Fintech Startups Digital Security Risks

Our era of digitalization pushes the financial and banking industry to transform their services into financial technology – FinTech. It’s been around for quite some time in the form of e-wallets, online and mobile payment systems (PayPal, Apple Pay), virtual buying of stocks, etc. But the year of 2017 did bring a bunch of new disruptors that will displace traditional e-commerce providers. Such new FinTech startups offer more efficient services, seamless customers experience, free person-to-person payments.

However, there is such drawback as digital security risks... If you’re a newbie in the FinTech business, keep reading the article to discover which pitfalls and how to avoid.

What is FinTech?

The broad definition of FinTech would be simple – it’s the implementation of modern technology in traditional financial services and in the management of financial aspects in various companies and business. Anything from the new software installed and financial mobile apps, calculating business models and processing the money transactions.

Fintech Description

Years ago it was considered as a back-end, a data center processing platform, but after the 2008’s global financial crisis FinTech became a basis for end-to-end transactions processing provider that uses Internet and cloud services. It has transformed banking and investments, assets management and insurance, security protocols and the money itself (a revolution of cryptocurrencies like Bitcoin). A couple of years more, and the top FinTech companies will define the direction and pace for almost every financial services area.

Disruptive and Reshaping Perspectives of FinTech Startups:

Banks and various financial service providers keep losing in the race against those who own the customer experience – FinTech companies who own the ways to engage customers.

Rapidly growing online shopping leads to the dominance of cashless online payments.

AI is now differentiating financial services products and combining with FinTech it will replace multiple complex human activities.

An ongoing transformation of the insurance industry – their products are becoming more and more tailored to customers. They require coverage for specific usage, timeframes and locations, which leads to the need for additional clients’ data collecting and analysis for insurers to do with the help of FinTech.

Same goes for the new stocks trading platforms that collect enormous amount data and analyze it to predict future trends.

Also, FinTech startups that provide data collecting and analytical services along with the integration technology for banks saw a significant increase in the use of their hosted services.

Fintech Startups Stages

Any FinTech startup must go through the keys stages – allocating and calibrating the resources. The first barrier to overcome would be assigning the tech decision maker, could be CEO or CTO, who would take the responsibility of following a company’s core IP and gathering technology assets. This person also will decide what could be built or purchased at a lower cost and which team will do it – external or internal.

So, what are the other stages you need to pass to build a successful FinTech startup?

1. Envisioning Project Concept

When you’re about to start developing a top-notch FinTech company you’ll have to hire a team to work on a software design. So, in this case, all parties ought to have a comprehensive understanding of your project’s core idea – how to execute it and which results to expect. Here is the main issue why many FinTech startups never even take off the ground – the mismatch between vision and execution ideas.

There should be a clear execution plan for the whole team and CTO, as well. Starting from the MVP concept that will give you, your investors and development team a taste of how the first version of the project works and which changes does it require.

The precise communication about the project specifications is especially valuable when you work with an outsourcing IT provider. Such development team will be located offshore, so the startup founders and their CTO may experience some difficulties in this mix of an interracial relationship and different approach to communication. That’s why a seamless collaboration and the crystal clear vision is a key to the smoother way of your business project execution.

2. The Level of Professional Competence

An appropriate skill set is crucial for both CTO and his team – they should be experienced and skilled in all the relevant IT and FinTech development fields. All candidates must pass a suitable interview with HR specialists and project manager before being brought to a CTO’s team. And they need to understand how to handle the digital security risks on advanced level.

3. Budget

Any new startupper knows how hard it is to find investors with enough money to forsake all the troubles with hiring expensive professionals developers. Here is why you’ll need a strong business and marketing plan with calculated risks and profits, budget amount and outlined expense items. In most cases, a way to a nice reduce of expenses is hiring an outsourcing development team that has need skill set for a lower price. Or the reverse scenario – such offshore provider might have a higher price but the benefits would pay off greatly later on.

4. Flow and Speed

The founders should understand that every development team is different and has its own workflow, everyone is committed to the process in a different way. It concerns the pace of product building and the ability to adjust quickly during particular development phases. So, your CTO should state a clear timeline for an outsourcing IT provider, along with realistic requirements for project management team that will be in charge of product development.

Just keep in mind that when it comes to the FinTech architecture there can’t be any fudge and letting things slide: it needs to be thoroughly planned and carefully executed. A specialized offshore provider experienced in the financial services world and software making will deliver you a cost-saving high-quality product. You just need to establish some desirable conditions for them to do it.

5. Protecting Intellectual Property (IP)

Concerns with their Intellectual Property Rights have been boiling in the software development world for almost a decade. No one likes to see their products being replicated by irresponsible developers and competitors. That’s why it’s worth your considering signing an NDA with your team to protect the code and patenting the whole final product. It’s not an absolute protection, sure, but it’s a start. You have to build your team based on a trust, create an environment that would generate loyalty within your developers.

Cybersecurity Risks and Solutions

Having a team that understands FinTech is the safest way to find the right tools that help to identify digital security risks at an early development stage and spot the potential ways to solve them. Here are some of the biggest cybersecurity challenges FinTech startups should be aware of.

