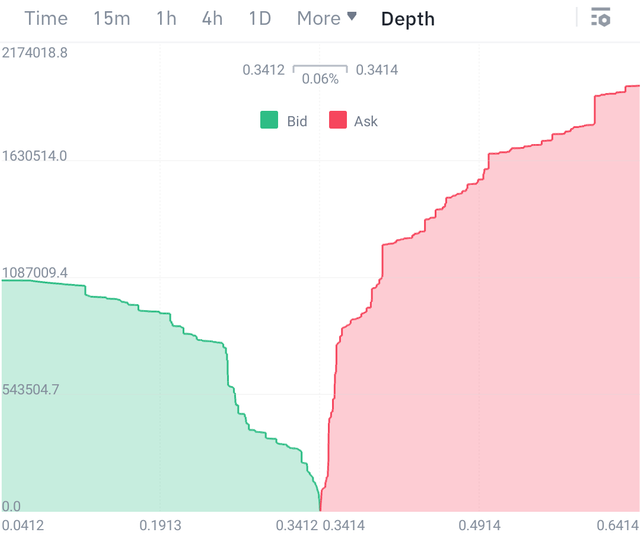

Further analysis of the Binance depth chart for Steem revealed a notable selling bid, indicating strong selling pressure.

This emphasizes how important it is to use both sentiment analysis and technical indications when navigating the Steem market, particularly when activity is high or there is a big event happening, like the halving of Bitcoin.

Making sensible choices in a volatile market such as STEEM requires careful consideration of a few key criteria when doing sentiment analysis. Investors may manage the market with confidence and reduce the dangers brought on by volatility by being aware of these factors.

- Volatility of the Market:

Prices can fluctuate quickly in a turbulent market due to a variety of variables, including news, rumors, and market mood. Investors must understand how volatility affects STEEM's price fluctuations in order to modify their trading tactics. Sentiment analysis can reveal how the market is feeling about STEEM, which can help investors prepare for future price fluctuations and modify their holdings accordingly.

- Time and Accuracy:

In unpredictable crypto markets, timing is very and very crucial, and sentiment analysis can assist investors in determining the best times to enter or exit transactions. Investors can make timely decisions that are in line with market sentiment by precisely assessing sentiment patterns on social media sites like Reddit & Twitter. To validate trade signals, reduce the possibility of false positives or negatives, and verify the quality of sentiment analysis tools, it's crucial to take into account other variables like technical indicators.

Through careful consideration of these variables and skillful application of sentiment research, investors can obtain important insights into market sentiment and make better informed judgments on STEEM.

This can give them more confidence and success as they take advantage of opportunities, reduce risks, and negotiate the unstable STEEM market.

Traders can gain a significant edge in the dynamic STEEM market by consistently monitoring trends and sentiment research on social media. Through monitoring discussions about STEEM on social media sites like Reddit and Twitter, traders may identify trends and make more informed choices.

For instance, if STEEM is receiving a lot of positive press witnesses now a days, it may indicate that more people are interested in purchasing it, which could raise the price. Conversely, negativity or skepticism may indicate that the price is about to decline.

Traders can modify their strategy by closely observing these trends. By purchasing STEEM at a high sentiment juncture and selling it at the highest point, they can profit from bullish tendencies. In a similar vein, they can profit from price drops by shorting or selling STEEM in anticipation of adverse trends.

All things considered, trading professionals can gain important insights and a tactical advantage in navigating the volatile STEEM market environment by consistently monitoring social media trends and sentiment analysis.

With Best Regards

@artist1111

Goodbye, friends. It's been a pleasure getting to know you all participating in this community. I will miss interacting with all of you, but it is time for me to move on. Take care & I hope to see you all again very soon , Best of Luck .

As the sun sets on the day

And the night falls softly in

We close this chapter, dear reader

But the story's not yet done

Tomorrow's pages wait, unwritten

INTRODUCTION

As the sun sets on the day

And the night falls softly in

We close this chapter, dear reader

But the story's not yet done

Tomorrow's pages wait, unwritten

INTRODUCTION

Your post explaining the importance of sentiment analysis on social media around the STEEM token is very thoughtful and impressive. I learned a lot from your graphical analysis.

