Crypto Academy Season 2 - Week 2 - Homework post for [@kouba01]

This is my homework post for week 2 of Season 2. I am really thankful to Professor @kouba01 for this amazing lecture.

What is a cryptocurrency CFD

Image Source

CFD transactions for buying and selling CFDs through online providers. When you replace a separate contract with a contract, you have reached an agreement in exchange for the difference between the price at which the contract was opened and the price of the asset at the time the contract was closed.

Cryptocurrency as an alternative investment or contract for difference has also begun to arouse great interest.

A large part of this was attributed to the huge leap in the value of Bitcoin that made headlines, as the price of BTC was about $1,000 at the beginning of 2017 and soared above $19,000 by December of that year. When prices fluctuate rapidly, traders will pay attention.

When well-known exchanges like CBOE and CME launched Bitcoin futures contracts, this new asset space gained further credibility.

Many people can access cryptocurrency by simply investing money in cryptocurrency (that is, buying actual digital currency). However, there is a downside to doing so. The processing time for purchasing cryptocurrency is slower than the instant filling that represents foreign exchange transactions. They are not regulated and have horror stories about damaged Bitcoin and Ethereum wallets.

You can trade cryptocurrencies through CFDs, easily avoiding all these problems. Using CFDs allows very fast trading times, which is useful for such a turbulent market. Admiral Markets UK Ltd is authorized and regulated by the Financial Conduct Authority (FCA), so our Bitcoin CFD transactions are regulated in the same way as ordinary FX.

How do traditional CFDs work

The working mechanism of CFDs usually follows the following logic or similar logic:

- Traders choose brokers to provide assets as CFDs. It can be a stock, index, currency, or any other asset chosen by the broker.

- Traders open positions and set parameters, such as whether they are long or short, leverage, investment amount, and other parameters, depending on the broker.

- The two signed a contract, agreeing on the price of opening a position, and whether additional costs (such as overnight costs) are involved.

- The position is opened and remains open until the trader decides to close it or close it through an automatic command, such as reaching a stop loss or profit point or the contract expires.

- If the position is closed to make a profit, the broker pays the dealer. If the position is closed at a loss, the broker will charge the trader the difference.

CFD Trading is Risky

CFD trading carries a high level of risk and may not be suitable for all investors. CFDs use more OTC derivatives. Your capital loss may exceed your initial deposit, and the potential loss may be unlimited.

Like any product on the financial market, CFDs also bear risks. CFD trading is used, so although you can make more profits using small deposits, you may also lose more funds than stocks. Although it is possible to assign a stop loss to each transaction, due to market differences or slippage, the stop loss cannot be guaranteed, and the stop loss requirement may not always be met in a volatile market. Since many CFD providers charge commissions, investors should also pay attention to the cost of commissions.

Do all brokers offer cryptocurrency CFDs

Not all brokers provide cryptocurrency CFDs, only some brokers offer cryptocurrency CFDs. I have compiled a list of brokers who are currently providing services to traders. They are the leading brokers that provide cryptocurrency CFDs.

The list is given below:

XBTFX

TIOmarkets

BitMEX

PrimeXBT

eToro

Explain how you can trade with cryptocurrency CFDs on one of the brokers (Using a demo account).

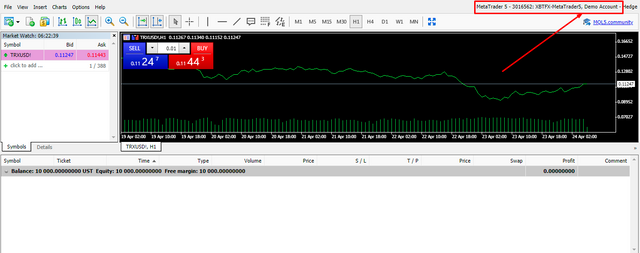

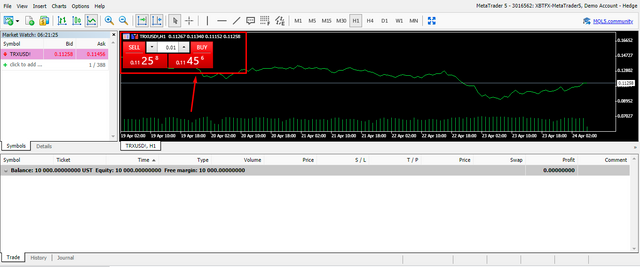

I opened my demo account in XBTFX, I have tried to trde TRX/USD. The screenshot given below.

Simply you need to click on buy and trade will opened.

Conclusion

All in all, it can be said that traders with very small capital can use regulated brokers to trade with Cryptocurrency CFDs. Such transactions always involve high risks, so risk capital must be invested so that traders can easily afford the capital.

Thanks for this amazing lecture.

Regards. @amjadsharif

Hi @amjadsharif

Thanks for your participation in the Steemit Crypto Academy

Feedback

Good work. Well done with your research on CFDs

Homework task

7

Thanks you sir @yohan2on & @kouba01 for your Appreciation.