HEX: Of Use Case, Mysterious Accounts & Perpetual Yield

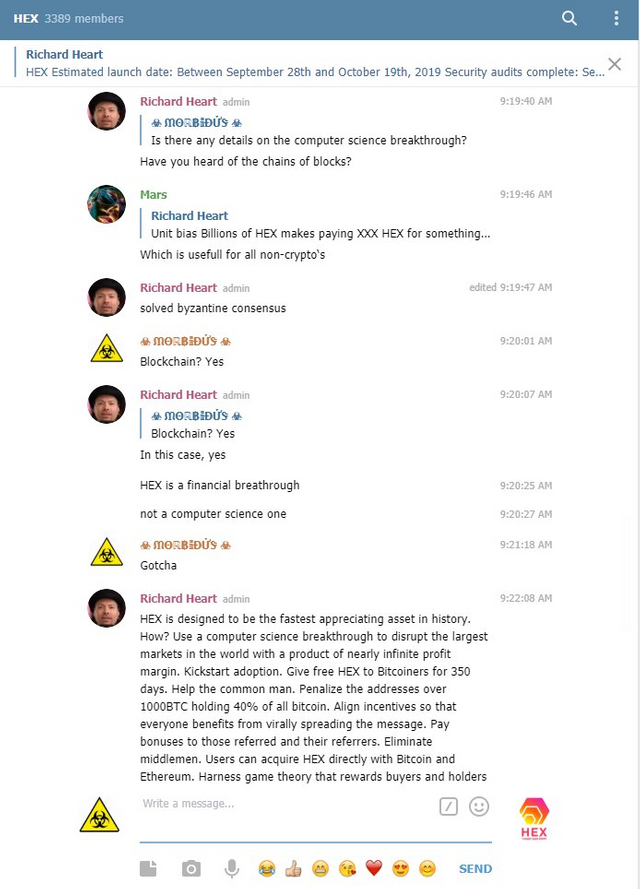

In the last week I had seen a swell of Hex supporters coming to Coinmarketcap's Telegram. I am a moderator there. They wished to know why HEX was not listed in the top 200. The response was simple on my end. Having followed the project since August 2019, 4 months before it launched, I was very familiar with it and all of its red flags. The fanciful promises of 10000x and faster appreciation than any other asset in history. The indication that it was a computer science breakthrough that will "disrupt the largest markets in the world with a product of nearly infinite profit margin." What is nearly infinite profit margin anyways? Infinite right?

The image was taken from a conversation I had with Richard in 2019. He was working on the website, brainstorming the wording he would use to capture the tendency for some to give their crypto over to scammers. That's his words. HEX was his solution to scams. It would starve the scams of their primary source of income, the naive. And to do so he would use Ponzi style marketing. Again, his words, as you can verify watching his many interviews leading up to the launch.

I am thankful that CMC has higher standards for listing projects in the top 200 than simply market capitalization. Needless to say the HEX community was not happy with the responses they received when coming to ask about it. Some resorted to tantrums, others argued their points maturely, but my point in making this article is to share an impromptu interview that resulted from the situation. In a discussion with Saan Fran (@sh101a) one of the more level headed HEX supporters, my stance centered on three main questions:

What product or service does HEX provide that constitutes incentives paid for staking?

In what way is HEX designed to appreciate faster than any other asset in history?

Why does HEX need an origin address? What does that address accomplish for the project?

Eventually Firebun (@firebun) joined the channel and the interview of sorts began. It was a messy start, but quickly settled into one of the best conversations Ive had about HEX, and I thought worthy of sharing with those who care to read. The whole of it can be read in the Coinmarketcap Community on Telegram @CoinMarketCap

Firebun (@firebun):

HEX solves trustless interest

Morbidus (@ProfessionalJackass):

How?

Firebun (@firebun):

You can think of HEX as an appendage to the ETH ecosystem where users can get interest by staking longer and/or larger

Morbidus (@ProfessionalJackass):

It simply uses inflation to pay people to hold it. Without a usecase unique to it it drives no demand on its own.

Firebun (@firebun):

That is the usecase

Why do you need more than that?

It already does more than BTC with just that

Morbidus (@ProfessionalJackass):

Unless you are contending value is not ultimately decided by a ration between supply and demand

Firebun (@firebun):

Staking reduces supply and cannot be sold immediately without penalty

There is a demand for interest

Morbidus (@ProfessionalJackass):

Btc is not trying to do more than store value and be a means of p2p transfer. Hex does not provide the same quality, not even close. Now please stop deflecting.

Let's just assume btc is also a scam then if it will allow us to focus on why hex is not

Firebun (@firebun):

Lets assume BTC can only be transferred between users

and security is solved by ETH

Morbidus (@ProfessionalJackass):

There is demand to park value for savings for interest, that has always been on a system in which the staking provides a benefit to the network or ecosystem that warrants paying incentives for people parking there

Firebun (@firebun):

Yeah, historically this is true

Morbidus (@ProfessionalJackass):

See this is the problem. Opting to deflect rather than stay on topic.

Firebun (@firebun):

I'm just trying to understand why you don't think similarly for that topic. I'm not intending to deflect. Just think so radically different than you are that you think it's a deflection

Morbidus (@ProfessionalJackass):

Because when the hype is gone, there is no basis for demand and thus the value collapses.

I think you know exactly what strawman tactics are.

Firebun (@firebun):

What if the interest is only paid to users that lock up

The demand is guaranteed until stakes end

People locking up for 1day - 15 years. Stuff should move slower than a hype cycle

although i bet hype cycle helps

Morbidus (@ProfessionalJackass):

Its what conflates my point. The concept of staking for staking sake is what i dont comprehend.

