Insights from George Rosen Smith on 2023 Stocks

Insights from George Rosen Smith on 2023 Stocks

In 2023, the financial market has experienced a turbulent year, full of various social chaos. First, the inflation problem is extremely serious, interest rates and prices have also risen sharply, and the stock market has also soared rapidly. Combining various phenomena, we find that the commonality this year is that monetary tightening policies have been generally implemented worldwide, resulting in a decrease in the amount of money in circulation, and people generally feel that economic pressure has increased.

For ordinary people, monetary tightening may seem far away from daily life, but in short, the money in circulation around the world has become more limited, making people feel that funds are tight. This is the ultimate commonality of various chaos this year, that is, the general feeling of a decrease in funds. Against this background, we can't help but wonder what happened and why this phenomenon occurred.

We will be divided into four parts. First, we will introduce the major financial events that occurred in the United States this year and summarize the impact of these events on the US and global macroeconomics. After the macroeconomics is affected, we will focus on the performance of the US stock market, especially considering that the Dow Jones Index has hit a record high. Finally, we will discuss the possible direction of US stocks in the future.

The Big Financial Events of 2023

We begin with a review of the 30 big financial events that occurred this year, each of which will be discussed in more detail later.

The first event occurred on January 1, when Croatia joined the eurozone as the region's 20th member, marking the expansion of the euro's global reach. Then, the EU fined Facebook and Instagram for data use violations, highlighting the EU's geopolitical and economic clout.

On March 15, U.S. federal regulators approved the merger of the Kenzas Southern Railway and the Canadian Pacific Railway, making the Canadian Pacific Railway a U.S. asset. On the same day, UBS officially announced its acquisition of Credit Suisse, ending its existence and having a huge impact on overall U.S. finance.

On April 23rd, furniture chain Bed Bath & Beyond declared bankruptcy, an event that underscored the lack of real value of companies that were hyped in the past, and that closure became the inevitable result of a reshuffle. It also symbolized the beginning of a global economic reshuffle that ushered in the collapse of many companies that previously had no real value.

On May 1, 2023, First Republic Bank was acquired by JPMorgan Chase, becoming the third bank to be acquired in the United States. Although the bank did not go bankrupt, the current state of the enterprise may be worrying. In just over a month or two, the United States experienced the collapse of three banks, which had a significant impact on the financial system. Fortunately, the US regulatory authorities took timely action to prevent the spread of the bank bankruptcy wave and stabilize market confidence.

On May 30, Former Theranos CEO, Fromos, began serving his sentence. This was a company that was once touted as a VC darling, claiming that it could detect a variety of diseases such as cancer with a single drop of blood. However, in reality, it was a VC scam that deceived investors and politicians. This incident reminds us to be wary of similar scams in investment, and Fromos's conviction also sounded the alarm for the investment market.

On June 3, Biden signed the Fiscal Responsibility Act of 2023, which significantly raised the U.S. debt ceiling. This created the conditions for the U.S. to continue to issue money, a sign that the upward channel of money printing is once again open.

As of the end of June, Apple became the only U.S. listed company with a market capitalization of more than $3 trillion to date, a sign of the strong growth of U.S. businesses.

On July 11, the U.S. Consumer Financial Protection Bureau fined Bank of America $250 million, $150 million of which was for alleged fraud and abuse of investment fees. This shows that there is still chaos in the financial market, even such as Bank of America, such a large enterprise can not escape the sanctions of financial regulation.

On July 26, the Federal Reserve raised interest rates again, to the highest level since 2001. This is a trend of rising interest rates so far this year, leading to monetary tightening.

On September 5, New York local law went into effect, officially banning Airbnb from operating indoors. This signaled political resistance to the sharing economy model and raised questions about the viability of the sharing model.

On September 6, U.S. geographers discovered the largest carp mine in the U.S., estimated to contain 20 to 40 million tons. This is instructive for the financial markets because carp ore is a basic material for making clean energy, and its discovery means that the United States will dominate the clean energy sector in the future.

