The best store of value

What defines value? Is value based on that which is simply in the eye of the beholder, or does there need to be use assigned to something of value? And what is the best store of value?

In this article I look at a few alternative investment opportunities that have nothing to do with the traditional stocks, bonds and real estate.

Art

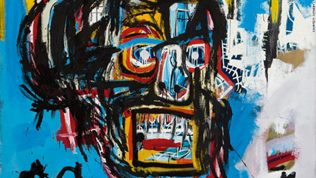

A painting by Jean-Michel Basquiatat recently sold for $110.5 million at Christie’s in New York. The painting was “only” bought for $19,000 at an auction back in 1984. The claim can easily be made that this is one of the best single investments ever made, since the ROI on the below painting dwarfs anything done by the likes of Warren Buffet.

Perhaps the person who recently bought this canvas could be deemed to have slightly overinvested. But the colossal amounts of money invested in art these days is an indication that high net worth individuals are seeking alternatives from traditional stocks investing.

Bitcoin and other cryptocurrencies

On the other end of the wealth spectrum, people from all walks of life are trying to create a return on investment outside of the traditional methods too.

More and more people are choosing to invest in cryptocurrencies such as bitcoin, ethereum and a whole host of so called alt-coins.

This second coming of interest in the cryptocurrencies has arrived at a time when banks are offering record low rates on savings accounts.

Simultaneously, cryptocurrencies are increasing in price at a rapid rate, and what’s more, cryptography seems to be offering real world solutions for trust and contractual dilemma’s.

Precious metals

Gold and silver have been around for thousands of years. They have always functioned as money and to this day are still seen as the ultimate store of value. Despite a stellar rise over the past few years, both gold and silver are still considered undervalued and a good buy.

However, buying metal through an ETF is seen as exactly the wrong thing to do. Yes, you are buying into the metals, but doing it through the wrong vehicle.

The whole idea behind buying physical precious metals is because you want to have unencumbered money in your own hands, and, as a result, cannot be manipulated through the dealings of central bankers.

So, what to invest in?

Ultimately diversification is key to any good portfolio. The traditional way of working was to diversify in stocks, bonds and real estate. However, over the years all these elements have been pumped up by the central banks. What’s more, all three “assets” are currently pretty much priced at all time highs.

Art is difficult to buy since most high valued art is very highly priced. But cryptocurrency and metals are still available at a great price.

And ideally you should own both crypto’s and metal, because they have attributes that complement each other.

Where cryptocurrencies are intangible, gold and silver are tangible.

Where the metals are difficult to haul around, crypto’s are electronic and easy to store.

And finally, where crypto’s can be used in the digital world, metal can be used in a potential barter situation.

In short, exchanging your dollars and euro’s for a bit of bitcoin and gold will most likely be a great investment in the future!

I agree in my parts of your post.

Anyway investing in art, could be very "tricky".

Platinum is also other precious metal that is very undervalued and usually forgotten.

great advice thanks man!