Crypto Academy | Season 3 Week 6 | Cryptocurrency scams by @amritraj

Hey all, I studied the lecture of professor @yohan2on about Cryptocurrency scams. I learned alot now I am doing my homework.

.png)

Question 1

What are Crypto scams? Make your research on any Cryptocurrency scam.

The birth of the crypto ecosystem and its technology has created many opportunities for interested individuals to benefit from many parts of it, such as asset exchange, mining, DApp development, adoption of blockchain technology in other fields, provision of liquidity, etc. Widespread acceptance of the crypto ecosystem keeps the ecosystem and its affiliated digital tokens increasing in value, creating a revenue channel for its participating users. This also creates opportunities for fraudulent activities like fraud and theft in the ecosystem. Crypto scam refers to the use of various scams to obtain encrypted assets for investment. The target person loses valuables in the form of cryptocurrency, private key, wallet address, seed phrase, etc. To unauthorized persons (scammers) who fabricate fraud plans. The openness (easy access by anyone) and anonymity of the encryption ecosystem technology has another effect that crooks can use to create various plans to deceive the unfortunate victims of the conspiracy. Some of these scams also includes:

1) Fake websites and phishing services

This type of fraud involves the use of phishing services, such as URL links, emails, and password logins. Embedded in a fake website that replicates the exact characteristics of a legitimate website. Scammers use this process to obtain confidential information, allowing them to access the victim's wallet and account without authorization, which usually results in the loss of the victim's funds.

2) ICO scam

New cryptocurrency projects use Initial Token Offering (ICO) to show their native tokens to the general public and provide a percentage of their share of the highest offer in order to gain more users and value. When the ICO campaign starts, depending on your project, it will attract the interest of investors and they will exchange other tokens such as BTC, ETH, etc. Pass the project’s native token. After a large number of investors register, the scammer transfers the invested assets to another blockchain. This is also called carpet traction.

3) Social Engineering Scam

This type of scam involves the use of active social activities such as sponsored ads, bots, advertising services, and false information to raise public awareness of cryptocurrency investment opportunities. Victims of these types of scams are often triggered by fake testimonials randomly generated by scammers to verify investment opportunities.

4) Transaction Fraud

This analysis involves the use of transactions created by scammers to defraud victims of funds that they intend to exchange. Cryptocurrency exchanges also provide wallet services, liquidity pools, agriculture, etc. This type of scam will be tracked for a long period of time to allow scammers to become an exchange recognized by many users through these processes. When this type of scam is carried out, a large amount of cryptocurrency will be lost.

5) Fake mobile apps

Another common way that scammers mislead crypto investors is thru fake apps which will be downloaded through Google Play and therefore the Apple App Store. Although stakeholders can usually quickly find these rogue apps and take away them, this does not mean that these apps don't affect much of the underside line. per Bitcoin News, thousands of individuals have downloaded fake cryptocurrency apps.

Although this is often a serious risk for Android users, all investors should remember of this possibility. Are there obvious misspellings within the copy or within the name of the app? Does the brand look unreal thanks to strange colors or wrong logos? Please consider and reconsider the download.

Through extensive basic research on exchanges, proposed projects, and designed solutions, investors can avoid becoming victims of crypto scams. This helps reduce the uncertainty associated with currencies.

The use of cold wallets to store digital assets securely offline has increased the security features of the encryption ecosystem, which can prevent unauthorized access. To access the content of the wallets offline, physical theft is required. Reduce the risk of an encrypted asset on multiple exchanges and wallets. If the carpet is pulled, hacked or stolen, this can greatly reduce the risk. This is achieved by having multiple wallets on multiple exchanges.