On September 20, the U.S. national debt exceeded $33 trillion, which may be related to the debt ceiling increase that is rapidly driving up the U.S. national debt.

On September 25, 2023, the U.S. deficit reaches $1.4 billion to improve safety and debt volume on the nation's rail network. This signaled an economic windfall as the United States began to strengthen its infrastructure. Funds, manpower, and material resources are being invested in building the U.S. infrastructure, and this initiative is an important guide.

Then, on September 26, the Federal Trade Commission filed monopoly charges against Amazon for monopolistic practices, particularly in the area of online e-commerce network sales throughout the United States. This highlighted concerns about monopolistic behavior by the tech giant.

On October 11, ExxonMobil acquired Pioneer Natural Resources for $6 billion, making it the largest acquisition in the energy industry in nearly 20 years. Against a backdrop of market turmoil and the rise of emerging energy sources, the traditional energy industry is reimagining its landscape through mergers and acquisitions.

Then, on October 15, the drugstore chain Lai-Aid declared bankruptcy, highlighting the alternating waves of mergers and acquisitions and bankruptcies. Similarly, Chevron's announcement of its $50 billion acquisition of Amerada Hess Corporation demonstrated the trend toward strength in the market.

On November 2, Sam Bank-Fried, former CEO of cryptocurrency FTX, faced seven counts of fraud and was convicted on all of them. This event had a decisive impact on the cryptocurrency industry as a whole, highlighting the fraud problem in the sector.

On November 6, WeWork, with $50 billion in debt, filed for bankruptcy, marking the failure of the shared office space model in the marketplace. Once touted as the most valuable startup in the U.S., WeWork ultimately led to heavy losses for investors.

On November 17, OpenAI's CEO Sam Altman was fired from the company and then reinstated, causing a stir in the AI industry. This event revealed the changes and complexities within the AI industry.

On November 22, Zhao Changpeng, CEO of cryptocurrency exchange CoinSafe, pleaded guilty to paying a $4.3 billion fine, further highlighting the money laundering problem that exists in the cryptocurrency world.

Finally, on December 13, the United States Dow Jones broke through to a new all-time high of 37,000 and continued to reach new highs over the next four days. This demonstrated that the financial markets showed strong performance at the end of the year, with far-reaching implications for the U.S. and global macroeconomies. These big events not only relate to the state of the economy, but also provide important references for investors and market participants.

The reason why we need to spend so much time talking about these major events is that they will have a huge impact on the entire U.S. macro-economy and even the global macro-economy.

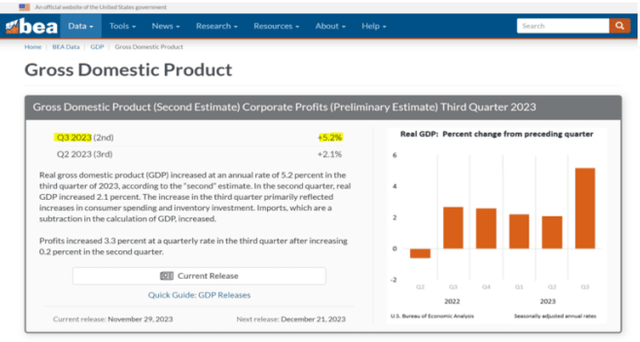

First, going into the third quarter of 2023, the U.S. GDP grew by an astonishing 5.2%.

A 5.2% increase is very unusual for an economy as large as the United States. An annual GDP growth of 2% is considered normal, 3% is a huge increase, 4% is unimaginable and 5% is already astronomical. Therefore, the GDP growth rate of the United States in the third quarter indicates that the U.S. economy is strong to an unparalleled degree.

