How to Forex - A Beginners Guide to Forex Trading - Part 2: How to use Forex Platforms

This is part 2 of my easy-to-follow series on Forex to teach you what Forex is and how to use it to make money.

How to Forex - A Beginners Guide to Forex Trading

Table of Contents

In this five part series you will learn:

An Introduction to Forex - What is Forex, the brief history of Forex, the benefits and risks of Forex

How to use Forex Platforms - Trading Applications, Brokerages, Opening live and demo accounts

Forex Trading Strategies - Trend trading, Scalping, Range trading, Breakouts, Signal trading, and Risk Management

Market Analysis - Fundamental and Technical analysis

Start trading Forex - Summary of all lessons, how to create your own strategy, the psychology of trading, and remembering the risks

2. How to use Forex Platforms

What is a Forex Trading Platform

A Forex trading platform is a type of software used by currency traders to help analyse the market and execute trades.

Trading platforms provide charts and order options - open, close, and manage positions.

Trading platforms vary in structure, functionality, and quality.

Some trading platforms are free and others are not.

Each Forex brokerage trades on a certain trading platform. You should test out each brokers platform to see which best suits your needs.

What is a Brokerage

A Forex Brokerage is a firm or business that allows traders to buy or sell foreign currencies.

Brokers hold a small portion of the overall volume traded on Forex which traders use when leveraging.

Forex brokers offer a spread - the difference between the buy and *sell price - which is their compensation.

Some Forex brokers also charge a commission rate on trades.

Each Forex broker offers something different - such as their own trading platforms - they each have different fees and spreads that you should research before signing up.

Certain Forex brokers offer large amounts of leverage so that traders can trade larger sums of money than they actually hold in their account.

Calculating Leverage is Important!

In Part 1: An Introduction to Forex I explained that leveraging carries a high degree of risk.

Understand how much you're leveraging and what your margin is. Your broker could shut you out if your margin falls below a certain percentage of your equity.

The following table shows the relationship between leverages and minimum margin requirements:

| If Leverage Ratio is | Then the Minimum Margin Requirement is |

|---|---|

| 100:1 | 1% |

| 50:1 | 2% |

| 40:1 | 2.5% |

| 30:1 | 3.3% |

| 20:1 | 5% |

| 10:1 | 10% |

| 1:1 | 100% |

It is important to understand exactly how much you're leveraging on your positions as leverage is one of the main things that traders fail to understand.

You should research different brokers to see what features and fees they're offering before you sign up

Open a Demo Account

- A Demo account is a trading account that allows traders to test a trading platform before funding the account

A Demo account is a practice account - like using monopoly money - a Demo account requires no funding and you can choose the amount of equity and leverage the account holds. I recommend setting a Demo account's equity and leverage to the same amount you intend to trade when you start funding an account.

- Demo accounts use live currency prices

Although a Demo account doesn't hold any real value, you will still be trading the price movements of the live Forex market. You may not be trading real positions but it will feel like you are. This is the perfect way for traders - beginner or advanced - to practice their trading strategies.

- Create as many Demo accounts as you like

An excellent strategy when starting your Forex journey is to create different Demo accounts with different settings. This way you can test multiple strategies to find out what works best for you.

- Return to your Demo account at any time

Because the Forex market is so volatile your particular trading strategy may start to fail. If your strategy begins to fail you can always return to your Demo account and build a new strategy.

- No need to sign up

There's no need to sign up with a brokerage in order to start a demo account. Some trading platforms - such as CTrader or MetaTrader 4 - allow users to create an account using only their email address. Build your trading strategy on a Demo account before choosing the Forex broker you're going to stay with in the future so you know what it is you're looking for.

Open a Live Account

- A live account is a self-funded account offered to traders through a Forex broker.

A live account is provided by a Forex broker under the terms they offer. An agreement with a broker allows you to fund and operate an account provided to you by the broker for an agreed upon spread and commission rate.

- A live account is funded by you

All the money you use on a live account is your own. You can not start trading on a live account until you have deposited money into that account. Some brokers will allow you to trade on credit but obviously that is not a good idea.

- Only open a Live account after using a Demo account

Forex trading is a slippery slope - don't tackle that slope without the right equipment - and so you should only start trading on a Live account once you have the right trading strategy. This includes a solid risk management plan and both a mixture of fundamental and technical analysis.

