Unlocking the FTX Reorganization: Why Market Makers Thrive on Uncertainty and $16B Liquidity Could Push Bitcoin to $102K

On October 7, 2024, a court hearing will be held to confirm FTX's Chapter 11 plan of reorganization. If the court approves, it will clear the way for repayments to begin.

- Post-Hearing Payments: Additional hearings are scheduled for October 22, November 20, and December 12, 2024, to finalize the details. Distributions for claimants with claims under $50k will begin within 60 days of the plan’s approval. Larger claimants will have to wait until at least Q1 2025.

I've talked about this in the past, and now is the best time to clarify everything, as repayments are drawing closer.

In my years of experience, events like these often present opportunities for market makers (MMs) to create uncertainty even when the direction seems clear (in this case, approval). This type of uncertainty plays out through the court hearings and approval process—similar to how it’s been with ETF applications. You’ve seen it before, and now you’re seeing it again.

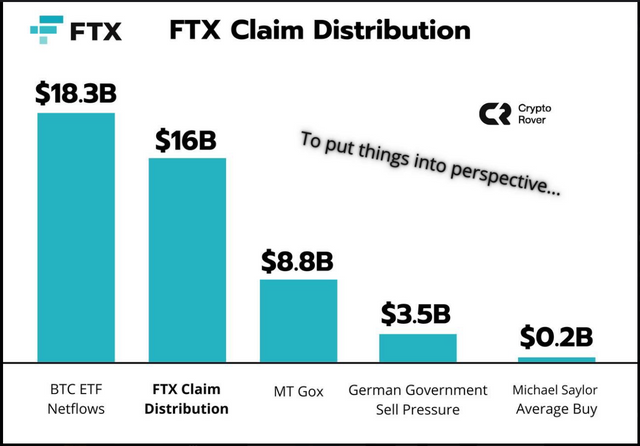

The fact that $16B worth of liquidity is involved is massive. To people like us (who aren't dealing in billions yet), $16B is a huge deal. This is why we saw market sentiment react strongly when Germany decided to sell $2B to $3B worth of crypto.

Market players will use this to manipulate probabilities in your mind. Soon, you'll start seeing big accounts tweeting things like, “FTX approval is now at an 80% probability.” These types of narratives are necessary to build momentum in the market and attract more attention, creating FOMO as prices rise.

I’m confident events like this are orchestrated in a way that’s not immediately obvious. Do you really think $16B will be disapproved, especially when the collapse that led to this situation is what triggered the bear market in the first place?

This whole process is a pattern we’ve seen many times before—it just has a different name this time.

A few weeks ago, I mentioned that positive news would drop. Some don’t see this as bullish because of the need for “approval,” but in reality, this is incredibly bullish. That's why the charts are showing macro signals on several fronts (e.g., BTCDOM, ETHBTC, TOTAL3, USDT.D) along with Bitcoin heading towards $102k.

As I’ve said before, charts reflect reality first, and then news follows to support the narrative.

What I’m teaching you is a way of thinking that gives you an edge in the market. Market psychology plays a crucial role in understanding price movements—why prices are where they are, why buy or sell signals trigger at certain times, and why prices reverse at key levels (who’s bidding or selling in these zones).

Everything is connected—just like microstructures in the market.

This is one of the most important points I’ve ever mentioned in this space. It’s a perfect example of how every aspect of the market connects:

- Why price gives macro signals before narratives emerge

- Why narratives must form to match those signals

- How catalysts build on top of one another, especially with the money printers about to start

I’ve also recently shifted my target to $102k as a local top for Bitcoin, and everything is starting to align.