MAP Rewarder: MAPR Payouts to Delegators and Price Increase for Token-Holders for 22 June 2020 (21.5% APR)

Earn significant passive income with STEEM without locking SP by investing in MAPR tokens.

This week's distributed profits are 0.412%, equivalent to 21.5% APR and 23.8% APY.

This is higher than most individuals can earn from vesting their own STEEM.

There is a lot of information to get through today, so please read the News below very carefully.

Remember that MAPR has a unique distribution and pricing system. If you look at the MAPR tokens you, as delegator, have received today, multiply that number by the new official BUY Price and you get the same amount in STEEM as you would have done under the old system of just paying out STEEM transfers.

Token-holders receive no token distribution, unless they are also delegators. Their profit comes in the token price increase.

The added bonus is that if you don't sell this week's tokens, then next week their value will rise to at least the new BUY Price. This is how the token allows compounding of profits, for both delegators and token-holders.

Using the language of investment trusts, delegators hold "income" stakes where the "interest" is paid out in tokens, whereas token-holders have "capital" stakes where the profit is added to the token price.

A reminder that new delegations start to earn 2 days after the day of delegation. This means that the first week's payout will be lower than for a 7-day week. Also, as payouts are done on Mondays, delegating on a Saturday or Sunday will yield no distribution till the following week. This has always been in place and is to avoid people trying to game the distribution. The positive part is that there is no unstaking period for the tokens, merely the standard waiting time for undelegating.

MAPR: The Numbers

All these numbers relate to a 7-day period (Monday to Sunday) and calculated in STEEM per SP.

Value of Steem upvotes = APR 55.7% [1a], 31.7% [1b], 30.6% [1c]

Value of Steem author rewards payouts = APR 28.1% [2a], 16.0% [2b], 15.5% [2c]

Distributed MAPR payouts = 0.412% (APR 21.5%) [3]

Projected Compounded APY 23.8% [4]

Average APR 17.1% (26-weeks)

MAPR BUY Price: 1.16350 STEEM [5]

MAPR Price increase = +6.8% APR

MAPR SELL Price: 1.175 STEEM [6]

[1] Theoretical maximum value of Steem upvotes, assuming 10 full upvotes at 100% power for 7 days, averaged over 7 days and expressed as an APR. This calculation was performed for an SP of 1 million STEEM to be as close as possible to linearity. Your own upvote will be somewhere between 50-100% of this value.

The values are now calculated for three levels of voting power: 1 million SP (a); 10,000 SP (b); and 1,000 SP (c).

[2] Theoretical value of Steem upvote author rewards, assuming 50% curation rewards, 50-50 split of post payouts and SBD print rate, averaged over 7 days and expressed as an APR. Your own author rewards will be somewhere between 50-100% of this value.

[3] MAP Rewarder distributed payout sent to delegators this week as tokens and the MAPR price adjusted to reflect this.

[4] Equivalent compounded yield as an APY for this week's distribution in [3]. We now have enough data to give a better historical picture of progress and have including a 26-week average to give a measure of medium-term returns.

[5] Our BUY price is the price you may sell your MAPR tokens such that their value in STEEM is the same as if this week's distribution was done by direct STEEM transfer.

[6] Our SELL price is about 1% above the BUY price.

Our MAPR distribution [3] is much higher than the average blockchain author rewards for most users [2b & 2c].

Profits will be paid today in the new MAPR tokens. The token buy-backs on Steem-Engine may need to wait a few hours for our power-down to take place.

MAPR News

As I mentioned last week, I have decoupled the distribution to delegators from the token price increase. This will take, I feel, another two weeks. Then we shall move back to them being about equal.

The reason for this, as also mentioned last week, is to enable another downgrading of the few third party tokens still held within the MAPR fund. The current gross income is decent, so as it is the delegators who help produce such income, I think it justified they receive the bulk of rewards, at least for this week. Token-holders also contribute, but at the moment we are powering down to allow some to liquidate, so that the proportion of SP is swinging back towards being largely owned by delegators.

