A beginners introduction to the FX markets - Part 2 - Why trade FX and who trades in the FX market?

Why trade FX?

There are a whole host of reasons as to why to trade forex. Following is a short list of some of the advantages of trading FX as opposed to trading other markets:

- No middle man - With a broker that uses no dealing desk there is no middle man involved as you are connected directly to the interbank market prices.

- Practice for FREE - Most professional brokers provide a 'demo' trading account for you to gain experience and practice with. This allows you to grow as a trader without risking any of your hard earned money.

- Trade from ANYWHERE in the world - The forex market is entirely on the internet so you can trade from anywhere in the world where you can get an internet connection.

- Start small - Minimum deposits for most brokers are below $100. Once you are ready to start trading for real money, you can start small until you feel confident enough to increase your lot sizes.

- Recession proof - As you can buy OR sell in the forex market, it makes it recession proof. If the global markets are collapsing, simply take a short position to profit in this scenario.

- No fixed lots - In stock trading and similar markets you have to purchase a minimum fixed lot size. In FX you are free to buy and sell as much or as little as you wish.

- Low transaction costs - Transactions in the FX market are usually just the value of the spread for that trade. There are no other hidden commission fees, clearing fees or any admin costs.

- 24 hour market - As the world is awake at different hours during the day the forex market does not close throughout the working week and only closes at the weekend.

- No one individual can corner the market - Considering the size of the FX market, there is not one actor that can trade enough volume to shift market trends alone.

- Leverage provided by brokers - Leverage in the forex market is one of the highest leverages achievable in any market. Leverage allows for a trader to control a large position size with only a small margin of their account being used.

- High liquidity - The high liquidity makes it easy to get in and out of trades quickly no matter how much you are trying to trade.

- Low barriers to entry - Most brokers offer micro accounts that require only a deposit as small as £100 to start.

Who trades FX?

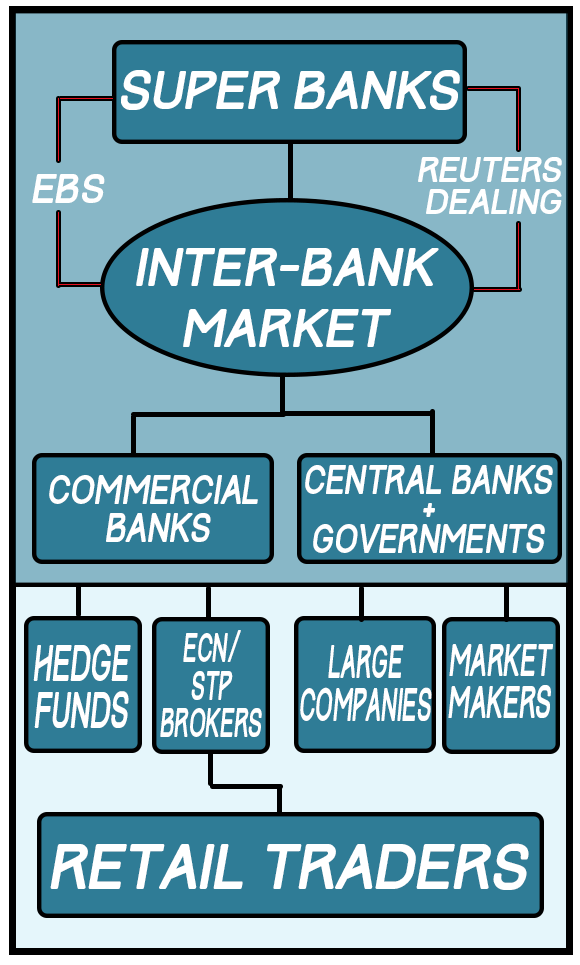

It is important to understand that there is no central physical location for the foreign exchange market. The market is made up by a network of participants which starts with the major market players who have the highest liquidity at the top and then trickles down to those with progressively less and less liquidity.

At the top of the liquidity pyramid we have the “Interbank Market”. This is a network of the largest trading super-banks in the world, known as tier-1 banks, who determine the exchange rates through the supply and demand factors of the currency. The interbank relationship is the heart of the FX market with almost 75% of all trading activity being conducted amongst themselves on a daily basis.

The largest banks in the world trade amongst each other within the interbank market through a loose affiliation of credit. At this level of the market structure, the spreads (the difference between the buy and the sell price) are the tightest and the volume is the highest. The super-banks can trade with each other directly or through a choice brokerage platform which are known as the “Electronic Broking Service” (EBS) or the “Thomson Reuters Dealing 3000-Spot Matching”. Some of the biggest banks that make up the interbank market are; Deutsche Bank, UBS, Barclays and HSBC.

As we move down the liquidity pyramid we have governments, central banks and Medium-Small sized commercial banks. These institutions all have specific relationships with the interbank network allowing them to receive favourable rates for the significant amount of volume they provide.

Governments and central banks take part in the foreign exchange market to handle their everyday operations. A central bank is an authority that controls the money supply of its national currency to keep in line with their goals. An example of a few central banks are the Federal Reserve (the Fed) which governs the United States, the Bank of England (BofE) which governs the United Kingdom, the European Central Bank (ECB) which governs the European Monetary Union and the the Bank of Japan (BOJ) which governs the national currency of Japan.

