Forks are inherent in the system

Decentralised systems have a different governance model than centralised ones. It is often hard to make the mental leap when first encountering blockchain technology. In this article, I want to give my view of the current bitcoin blockchain debate(s).

Anyone involved in blockchain should have a general knowledge of governance, as it is a vital element in how the software is constructed and why it works as it does.

For those following Bitcoin at the moment, it’s either a very exciting time, or an extremely stressful time.

For those who aren’t following bitcoin at the moment, but who are interested in seeing a very interesting exploration of new forms of governance in action: I invite you to google “Bitcoin fork” and take it from there.

What is a fork?

Very succinctly, a fork occurs when the software for a blockchain gets changed in such a way that compatibility becomes an issue.

We can roughly define two kinds of forks:

soft forks, that tighten the rules for acceptance. This means that all old software would still be able to accept new blocks, because these new blocks are held to even higher thresholds of acceptance.

hard forks, that loosen the rules for acceptance. This means that all older software will *not* accept the new blocks, because under their rules they would pass the criteria.

These are just rough guidelines, as I just want to give you a handle on the terminology. Again: I invite you to google on soft forks and hard forks to deepen your knowledge.

What I want to concentrate on is this:

Forks are normal!

The current debates in Bitcoin make it sound like forks are a bad idea, or even an attack on Bitcoin.

Actually, forks are common as muck. Every time the software is updated, there is a technical fork. The reason why they usually pass completely unnoticed is that both users and miners accept them and there is no problem at all. Everyone just upgrades and the new rules get adopted without a hitch.

One of the reasons for this is that new software doesn’t just get dumped on an unsuspecting community, but that it first goes through a long process of discussion before it reaches production stage, just like in most software.

Bitcoin has a formalised Bitcoin Improvement Proposal (BIPs) procedure, there is a mailing list for developers and of course there are numerous forums where these proposals are discussed.

The current issue (colloquially and erroneously known as “the Blocksize Debate”) is the first time that the bitcoin community has not come together on the way the software should evolve, sparking a heated debate and many tensions.

Bitcoin Governance

Because Bitcoin is decentralised, there is no Central Authority(tm) that can decide the way this is going. Again, this is by design.

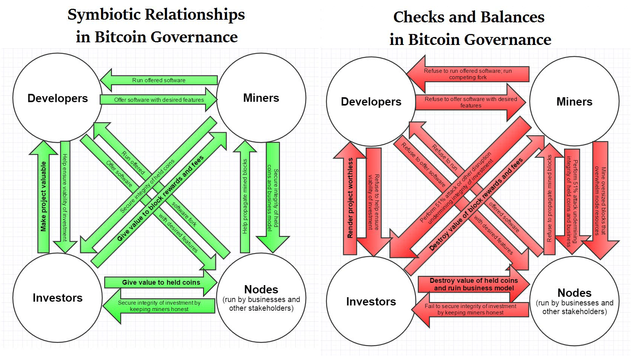

Blockchains are set up in such a way that none of the stakeholders (defined as Developers, Miners, Businesses, and Investors; there are more, but these are at this moment the most influential ones) have full control.

All of these groups have different objectives and goals, and this dynamic interplay is meant to make sure that eventually there will be a balance that will work for all of them. This does not mean all will be happy or it will be perfect: it will work well and within boundaries each of these groups can accept.

Source: Bitcoin’s Incentive Structure by George Papageorgiou

What we see now is an expression of an out of balance situation, and the symptom of this can be defined as a rebalancing: for the first time in Bitcoin the stakes are very high, which explains why there is a lot of fierce debate (and mud slinging). The community is, in a very roundabout way, defining the process as it goes. The fact that this is not done fully rationally actually fits into the Game Theoretical framework described above: it doesn’t need everyone to be rational, emotional appeals are also part of it.

An Example

In the current debate, the main contestants are the long standing developers of Bitcoin Core and the “new” developers on the block who have proposed Bitcoin Unlimited. Without going into the details of either proposal, we need to assume that both teams have reasons for wanting their software to be the one accepted. These reasons may be either selfish or altruistic, but they will be convinced their solution is the best. Taking into account human nature, we can also assume they stand to gain from acceptance, if only because their names will be attached to the bitcoin protocol for years to come.

Their incentives do not necessarily align with those of other stakeholders like miners and investors and businesses, but in order to ensure all of these will support their solution, they will need to at least offer a solution that will not harm any of these groups. Miners may balk at these plans, but if businesses en masse choose one, it will make sense for miners to follow suit. If most businesses disagree, either miners and developers (independently or in tandem) will need to offer convincing arguments or change something else to get them on board.

As there is no central method of decision, this can take quite a while, but with a large amount of value at stake, pressure will continue to rise as value is threatened. The theory is that in this way, the system will balance itself, because no actor in the system will irrationally destroy the project they live on.

Unless they fork

Of course, it may happen that stakeholders may feel so out of place in the initial project, they feel the need to leave. In this case, it’s most likely that eventually they will fork away from the older project.

Last year, this happened after the DAO project was exploited in Ethereum. In response to the exploit, the Ethereum Foundation felt they needed to offer a solution to the community, so that the exploiter would not profit from his actions. A significant minority of the community however disagreed and held the position that the Ethereum Foundation had betrayed the rule that blockchains should not be tampered with by a central authority. In response to this, they kept supporting a version of the software that did not contain this change and thus formed a fork, which is now named Ethereum Classic and which still has a large following and is actively being developed.

Forks are seen by many as bad: they split the value of a project and they split communities, reducing their resources. They are seen as a weakness in not being able to get consensus.

I contend that forks are inherent in blockchain systems. They are built in options that actors can use to express choice. Vitalik Buterin recently wrote an interesting article exploring this topic.

I would like to add to this that in my experience social forks precede network forks in general anyway. Regardless whether an actual fork will happen, people who feel really distressed by changes in the protocol will eventually leave the project in any case. In some cases they will succeed to maintain a fork of the original project like in Ethereum’s case, in other cases they will set up competing blockchains like the Waves and Komodo projects did after their project leads split off from the Nxt and Ardor project over disagreements with the core development team.

Fork Away!

In either case, these forks are healthy! If, after trying to mediate and moderate between factions, no social consensus is reached, it is much more healthy for people to be allowed to leave and set up their own projects. This should not be decried, but rather embraced. Forks do not detract from value, they add to the ecosystem. This is part and parcel of the open source philosophy and is what sets it apart from the deathly competition in proprietary software.

It allows the original project to regain focus and work with a community that is aligned with it in a much more coherent way. If handled correctly, it can give a significant positive boost that will far outweigh any negative fall-out from added competition. And if it’s a straight fork, the project can always borrow new solutions developed on its forked branch.

So, fork away, if eventually all other avenues have been exhausted! It may lead to a temporary drop in value, but the added new sense of direction offers a much bigger chance for eventual success than endless bickering in the family.

Your post made me realize I have a lot to learn about bitcoin. There are a lot of terms that I need to familiarize myself with in order to completely understand your post. Thanks for this.