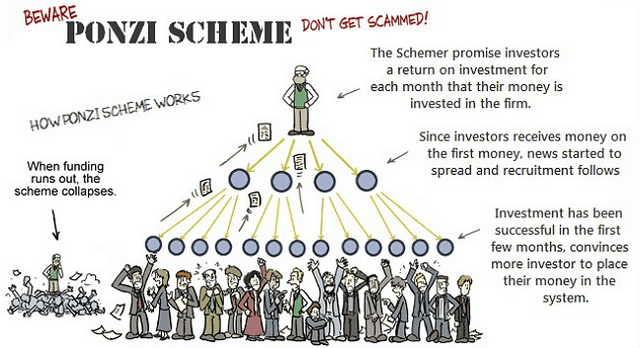

The cryptocurrency has developed to a higher level, which also brings a different history of scams. Encrypted space. There are many crypto scams in the crypto space; some are Pincoin (Pin) crypto scams, OneCoin crypto scams, WXCOIN scams, etc. But for the sake of this article, I will talk about the OneCoin project. Dr. Ruja, also known as the queen of cryptocurrencies, used the popularity of Bitcoin to establish a Ponzi scheme in 2014 in which she was able to defraud millions of people. As we all know, this scam is one of the famous cryptocurrency scams in the history of cryptocurrency. According to a report by the US government, The Crypt Queen and her team were able to steal about US$4 billion, but some sources said that the amount stolen would be as high as US$19.4 billion.

Source: https://images.app.goo.gl/CGXwzJQPQUe2qvgG7

Dr. Ruja has won the hearts of investors with her reputation, confidence, wisdom and many other qualities. At any time, Onecoin itself does not have any blockchain. Their Ponzi scheme relies only on Bitcoin's reputation. Most investors did not understand cryptocurrency at the time, but persuasive words made them believe in the queen of cryptocurrency. He told them how to get rich by investing in the project.

Source: https://images.app.goo.gl/KMxnZCoeXo9XasSS6

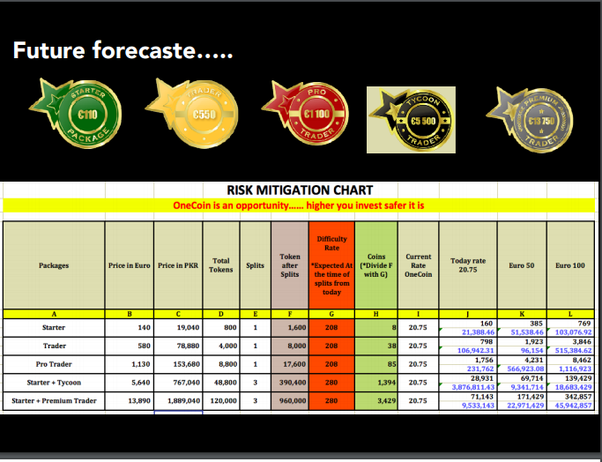

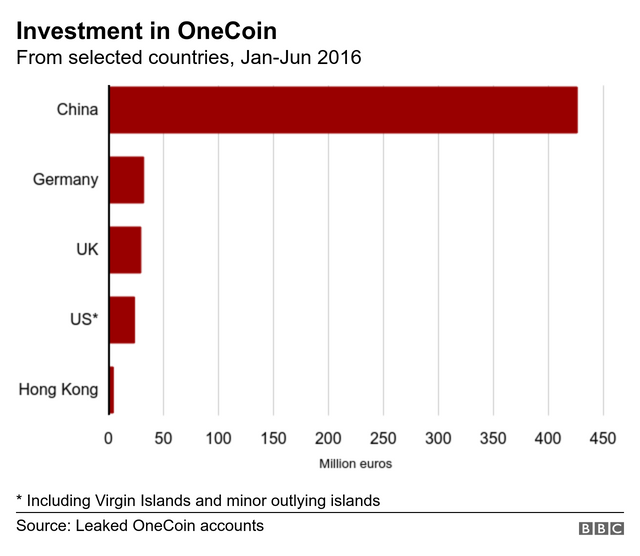

The project comes with different educational packages for investors to choose from, and each package has its own price. Prices range from 110 euros to 188,000 euros, and each package comes with tokens that investors can use to mine OneCoin. In order to allow users to sell tokens, OneCoin created a fake exchange claiming to sell tokens. In fact, few people can sell their tokens to companies in euros, but there are restrictions on such sales. Since OneCoin is a Ponzi scheme, members can get more benefits by inviting people to join the company. The exchange closed in March 2016, and those holding tokens have nowhere to sell. In a limited time, many people have made large investments in the company. The following are the investments that people make according to their own country.

