Getting Started in Forex

Forex

This will serve as quick start guide for those that are interested in getting into forex and:

- Don’t know how start forex

- Don’t know how to trade forex

- Don’t know when to trade forex

This is not too detailed, but there is enough to get started. More detailed content will be posted on my site in the future.

We will start things off with a couple announcements:

DISCLAIMER!

I AM NOT A LICSENED INVESTOR. INVESTING CAN BE RISKY. YOU HAVE THE POTENTIAL TO LOSE THE MONEY JUST AS EASILY AS YOU CAN MAKE IT. All the INFORMATION I HAVE WRITTEN HERE IS SIMPLY WHAT I HAVE DONE AND WHAT I CURRENTLY DO. IT MIGHT WORK FOR ME AND MAY NOT WORK FOR YOU. YOU ONLY HAVE YOURSELF TO BLAME IF YOU LOSE MONEY IN CRYPTOCURRENCY, STOCKS, FOREX, OR DERIVATIVES.

AFFILIATE DISCLAIMER!

THE ARTICLE CONTAINS LINKS TO EXTERNAL WEBSITES. I DO NOT OWN THOSE WEBSITES. THESE LINKS ARE CALLED “AFFILIATE LINKS.” WE MAY BOTH MUTUALLY BENEFIT FROM YOU USING THE LINKS WITHIN MY ARTICLE. IT WOULD BE MUCH APPRECIATED IF YOU USE MY LINKS IF YOU PLAN ON VISITING ANY OF THE WEBSITES LISTED BELOW.

I will start by addressing:

- How do I get started in forex?

You can start by choosing a broker, or two, or several? You can try out as many as you like and see which ones you like. There are no limitations. The major considerations are:

1 A. National and/or regional restrictions/regulations

1 B. Promotions

1 C. Trading Instruments and

1 D. List of Brokers

1 A. National and/or regional restrictions

Whether you can even use the broker or not may depend on which country you are from or which country you live in.

Nationality – The broker may not be able to accept certain nationalities due to regulations related to that country

Regional – The broker may not be able to accept you into their exchange based on the regulations of you local region.

1 B. Promotions

You may also consider the promotions a broker offers, such as a no deposit bonus, a deposit bonus, or cash back bonus.

No deposit bonus – usually a bonus meant to for the trader to test the broker out for 7 - 30 days. This money cannot be withdrawn, but the profits can be. The amount is usually between $10 and $100.

Deposit: Some regulations may require a deposit before any withdrawals can be made. This can be as low as $1 or $10.

Identification: You are also required to verify your identity. This is no different from being required to show your identification if you want to buy alcohol.

Deposit bonus: Usually between 20% and 200%, it could also be a flat rate $10-$100+ as well

Cash back bonus: Performing a certain number of trades or a certain amount for a certain duration (usually 5 minutes) may lead to a small cash back bonus. The amount is usually 1-5 cents per lot. A small amount, but it will be more noticeable as you build your portfolio.

1 C. Trading Instruments

The number of tradable items the broker gives you access to. It is usually typical to have the fiat pairs such as EURUSD and precious metals such gold, but it depends on the broker or the type of account that you open. Some offer crypto and other commodities.

Here are some brokers that offer bonuses that include a no deposit bonus, deposit bonus, trading bonus, or trading competitions. This means that it is possible to start trading and earning money in forex without using any of your own money. Feel free to use the links to direct you to the register page

1 D. Brokers

FBS

$100 Trading bonus

Forexee

$20 Trading bonus

Forex Times

Cash back trading bonus

Grand Capital

$500 demo account with potential to withdraw profits as a deposit bonus

Trading competitions

Roboforex

$30 welcome bonus on a deposit

Superforex

$50 Trading bonus

Rewards users daily with credits to trade with and daily/weekly missions to complete for extra credits

Worldforex

$10 Trading bonus

- How do I start trading forex?

2 A. Risk management

2 B. Creating a trade

2 A. Risk Management

This section is necessary to help you secure profits and control your position.

Margin: Creating a trade in forex has leverage which will limit the number of trades you can make based on how well your margin is doing. That leverage has a maximum margin ratio that you can read more about on the broker’s website. In general, I would recommend that you not make more than one 0.01 trade for every $20

5 Trades for every $100

You’re doing well if you make it above $100, but continue to manage your risk the same way or even increase the risk management.

You may want to have a stop loss and target price on your trades as well. These can be adjusted while the trade is open on Meta Trader.

2 B. Creating a trade

Most brokers will use Metatrader 4/5. They’re quite similar and very user friendly.

You can either create a Buy/Call/Long and Sell/Short/Put when opening a trade.