Now, let's look at overall U.S. economic growth in 2022 and 2023. It's just those two years, and let's extend the time span a little bit longer to 2021 where the epidemic is not over. We all know that there was an outbreak in 2020, and the epidemic is not actually over in 2021. What about GDP growth in the U.S. in 2021, when the epidemic is not over, 4.2%, 5.2%, 6.2%. It was down to 3.3% for a while, then quickly spiked to 7% GDP in the first month of 2022. of course, the real growth rate slowed down in 2022 and early 2023, but going into the third quarter of 2023, U.S. GDP was once again at a record high of 5.2%. As you can imagine, the overall U.S. economy is so huge that 2% growth is already huge growth, so a 5.2% growth rate for several years in a row is very impressive.

Next, let's further analyze what exactly is causing this increase.

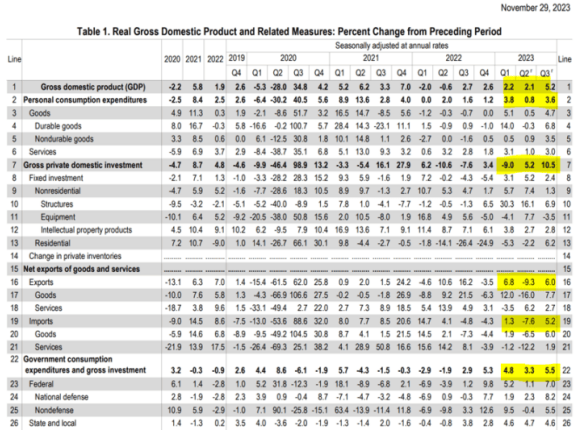

We saw a decline in personal consumption in the second quarter, but it rebounded quickly in the third quarter. Private investment across the country reached a new high in the third quarter, especially in manufacturing. In addition, exports picked up again in the third quarter, while imports are growing, indicating a strong recovery in the U.S. economy.

Of particular note is government spending, which has been stimulating the economy and reached 5.5 in the third quarter. this again confirms the strong performance of the US economy. As for the unemployment rate, due to the large amount of investment into the manufacturing industry, the employment rate in the United States has remained low and the unemployment rate has been maintained at a low level.

These large investments, mainly in the manufacturing sector, are at a more than 60-year high. This means that the manufacturing industry needs to hire more employees, prompting an increase in employment. With jobs and a steady income, people's consumer demand increased, which is why inflation has risen rapidly since 2021.

The U.S. economy performed strongly in the third quarter of 2023, with a GDP growth rate of 5.2%, which is a significant increase from the previous 2.1%. This high growth rate is a rare phenomenon in the U.S. economic system and highlights the strong state of the economy.

It is worth noting that this strong economic performance was closely linked to the Fed's monetary tightening policy. Despite inflationary pressures, the Federal Reserve has managed to keep unemployment low while curbing the rapid rise in inflation through the skillful use of monetary policy tools, highlighting its superior ability to manage the economy.

After peaking in the summer of 2022, inflation has been on a downward trend for a year and a half as food, energy and commodity inflation has retreated. Inflation in services, which depends heavily on wages as labor is the most important cost in service production, has decelerated at a slower pace and kept pace with the gradual slowdown in wage inflation. Meanwhile, new rental market data suggest that house price pressures should continue to ease.

As CEA highlights, the rise and subsequent fall in inflation during the epidemic is largely related to supply-side forces, including disruptions in global supply chains and rising labor force participation in prime age. Our analysis finds that supply chain disruptions (either within the supply chain itself or in conjunction with cooling demand) explain 80% of the deflation that has occurred to date. Indeed, one of the most important economic developments this year has been the dramatic reduction in inflation that has been achieved without a significant rise in unemployment.

As inflation receded from its 2022 peak, workers' nominal wages rose sharply and real wages began to increase in 2023.

In the year to November, real wages increased by about 0.8 percent for all workers and by 1.1 percent for 80 percent of production and non-management workers.

In addition, wage inequality declined, with the ratio of 90 percent of wages to 10 percent of wages falling nearly 6 percent over the year. One of the reasons for continued optimism about this trend in 2024 is the historic unionization campaign and victory in 2023. Strong labor unions help economic growth by reducing inequality and raising incomes.

As inflation retreats from its 2022 peak, workers' nominal wages grow sharply and real wages begin to rise in 2023.

