Crypto Academy Week 6 - Homework Post for [@yohan2on] Stable coins

Hi @yohan2on, my name is Allbert and this is my first class and assignment with you. I have been trying to catch up with your past classes and after a few weeks of studying I finally think I am able to submit my first assignment for week 6: Stable coins.

My selected stable coin has been one that I started to get familiar with and trade last week: Tether (USDT).

TETHER: My selected stable coin. Image source: https://www.cryptonewsz.com/price-analysis-of-tether-on-8th-may-2019/

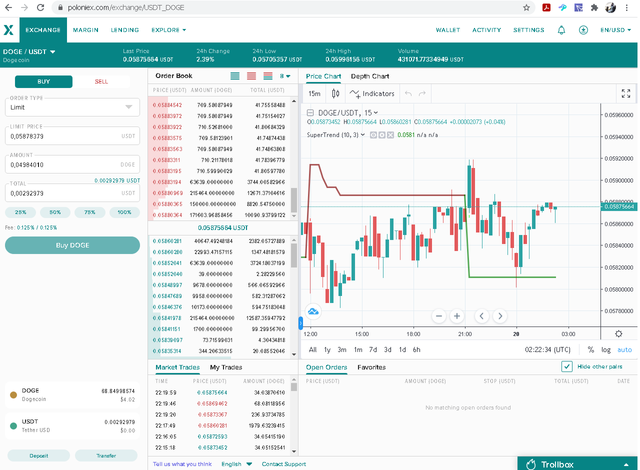

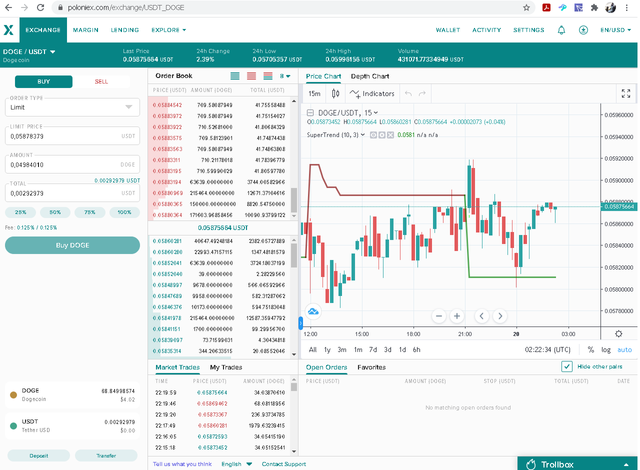

TETHER: My selected stable coin. Image source: https://www.cryptonewsz.com/price-analysis-of-tether-on-8th-may-2019/ DOGE/USDT Chart from my Poloniex account. Taken by me on March 19th, 2021.

DOGE/USDT Chart from my Poloniex account. Taken by me on March 19th, 2021.

TETHER: My selected stable coin. Image source: https://www.cryptonewsz.com/price-analysis-of-tether-on-8th-may-2019/

TETHER: My selected stable coin. Image source: https://www.cryptonewsz.com/price-analysis-of-tether-on-8th-may-2019/Origins

The coin was created in July 2014 under the name Realcoin by Stanley Hainsworth, vice president of Starbucks. Some time after the launch of the project, the cryptocurrency was added to the popular cryptocurrency exchange Bitfinex. However, it was not in demand among exchange customers. Therefore, in November 2014, it was decided to carry out a rebranding, as a result of which Realcoin was renamed Tether. Tether's management company and sole issuer is Tether Limited. The first block on the Tether network was generated on March 12, 2015. Tether uses a unique network consensus algorithm not found in any other cryptocurrency: Proof of Reserves. The principle of this algorithm is that it compares the amount of issued USDT and EURT tokens with the actual reserves of euros and dollars in Tether Limited's reserve accounts. This process is carried out thanks to the capabilities of the Omni Layer protocol of the Bitcoin blockchain.Operation

1. Any user who wishes to buy Tether coins deposits fiat money into the Tether Limited account. 2. Once the money is credited, the Tether company creates new coins and the amount of issued tokens exactly matches the amount of fiat units deposited in the account, in a 1: 1 ratio. 3. Tokens are credited to the user's Tether account. You can dispose of them at your own discretion: for example, exchange them for other cryptocurrencies. (Just my case) DOGE/USDT Chart from my Poloniex account. Taken by me on March 19th, 2021.

DOGE/USDT Chart from my Poloniex account. Taken by me on March 19th, 2021.Advantages

1- Almost zero volatility: unlike conventional cryptocurrencies, the cost of Tether is almost always equal to the current fiat currency price, for example 1 USD = 1 USDT. 2- Low cost of transfers and speed of payments: unlike regular money, Tether allows you to receive a transaction within minutes after sending. In addition, transfers are completely free (as long as transactions are sent between Omni Wallets). At banks, transfers to equivalent amounts will cost tens of thousands of dollars, depending on the amount of the payment. 3- Using Omni Layer technology: this protocol is one of the most reliable due to the storage of data on the bitcoin blockchain. 4- Continuing with the security theme, Theter applies a KYC (Know Your Client) and AML (Anti-Money Laundering) process for the issuance of USDT and EURT in prevention of money laundering and terrorist financing. This process is rarely seen in cryptocurrencies.Disadvantages

1- Lack of decentralization: the consensus algorithm does not involve mining Tether, and the management company is the only issuer of this stable coin. Therefore, there is no need to talk about decentralization. 2- Susceptibility to inflation: due to the fact that Tether is pegged to the US dollar, like the latter, it is prone to inflation and gradually depreciates. 3- Scandals constantly arising around the cryptocurrency: it is noted that the company Tether Limited engages in very opaque activities. On some occasions they have been blamed for market manipulationand. In addition Tether does not disclose its actual reserve holdings and refuses to be independently audited. 4- Declining popularity due to the emergence of more responsible competitors: Tether is not the only stable coin, now several other currencies are actively strengthening their positions in the market.Conclusion

Tether sought to bring together the best of the worlds of traditional currencies and cryptocurrencies.

Traditional currencies have stability, a characteristic that critics say is necessary for cryptocurrencies to be taken seriously. Cryptocurrencies offer transparency, speed and low costs; characteristics that have attracted the attention of the market and the basis for their popularity. Thether offers all of these features.

Hi @albert

Thanks for attending the 6th -Crypto course and for your effort in doing the given homework task.

Feedback

This is excellent work. Well done with your research study on Tether and thanks for putting this together. It's an interesting informative article on Tether, a popular stable coin in the crypto space.

Homework task

10

Homework task

Thank You My friend it's such an honor your words. I learned a Lot with your class, I can't wait the new one this week.

From your post I have come to know about Tether coin. You have explained very nicely about how to collect this coin by sending money and the rivers way of burning you have explained very nicely as well. you have not only explain the advantages of the coin but the disadvantages like inflation and centralisation problem as well. it's really good and appreciating to know some new new ideas and thoughts from such kind of initiatives and I am thankful to you for sharing this nice coin

#affable #onepercent #bangladesh

Thanks mate. I'm glad You liked.