For a longer background to this, please read this longer post.

On a more positive note, this week's distribution is the highest ever since MAPR became a token. This is due to two factors: our current powering down means that each week's rewards are based on the previous week's SP and hence are higher as a percentage of the current SP; and the closing down of SteemAuto has created a sharp drop in overall votes and this has further inflated the reward pool. To those delegators who are not liquidating, this should be a good few weeks - with the ever-present caveat of a stable and functioning chain.

I think I've said enough for this week! To those interested in the Steem blockchain numbers published above, please read previous posts for some insights as to their meaning.

We shall continue to generate yields that are as high as we can given the economic model and in the hope that activity - voting rshares activity - will pick up at some point.

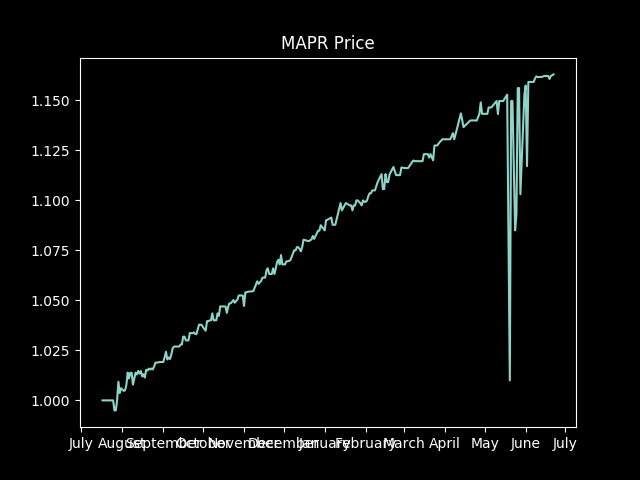

And finally, although our weekly returns are variable, here is a graph of how the token price has been performing since the MAPR token was launched. (Thanks to @gerber for the discord-bot.)

MAP Rewarder, without the token, has been in operation for some 30 months, so you can extrapolate back from that graph to get an idea of our returns to members. We celebrated 2 years of operations at the start of February.

"This graph is a record of actual transactions on the Steem Engine exchange so it can, in practise, deviate from this apparently-straight line!"

I quote myself (again) as an in-house joke, as recent turbulence is now amply reflected in the above graph. This may well continue for the next 2 weeks while we power down and some investors liquidate. The dips are merely impatient sellers; notice that each week it then rises again. This is all as expected, except I expected it a few weeks back!

Anyway, don't panic! We may need to flatten the curve slightly but, to be honest, this is the least of our worries.

See you next week!

Next rewards distribution will be on Monday 29 June.

[BUY MAXUV] - [READ MAXUV]

[BUY MAPR] - [READ MAP REWARDER]

ONECENT: The First Strategic Token Investment Game (STIG)

Thank you for being a part of the INCOME entertainment Fund, where builders are sought and supported!

This service is managed by @ecoinstant.

$trendotoken

Congratulations @ecoinstats, you successfuly trended the post shared by @accelerator!

@accelerator will receive 4.55755613 TRDO & @ecoinstats will get 3.03837075 TRDO curation in 3 Days from Post Created Date!

"Call TRDO, Your Comment Worth Something!"

To view or trade TRDO go to steem-engine.com

Join TRDO Discord Channel or Join TRDO Web Site

Hi @accelerator, a modest tip of appreciation:

$trendotoken.

Also, please check out my Nonsense Community.

Thanks!

Congratulations @rycharde, you successfuly trended the post shared by @accelerator!

@accelerator will receive 5.01627938 TRDO & @rycharde will get 3.34418625 TRDO curation in 3 Days from Post Created Date!

"Call TRDO, Your Comment Worth Something!"

To view or trade TRDO go to steem-engine.com

Join TRDO Discord Channel or Join TRDO Web Site

Congratulations @accelerator, your post successfully recieved 9.57383551 TRDO from below listed TRENDO callers:

To view or trade TRDO go to steem-engine.com

Join TRDO Discord Channel or Join TRDO Web Site