My view on gold

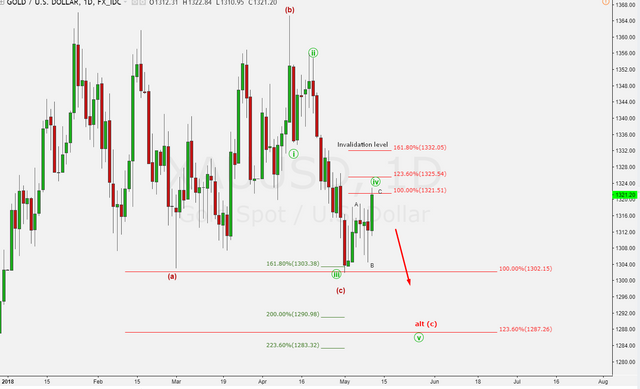

This is just a short term analysis so I will keep it brief. Gold bounced higher as the dollar turned lower by a cooler than expected CPI for April. I don't think that this will be the start of a bigger rally. Not yet actually! I still believe that we will see $1450 but we need to finish that "short term bear cycle" first

Bull case

(c) equaled (a) in price so there is a possibility that we finished that bear cycle at the beginning of May. But I don't think that we are out of the woods yet.

Bear case

I can only count 4 waves in that (c) wave so that means that we still need one more leg down. That little bounce that we saw during the last couple of days was in my opinion a fourth sub wave of (c). And this sub wave looks almost overcooked so it wouldn't surprise me if we turn south again in the near future. I even expect a move below the "psychological" $1300 level. A move like that would be a great buying opportunity for what will come next!

Conclusion

I expect a lower low between $1287-$1290 in the near future. Don't panic if the talking heads on bloomberg or cnbc whine about a break of the "psychological" $1300 level. Grow some balls of gold and use that gift wisely!

PS: A move above $1332.05 would invalidate the bear case ofc. So we need to keep an eye on that!