Source: https://images.app.goo.gl/dY7Nqr6R1xxuY5Mx6

Investors in ONECOIN

source: https://images.app.goo.gl/veDmaLX7FAjb64oh7

When the exchange closed, investors became hospitalized and began to pressure her to introduce a public exchange to exchange her tokens. But Dr. Ruja was nowhere to be found. He was the last witness; what they saw in her was a plane flying from Sofia to Athens. It was the end of the cryptocurrency queen. Until now, no one has seen her again. Although his brother took over as the new CEO, he was still charged and pleaded guilty to money laundering and other crimes. He has a lot of money; the chart below shows the amount of investment from January 2015 to March 2017.

ONECOIN revenue

Source: https://images.app.goo.gl/MMhswjnATmj5SqkJ6

More refernces of Cryptoscams

Question 2

To what extent have Crypto scams affected the Crypto space?

The rise of crypto fraud has and will continue to have a significant impact on the cryptocurrency ecosystem. Some of these methods are listed below. The daily scam in the encrypted space has caused various forms of restrictions and prohibitions by private organizations or government agencies. Encryption plans and money laundering have led many countries to restrict or ban encryption in their institutions or countries. A few months ago, Nigeria banned all forms of cryptocurrency activities in the country. \

Source: https://images.app.goo.gl/iQnjyCcJuJzRihZC7

Due to many cryptocurrency scams, people now find it difficult to believe and invest in cryptocurrencies. Although there are open platforms where people can trade or invest in cryptocurrencies, some people have little or no interest in cryptocurrencies, especially those who have become victims of these scams. For example, Jen McAdam, a victim of the OneCoin Ponzi scheme, would have a hard time trusting the crypto space.

Fraud can be found in all sectors of the economy, and the crypto space is one of them. As long as we take care of something valuable, scams will appear. We must be more vigilant when investing. Despite all the encryption attacks, it still has a place in the market and in the world. Is in the range of 10, and I give 7 points to indicate the danger of encryption fraud in the encryption space.

Question 3

Will regulations in Crypto add value to the Crypto space?

The regulation of cryptocurrency will have a positive and negative impact on the ecosystem. The trade-off between regulated and unregulated crypto ecosystems is very obvious, because some key elements of the ecosystem will be compromised.

Positive impact

On the positive side, supervision will provide a form of insurance for deposited funds. Proposed projects of various crypto assets will be carefully evaluated before being listed on an exchange or ICO. This improves the sustainability of listed assets.

Secondly, the regulation of cryptocurrency will increase investor confidence and provide protection for the safety of investment funds. This will greatly promote the adoption of cryptocurrencies in major industries, such as technology companies.

Third, regulation will improve the stability of some encrypted asset prices. This will reduce the consequences of negative market speculation.

Negative effects

On the negative side, crypto regulation will violate the decentralization of the blockchain, invalidating the original idea of creating a centralized financial alternative. It also invalidates the anonymity and privacy that users enjoy in a secure and decentralized ecosystem.

Second, the regulation of cryptocurrency will greatly reduce the volatility of cryptocurrency transactions. This is due to the stability of encrypted assets.

Due to the pre-market project evaluation process, the process required to implement a newly developed encryption project will be cumbersome and costly.

Crypto scams are common in the market; They come from phishing sites and links, fake wallets and apps, crypto Ponzi schemes, fake mining bots, etc. The target of these scammers is account details; With the details, they can easily hack the account and steal any assets. Crypto fraud poses a great danger to individuals and the entire crypto market. People lost their life savings to fraud, and others even lost their lives. These scams have also made people very skeptical of cryptocurrencies. A well-regulated encryption space will help reduce fraud and improve the quality of the encryption space. This will add more value to the cryptocurrency. Thank you @yohan2on for amazing lecture on scams. This makes us more aware.

***Respected first thank you very much for taking interest in SteemitCryptoAcademy

Season 3 | intermediate course class week ***

thank you very much for taking interest in this class

Thank you professor