Governments and central banks participate in processes such as making international trade payments and handling foreign exchange reserves. Central banks may also intervene in their domestic currency prices to keep them in line with inflation through a process known as quantitive easing. Through this mechanism the central bank has the ability to print a certain amount of their currency which in turn affects the supply levels that are available in the market, and ultimately affects exchange rates.

The medium-small sized banks are those commercial banks that do not have enough volume to be involved in the interbank network. Instead they develop relationships with the super-banks to receive liquidity and also favourable rates for their clients.

As we move further down the liquidity pyramid we have the retail market makers, retail STP + ECN brokers, large commercial companies and institutions such as hedge funds and proprietary firms.

A retail market maker is an institution or individual who quotes both buy and sell prices of a particular market. These types of brokers are able to offer fixed and low spreads as they are effectively creating their own market. They do not quote the direct prices that come from out of the interbank market and instead elect to make their own market. Market makers tend to make money through their spreads and by taking a trade in the opposite direction to the ones their trading clients place. Any losses that the trader makes belongs to the market maker and any gains made for the trader are offset to the market makers liquidity provider which is usually closely connected to the interbank market. These market makers can also be labelled as a type of broker that uses a dealing desk, meaning they create their own dealing desk by providing slightly different quotes than the interbank network rate. However, due to recent increases in competition amongst market makers the quotes are usually very close to the official interbank rate, if not exactly identical.

Another type of broker that is within this level of the liquidity tier are those known as either STP brokers, ECN brokers or those that use both mechanisms

A Straight Through Processing broker, or STP broker for short, pass orders on that they receive from their clients immediately to their liquidity providers as soon as the order is received. This means that the delays are reduced in the order of being filled. Those traders who trade fundamental economic news releases, that often cause extreme market movements in a matter of seconds, may benefit using a STP broker as they are less likely to receive re-quotes during this time as the order is passed on immediately at the quote provided. These types of brokers make money through their spread and may also charge a commission for taking a trade.

An Electronic Communication Network broker, or ECN for short, process their prices through multiple market participants such as banks and market makers to provide the best big/ask spread quote available. The ECN broker does not create its own market but instead gives the best price from an average of their liquidity providers which are connected to the interbank network. They do not offer fixed spread, instead their spreads are variable relative to the trading activity amongst the specified market and can increase or decrease accordingly. An ECN makes its profit through the spreads or by charging commission. They may also have higher deposit rates and may require you to maintain a higher account balance than other types of brokers mentioned.

Hedge funds and proprietary trading firms also are located within this liquidity category. A hedge fund is an institution that will trade its clients money for a profit. They start with an initial investment and over time they grow the fund to maximise profits as much as possible whilst taking extra investment from new clients. The goal of a hedge fund is to grow it as fast as possible and then, in most cases, be sold onto another money manager at a higher rate than its value. Investors receive a percentage of profits based on their initial investment over a defined period (usually monthly or annually). A proprietary firm, prop firm for short, works similar to a hedge fund but they trade their own money and do not accept any outside investment from clients. They recruit experienced traders to grow their firm and pay the traders an annual salary along with a bonus depending on how well they do in their trading performance.

Large commercial companies are important facet to the FX markets. They participate in the market to conduct everyday business. For example, a company like Apple conducts its operations in most countries in the world. For them to be able to pay their employees in their respective currencies the company would have to exchange their dollars to the national currency of the employee. A large commercial company would also participate in the FX market to source materials, goods, labour and expertise from overseas for their company everyday.

Business deals such as mergers and acquisitions within large commercial companies, also have a direct impact in the FX markets. This is because, as the companies merge a large amount of assets would need to be converted from its original currency to the new required currency.

Major corporations may also participate in the FX market to hedge their risk. For example if a US company wanted to purchase some raw materials from Japan, which would be shipped in 6-months time, if they choose to pay in 6 months the time they run the risk of the raw materials being more expensive if the Japanese Yen appreciates against the US dollar. The commercial company has the option to either participate directly in the FX market by going long the yen or by purchasing yen at todays price and storing them until payment is necessary. In each case the commercial company would off-set its exchange rate risk and in turn would be hedging their positions.

As we move down to the lowest tier on the liquidity pyramid we reach the retail traders. Retail traders are individual investors that speculate on currency price fluctuations to make a profit. This is the category that you will be placed in. You will join the sea of retail traders who either day trade or swing trade to make profits. This is the most vicious level of the liquidity platform as you are going up against the greatest minds and investors in the trading world so it is imperative that you approach your trading with a professional manner and remain focused and disciplined according to the trading strategy you will develop.

Thank you for reading this post!

This is only part 2 and there are many more to come!

Here at the FX Learning Club, we became tired of all the OVERPRICED forex courses available on the market. So we decided to let our course be completely FREE. Our android app takes you through an in-depth forex course that will take you from beginner level to advanced. We have also developed 19 exercises for you to gain experience with regards to applying the knowledge in the course!

We are on the hunt for our first set of BETA testers to be the first to use the app! Message us NOW and start learning to trade forex TODAY!

www.fxlearningclub.com

Congratulations @fxlearningclub! You have received a personal award!

Click on the badge to view your Board of Honor.

Congratulations @fxlearningclub! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Interesting thoughts