In order to save themselves, FTX "last minute" almost "nuclear explosion of the coin circle"

The SBF is trying to "take the bottom out" by shorting the stable currency to make the market crash, Zhao Changpeng warned: "The more things you do, the longer you will be in jail."

In order to devalue FTX's huge debt, SBF even came up with the "bad move" of collapsing the market by shorting the stablecoin.

According to media reports, on November 10 before FTX's bankruptcy, Cryptocurrency CEO Changpeng Zhao (CZ) had a dispute with SBF over the stablecoin Tether, with CZ fearing that SBF would try to destabilize the cryptocurrency market in order to save FTX, which was on the verge of bankruptcy at the time.

The dispute took place in an online chat group, where CZ warned SBF that orchestrating Tether transactions now could send the entire industry into meltdown:.

Stop trying to decouple stablecoins. Don't do anything about it. Stop now and don't cause more damage.

The more damage you do now, the longer the jail time will be.

Tether is a so-called stablecoin whose price is designed to remain at $1. Tether is the linchpin of global crypto trading, serving as a pricing anchor and medium of exchange in the cryptocurrency market. Industry insiders have been concerned that if Tether's price drops, it could trigger a domino effect that would cause the entire industry to collapse.

Critics of the industry have also been saying for years that Tether is actually vulnerable to collapse as well, and regulators have previously accused Tether of lying about its reserve position, meaning the cryptocurrency's reliability is in doubt.

Hilary Allen, a financial expert at American University, has warned that

Tether is the lifeblood of the crypto ecosystem, and if it were to crash, it would cause the entire wall to come down.

Therefore, since most of Alameda's liabilities are denominated in unstable tokens, the value of those liabilities would shrink if Tether collapsed causing the market to collapse.

On the day CZ blamed SBF, Tether's price began to fall, dropping more than 2 cents from its usual $1 level.

Public blockchain data shows that Alameda borrowed more than 1 million Tether from crypto lending platform Aave in several transactions on Nov. 10, including one for 250,000 Tether that caught the attention of traders on social media. Alameda appears to have swapped some of its Tether for rival Coinbase's stablecoin USDC, which sparked concerns that Alameda was trying to depress the value of Tether.

In a Nov. 10 exchange, CZ noted that Alameda's trade was aimed at destabilizing Tether. SBF, however, was not convinced.

Hmm? What did I do to the stablecoin? Are you saying that you think a $250,000 trade in USDT (short for Tether) will devalue the dollar?

CZ responded that he didn't think a trade of that size would succeed in destroying Tether, but it could still cause problems.

My sincere advice is to do nothing. Put on a suit and go back to Washington to answer the questions.

The mysterious connection between FTX and Tether?

The reason why CZ is concerned that SBF will cause Tether to collapse is because Tether has been closely linked to SBF's FTX, and the vast majority of transactions handled by FTX involve Tether.

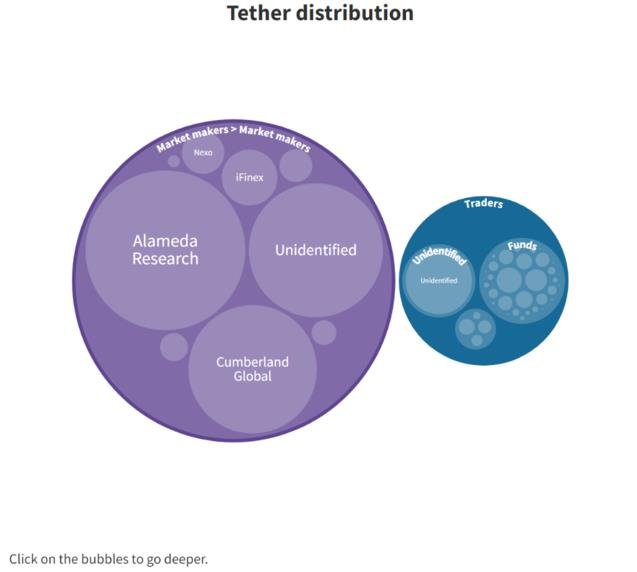

Cryptocurrency information platform Protos noted last year that Alameda was Tether's second largest customer and received more than $36 billion worth of Tether directly from Tether Ltd.

Furthermore, most major crypto exchanges prefer proprietary stablecoins, such as Gemini prefers GUSD, Coinan prefers BUSD, and Coinbase prefers USDC, while FTX has never issued its own stablecoin. For some reason, unlike the other major crypto exchanges, the vast majority of FTX transactions use Tether.

Another interesting coincidence is that on the same day that SBF founded FTX, Tether started a $1 billion funding round.

Despite the fact that no one has proof of the reasoning behind so many connections between Tether and FTX, Tether was shorted for a time shortly after FTX declared bankruptcy.

Luckily, Tether still held on to its peg and remains the third largest cryptocurrency in the world behind Bitcoin and Ether.