Thanks for reading! I'm glad you found the sentiment analysis and graphical analysis informative.

On this incredible tool, you can manage the turbulent STEEM market environment by constantly monitoring social media trends and sentiment research. Traders may obtain a considerable advantage in the volatile STEEM market by constantly watching trends and doing sentiment analysis on social media. Traders can see trends and make better decisions by watching STEEM conversations on social media platforms like as Reddit and Twitter. You clearly described everything in a professional manner, supported by appropriate research findings. I much appreciate your work. I wish you tremendous success, buddy.

Thanks for reading! Positive sentiment on social media boosts confidence in STEEM, aiding informed decisions. Good luck!

Greetings friend,

Think of Steem like the talk of the town in a neighborhood gossip circle. When people discuss it on social media, they're actually revealing their thoughts about Steem. It's like when neighbors chat about a new restaurant – if they're excited, more people might try it, but if they're not impressed, others might stay away. By listening to these discussions, we can get a sense of how the community feels about Steem. If there's a lot of enthusiasm and optimism, it could be good news for Steem's price. But if there's doubt or negativity, it might be a sign of problems. Of course, we should take it with a grain of salt, like any gossip. Not every opinion represents the whole community, and sometimes people just want to stir things up for fun. So, it's all about understanding the overall sentiment and being cautious.

Thanks for reading! Monitoring social media discussions about Steem offers insights into community sentiment, impacting potential price movements cautiously.

TEAM 5

Congratulations! Your post has been upvoted through steemcurator08.Hello friend greetings to you, hope you are doing well and good there.

It is possible that more individuals may want to purchase Steem have good updates and news present about it on social media. I agree to you here completely. You further said that Negativity, about a crypto asset may adversely effects it which would result in lowering it's price. I have seen some beautiful indicators you shown to us should be used in combination with fundamentals of the market.

You have given a too good description how to tickle the volatile crypto market. You said that making sensible choices in a volatile market requires careful consideration of a few key criteria. Investors may manage the market with confidence and reduce the dangers brought on by volatility by being aware of these factors. Yes this is very true, I think in volatile market, resk to reward ratio should be managed very carefully.

I wish you very best of luck in this contest.

Thanks for reading! Managing risk-to-reward ratio is crucial in volatile markets. Best of luck in the contest!

Greetings friend,

Analyzing sentiment on social media helps us understand how people feel about STEEM. Positive sentiment attracts investors and can give us confidence in the project. By tracking sentiment trends, we can make better decisions about buying, selling, and holding STEEM. Social media platforms like Reddit and Twitter are great for analyzing trends and understanding consumer behavior in the STEEM market. It's a valuable tool for businesses and researchers. Good luck in the contest

What a fantastic breakdown of how sentiment analysis can impact STEEM trading! Your insights really shed light on the importance of social media chatter in understanding market trends. The graphical analysis was particularly insightful. Wishing you the best of luck in the contest

Thanks for reading! Glad you found the breakdown insightful. Best wishes in the contest!

Oh, okay, okay! This analogy really resonates with me. It's like when I was living in a neighborhood where everyone was buzzing about this new burger joint. The excitement was contagious, and soon enough, I found myself in line to try it out too. But if the buzz had been negative, I might have been more hesitant to give it a shot.

As far as I know, maintaining a positive tone can be a good sign in any situation. It's like when I was organizing a family gathering, and everyone was enthusiastic and upbeat about the plans. It gave me confidence that the event would be a success. Similarly, a positive tone about Steem on social media could signal brighter prospects for its future.

I feel like understanding market volatility is crucial, just like navigating through stormy weather. Once I was sailing, and the wind suddenly picked up, causing the boat to rock violently. It was a reminder of how quickly conditions can change. Similarly, in the crypto market, being aware of volatility helps investors brace themselves for sudden shifts and make informed decisions.

Good luck

Your breakdown of how sentiment analysis can impact STEEM trading is insightful and well-articulated. You've provided valuable insights into the importance of social media chatter in understanding market trends, and your graphical analysis adds depth to your explanation. thank you 🤭

Thanks for reading! Glad you found the insights valuable. Your appreciation means a lot!