Firebun (@firebun):

Yeah, that's where most people get hung up

Because the value comes from thin air

Morbidus (@ProfessionalJackass):

And we inherently know that's a very likely big red flag

Firebun (@firebun):

You gonna call me strawman again, but people say that about all crypto things

Depends on perspective

Morbidus (@ProfessionalJackass):

Economics has been well tested. Supply and demand is a law of economics

Firebun (@firebun):

I say - yes, there's value in an immutable interest bearing system

yes, and staking = demand

if less staking => higher interest

Morbidus (@ProfessionalJackass):

And yes they too can be broken, but it takes an Einstein

Firebun (@firebun):

if more staking => lower interest - but less supply

Morbidus (@ProfessionalJackass):

Ok so the demand is solely staking.

Firebun (@firebun):

Yup

Morbidus (@ProfessionalJackass):

Ok now the next question?

Designed to appreciate faster than any other asset in history

Firebun (@firebun):

Yes, that's the design intention

and that's fulfilled by paying higher interest to people staking longer AND penalizing for ending early (not fulfilling contract)

What happens if people are incentivized to remove supply AND not end stake early

Morbidus (@ProfessionalJackass):

The game theory.

Firebun (@firebun):

Yes, exactly

Morbidus (@ProfessionalJackass):

Its dependent on perpetual hype?

Firebun (@firebun):

I mean it's dependent on being a reliable system for a longer term time period

Hype helps adoption for sure tho

Morbidus (@ProfessionalJackass):

I mean when capitulation comes again to the markets, without an underlying usecase, how does staking draw in those capitulating

Firebun (@firebun):

Penalties $$$

Volatility brings penalties

It could crash into the ground.. still a crypto

Morbidus (@ProfessionalJackass):

People are capitulating, they believe they will lose more staying in.

Firebun (@firebun):

That's the beauty in being locked in

Harder to capitulate imo

Morbidus (@ProfessionalJackass):

With other things there is an underlying use that drives people to stay in because they use it for something other than investing

Firebun (@firebun):

Yep i understand

Money gets lent / borrowed

In this, the money gets burned temporarily for your principle + interest later

You're effectively doing a service by reducing supply tbh tho

Morbidus (@ProfessionalJackass):

But its still circular.

Firebun (@firebun):

Yep

Morbidus (@ProfessionalJackass):

It makes me think of perpetual motion

Would it be fair to say richard aimed to create a perpetual investment?

Firebun (@firebun):

Yes

Morbidus (@ProfessionalJackass):

Ok fair enough

Firebun (@firebun):

I don't think he's a scammer at all. And it disgusts me seeing these projects get listed that fail from existence within a week

they literally fail at existing (yam)

Morbidus (@ProfessionalJackass):

You and me both on the latter

And what of the OA?

Firebun (@firebun):

The OA can dial in the knobs

1 it can seed the market / adjust interest / create or reduce supply

Has enough to pay for ads / marketing / listing

And enough of a stack for it to make sense

The OA can torch the whole project too though

Morbidus (@ProfessionalJackass):

What is the total amount of hex the oa has been awarded?

Firebun (@firebun):

The OA will have ~50% of all HEX by end of launch

Sent out some mega stakes at the start, then has been holding liquid the rest

Nothing has been sold though

Morbidus (@ProfessionalJackass):

Also, what then is the flush address doing with the eth if not that same thing?

Firebun (@firebun):

Dunno

Better to have ETH to sell than HEX though :)

Morbidus (@ProfessionalJackass):

Did chain analysis (not to be confused with the organization) not show it going back into the aa?

Firebun (@firebun):

Yeah, i saw that a while ago. Goes through a small (maybe exchange?) and through a lot of other addresses. Haven't checked on it in a while

Morbidus (@ProfessionalJackass):

Did get a bit of an answer on that before, but eventually ends up largely back in the aa.

Firebun (@firebun):

That doesn't bother me if true

Morbidus (@ProfessionalJackass):

You have two related entities gathering hex. The oa at around 50% at end of distribution then what the flush address accumulates.

Its concerning without knowing what or who and why

Prime for a dump.

Firebun (@firebun):

Dunno can approach it from both sides

Morbidus (@ProfessionalJackass):

Which is the only reason people bring it up.

Firebun (@firebun):

Mhm, gotta play it like it is though

People ladder their stakes to distribute risk

I think that's a good idea

Morbidus (@ProfessionalJackass):

I dont think pointing out these concerns is doing a disservice.

Firebun (@firebun):

Nope

But, not also creating the counter-argument may be

Could be hella good for the project

Morbidus (@ProfessionalJackass):

That is for the other side of the debate to do.

Firebun (@firebun):

People don't understand that both sides exist

Or even understand how it works

Morbidus (@ProfessionalJackass):

Its actually a disservice that when asked thay the response is adhoms

Firebun (@firebun):

Fair enough although people don't usually try to understand anything about the project

Morbidus (@ProfessionalJackass):

Exactly the reason for the discussion

Agreed

My goal is to get though all the marketing jargon and bring the whole truth out on any given project.

Firebun (@firebun):

Makes sense to me. Sounds like a big brain tactic

Morbidus (@ProfessionalJackass):

Same with Bitcoin or any other.

And richard knew his ponzi marketing tactic would bring out the skeptics. Im not sure why he opts to ban those that do come out. Its a secondary red flag.

Firebun (@firebun):

Yeah, he used to let them hang around. They don't add much value to a chat that's pro HEX. I was banned at one point myself even o,o

Morbidus (@ProfessionalJackass):

I think trolls ruin it, but its easy enough to handle the trolls and also tolerate genuine questions and skepticism

I think we've addressed everything. I appreciate the discussion.

Firebun (@firebun):

Agreed. Nice chat. I know a lot about the project so lmk if you have any other questions