Weak Security Approach

Dozens of FinTech providers often forget to double-check their safety mechanisms trusting the Blockchain technology capabilities to protect itself. So wrong on many levels. It’s like leaving the door wide open for hackers. Your defense should have multi-store protection system – like traditional banks have high-security vaults, your financial services should be also protected with such digital vaults.

It requires a myriad of security tests being done with your software in the most holistic way. Everything in the development process must follow this approach in order to establish and avoid digital security risks. From planning, strategy building, milestones and end-points to code writing, devices testing and observation of human factor.

Hacking

All the good hacker needs is just your one vulnerability and you’re done – money, data, assets, everything is gone in a moment. As we wrote in our IoT Cybersecurity Threats report, cybercriminals don’t have mercy for entrepreneurs and organizations worldwide. However, no client will forgive you a security breach. In this age, even Bitcoins can be stolen and the Blockchain ledger could be exposed to hackers. So, your FinTech developers must create additional protection algorithms.

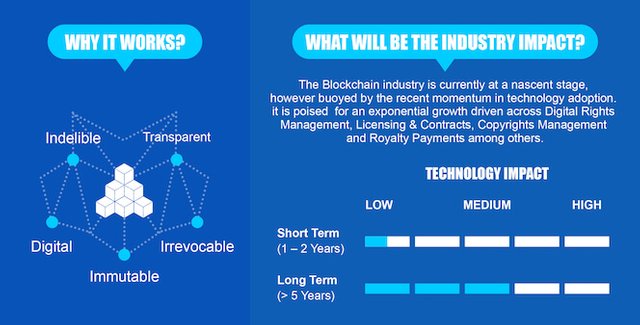

Blockchain as Panacea

This new encryption technology has disrupted the market during the last years. It promises the new level of security mechanisms. The Blockchain is a decentralized digital ledger without a need for administering where users don’t leave any paper trace after their transactions. While it’s a picture of a bright future, it’s still open for digital security risks and real innovations in the Blockchain encryption technology, that will make it a perfectly protected tool, are still far ahead.

Controlling the Money Flow

The problem with people trusting the FinTech startups is that no one really knows who is the sender and the receiver of money in digital peer-to-peer transactions. Unlike traditional financial services, the FinTech companies provide the software where participants would be mostly anonymous. Which leads to lack of strong credit and capital adequacy standards. Money could go to terrorists, drug lords and fictitious companies... Bad enough. So, while the whole system can be secured the participants of P2P exchange is still an issue. The possible solution would be mixing the business models of traditional financial services and FinTech startups.

Weak Guarantees

Unfortunately, numerous FinTech providers (even crowdfunding and P2P lending) credit various entrepreneurs and small businesses with no long or transparent credit histories. This often results in high defaults, so the loan guarantees are down the drain.

So, what is the possible ultimate solution for digital security risks?

Raising the Awareness of Digital Security Risks

Besides technological ways to protect your software from cyber attacks and breaches, we all should accept the rapid growth of need for digital technologies in all areas of our lives. This would push us to think ahead, plan the defense and act before a problem occurs.

We may consider forsaking key systems and replace them with more distributed ledgers. Also, put some additional limits on data storages and involve governments to regulate technological industry on the official level. Because no matter how much we want to avoid this aspect things like big data, AI, algorithms, machine learning, IoT technology and so on require regulators, indeed.

No one should assume that some technology is 100 percent safe – there is always a room for weaknesses. Recent cybersecurity reports and news about hacked Bitcoins let us see that while the Blockchain platform is the future of our world, it still needs huge improvements and open the doors for debates about potential digital security risks of such software for data security and society in general.

But while professional developers must stay on top with their security implementing skills, the organizations and companies who desire to adopt FinTech have to raise the awareness about data safety and protection mechanisms. Only innovations that walk hand in hand with regulations become a key for destroying the dark side of the FinTech and reducing the risks for everyone using the digital financial software.

Create Your Own Save Fintech Startup

As other top FinTech companies do, you can manage the digital security risks with the help of interoperable biometric solutions for Blockchain platforms. Or the solution can be found in centralizing know your customer data (KYC) over the Blockchain ledgers – the encrypted customer information would be updated and distributed in real time across a distributed financial system’s ledger. This could lead to anti-money laundering, lower a counterparty credit risk, etc.

However, designing and implementing such systems would be extremely difficult without the experienced development team. It must be good, cost-effective and reliable one, with prior experience in software making and payments processing. Only the FinTech and Blockchain developers know how to mix the traditional banking services with the secure digital financial ecosystem. It’s the future that most international regulators already recognize on a global arena.

Hey @kategan, great post! I enjoyed your content. Keep up the good work! It's always nice to see good content here on Steemit! Cheers :)

thanks a lot, @exxodus! I'll do my best, hope you'll enjoy the upcoming content as well :)

Congratulations @kategan! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @kategan, you have decided to take the next big step with your first post! The Steem Network Team wishes you a great time among this awesome community.

The proven road to boost your personal success in this amazing Steem Network

Do you already know that awesome content will get great profits by following these simple steps that have been worked out by experts?

thanks a lot, guys! I look forward to have an awesome time here!