- Decide what broker is right for you

Again, you should research different brokers to see what features and fees they're offering before you sign up. Make sure you thoroughly research what it is that they offer before you make an account. Also make sure that the broker you decide to go with is regulated. A broker is somewhat your business partner - be sure to choose the right one.

How to use a Forex Trading Platform

I have used screenshots from the ctrader platform to show you the basics of a trading platform.

Here you will see:

- EUR/USD Chart

- Charting tabs

- List of Currency Pairs and other spot markets available through my broker

- Account Balances - Balance, Equity, Margin used/free, stop out percentage, and unrealized profit/loss.

- Activity window - positions, limit orders, history, etc.

- Basic charting tools

(It is possible to customize some platform layouts)

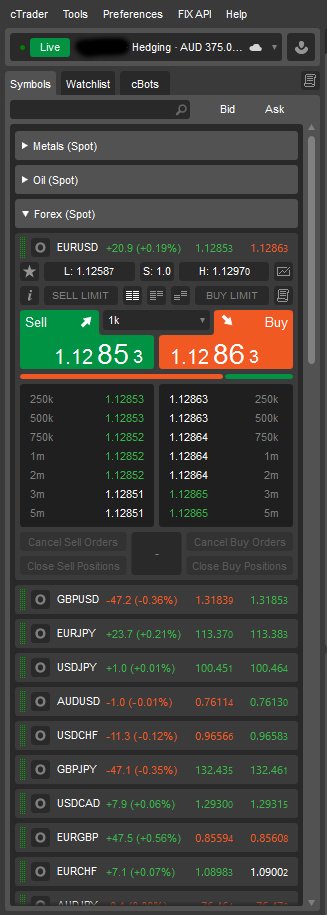

Below the account I'm using and a market list. You can see a few of the major currency pairs with the EUR/USD currency pair's options open.

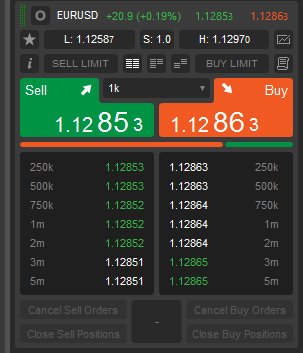

Here is the EUR/USD currency pair options closer up.

You can see the current spread and other information - low price, spread, high price, etc.

Most platforms will look similar.

Each currency pair will have a buy / sell option.

Once you buy / sell a position it will be visible in your open position window.

You can then track those positions in your activity window and on the chart you're trading.

Now you know how to use a Forex Trading Platform

In the next part of this How to Forex series you will learn Forex Trading Strategies

- Scalping

- Trend Trading

- Range Trading

- Breakouts

- Risk Management

- Signal Trading

I will try add each part of this series within 24 hours of one another

You can view Part 1 of the series here

Thank you for reading this article

This article is exclusive to Steemit

It has been provided to you by @senseiteekay - An aspiring Anarcho-Capitalist

All learning resources and references for each part of this series will be linked below

If you would like to donate towards my work you can do so using the button below

Disclaimer:

The contents herein these articles are not investment advice. Follow this guide of your own accord. If you do choose to follow these guides do so at your own risk. I am not a qualified professional. I am self taught and provide these guides as a guide only and not as a step-by-step rule to make money.

The Forex market carries many risks and anyone who decides to trade on Forex should know these risks before opening an account. I advise you to fully read each part of my series and to also do further research if there's anything you do not understand herein these guides.

Please be safe when trading.

Learning Resources & References:

http://www.investopedia.com/terms/forex/c/currency-trading-platforms.asp

http://www.investopedia.com/terms/forex/c/currency-trading-forex-brokers.asp

https://www.oanda.com/forex-trading/learn/intro-to-currency-trading/benefits/leverage

http://www.investopedia.com/terms/d/demo-account.asp

http://www.investopedia.com/walkthrough/forex/beginner/level3/types-of-accounts.aspx

Nice continuation, very easy to understand for newbies.

In my experience the most leverage I have used was 1:10 to try to stay below a 5% risk value, but nowadays I'm without leverage, using only my capital.

The A to Z of Forex....... good article.

Another post I would've upvoted (very complete info!)... yet, posting it at #general for promotion made me come to flag it.

Edit: After the deletion from the chatroom, I upvoted now ;) good article.

Yeah that was by mistake. Thanks for removing your flag.

With a please donate here button at the bottom. FFS.