Real wages for all workers grew by about 0.8% in the year to November, and by 1.1% for the 80% of production and non-supervisory workers.

In addition, wage inequality has declined. The ratio of wages earned by the 90% to the 10% has fallen by nearly 6% in a year. One reason to remain optimistic about this trend in 2024 is the historic union activity and victories in 2023. Strong unions help economic growth by reducing inequality and raising incomes.

In the previous article, we presented the top 30 events in the U.S. financial markets and provided an overview of U.S. financial macroeconomic data. We pointed out why investors should focus their investments on the U.S. market, emphasizing that the strong performance of the U.S. economy is not a short-term phenomenon, but rather has long-term and sustained characteristics.

While we provide a range of data and theoretical support, ultimately the goal of investing is to make a profit in the stock market. Therefore, we have to gain an in-depth understanding of the performance of the United States stock market. This year, the Dow Jones Index hit a record high, which triggered our attention to the stock market.

As you can see from the chart of the Dow Jones, there were ups and downs in the market at the beginning of this year, but after the end of October, the stock market went through a period of consolidation. It was not until the beginning of November that the market experienced an upward trend, culminating in mid-December when it broke through its all-time high to reach a new all-time high. This strong performance demonstrated the market's resilience and upward trend.

It is worth noting that there is important historical significance behind this rise. We analyzed the three-year consolidation zone of the Dow Jones Index, from February 2021 to February 2024, and this time span shows a long-standing consolidation zone. And this year's breakthrough represents the opening of the market's upside space, which has far-reaching historical significance.

However, we also remind investors that the rise and fall of the market is unpredictable and may fluctuate in the short term. But if you take a long-term perspective, historical experience shows that long-term holding of stocks is expected to gain. Therefore, we emphasize that investors should look at the market with a long-term and stable mentality, while seeing the overall upward trend.

Overall, the performance of the U.S. stock market this year is strong, and the breakthrough of the historical high has profound historical significance, demonstrating the potential vitality of the market. In investment decisions, it is crucial to understand history and look at the market with a long-term investment perspective.

We saw the market's all-time high in October 2007, marking the peak of that year. The financial tsunami of 2008 then brought the market to its bottom and touched its lowest point on March 6, 2009 and began to usher in an uptrend. The market reached an all-time high in 2013, but many predicted a pullback due to the tremendous headwinds of the past five years.

However, the market doesn't always go the way people expect. While everyone was waiting for the market to pull back, the market showed outstanding performance and more than 95% of people missed out on a major bull market of more than 10 years because they guessed the market would pull back. This highlights the unpredictable nature of the market and the risks that can result from relying too heavily on guesses and predictions.

Back to the present, the market has once again broken out to new all-time highs. While we can't say for sure if the market will pull back, we emphasize that predicting market movements is not the key to investing. Instead, holding and staying in the market for the long term is the key strategy for investing.

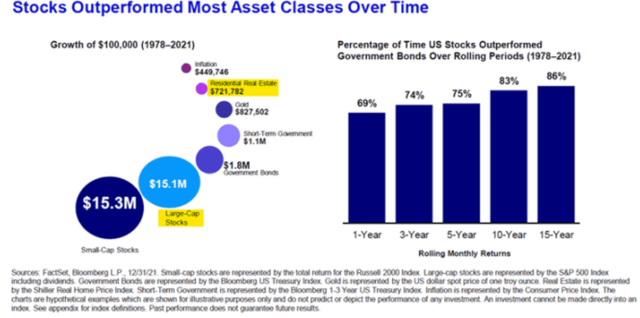

The chart above shows a comparison between investing in real estate and the stock market. $100,000 invested in real estate in 1978 has increased in value to $721,000 in 2021, while $100,000 invested in the stock market over the same period has increased in value to $1,510,000, demonstrating the vast potential of financial investments.

This shows that financial asset management is the key to the future and that investors should look to enter the investment industry rather than relying solely on predicting market fluctuations.