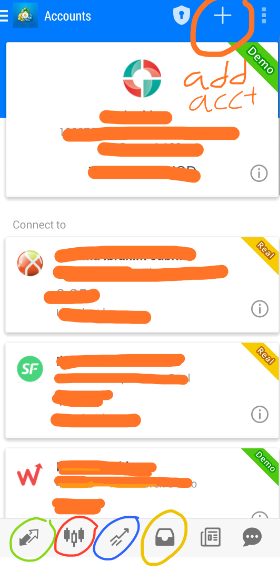

The add account button (orange) is how you add accounts. From left to right is

The quotes menu (green)

The charts (red)

Your open trades (blue)

Your close trades (yellow)

- Manage accounts

- Click the plus sign to add accounts

- Search for your broker and select it

- Enter your account details

- Click quotes

- Select your instrument to trade.

- Select new order

- Choose your volume (that should be 0.01)

- stop loss – the price your position will exit at if it reaches that price (at a loss at opening )

- target price – the price your position will exit at if it reaches that price (at a gain)

- Then choose whether to buy/sell (price is going up or price is going down).

You can modify stop loss and target profit by selecting a trade.

- How do I know when to make a trade?

3 A. Technical Analysis

3 B. Copy trade

3 C. Trading community

3 D. Signal Providers

3 A. Technical Analysis

A method for figuring out how to make a trade could be the use of technical analysis which is analyzing the graphs for the commodity you are interested in and applying techniques that are statistically probable to yield the expected results. Read more about technical analysis since my definition is incomplete.

If you are going to use technical analysis then a decent tool for that will be Trading View. Trading View has all of the tools necessary to perform a technical analysis for winning trades.

You can register a Trading View account here:

Trading View

You can use Trading View to make your analysis of the instrument you wish to trade and perhaps even see what others have published about their analyses. You can check the benefits of upgrading to premium and even try out the premium for 30 days at no cost.

You may want to consider setting price alerts so that you do not need to keep your face glued to graphs.

3 B. Copy Trading

You may copy the trades of others if they publish their trades. Some copy trading may require a fee. You can find people to copy trade on the broker’s that you register with.

3 C. Trading Communities

You may choose to join or form a trading community to mutually share ideas and positions for trades. You can find these communities on most social media platforms such as chats in trading platforms, Discord, and Telegram.

3 D. Signal Providers

Consider enlisting the service of a signal provider. These signal providers post a message via telegram that you can conveniently check on the app’s mobile version

Provide 1-3 signals per week in the free channel. Not every trade is a winning trade, but the majority should be winning trades (minimum >70%).

They will typically include:

The entry price

The stop loss price

The target price

I have made an attempt at evaluating the signal groups for forex. In general, I just looked for:

• Efficiency– How well they reach profit targets (hard to check unless they let you see the VIP group or offer a trial). Well above 70% would be satisfactory.

• Professionalism – How they respond to dialogue and how they operate as a business

• Transparency – Ensuring nothing is hidden and the information is straightforward, including losses on trades

• Support – The level of assistance offered to clients and how they help their clients secure profits, learn trading strategies, and risk management.

I tried to make contact and present myself professionally to each of the channel administrators that I believed would make ideal candidates for this article. I did my best to evaluate them based on the criteria above.

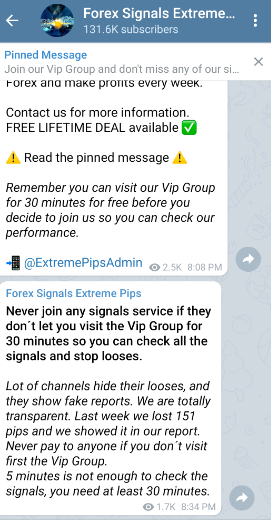

The one that met the highest standards was Forex Signals Extreme Pips

They offer free access to their VIP signals if you are able to use the broker that they trade with.

You can find the broker here:

BD Swiss

Gains and losses are not hidden. They are written clearly. Some groups will inflate profits by adding multiple trades of the same instrument on that same day. Some groups may also hide losses.

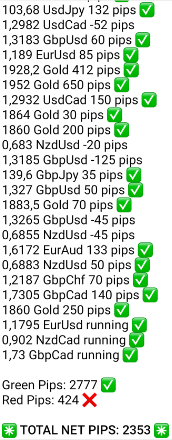

Here is an example of how a typical signal will look from [Forex Signals Extreme Pips]:

They give everything you need:

The entry price

The stop loss, and

The target price

Forex Signals Extreme Pips is quite transparent and they do not hide their performance. They also provide a really nice warning tip for anyone looking to enlist the service of a forex signal provider.

Here is an example showing that not every week can be a winning week:

On the other hand, the average over a month is quite good:

I have seen enough to say that if you want to start trading forex and are not sure when to make a trade then using [Forex Signals Extreme Pips] is worth a try, link below:

My Recommendations:

- Do not use forex as a get rich quick scheme. Use proper risk management to grow your portfolio.

- Make use of tools, technical analysis and/or enlist support to help you make winning trades.

- Do not be afraid to close trades early to secure profits.

Feel free to leave comments or questions. I would also like to hear from you.

Did you see anything that was helpful?

Did you try anything here?

What were your results?

I hope you found this helpful. You can look forward to my upcoming cryptocurrency and stocks article. They will include ways to earn cryptocurrency and stocks for free; as well as the best methods that I have found to increase portfolio value.