Road to financial freedom - Understanding Leverage

Understanding Leverage

When you looking a post like this, the questions you should ask your self is:

What is this?

Why Should I care??

Leverage is something could lead you to bankruptcy or glory.. and my goal is to help you to embrace leverage and eventually lead you to financial freedom.

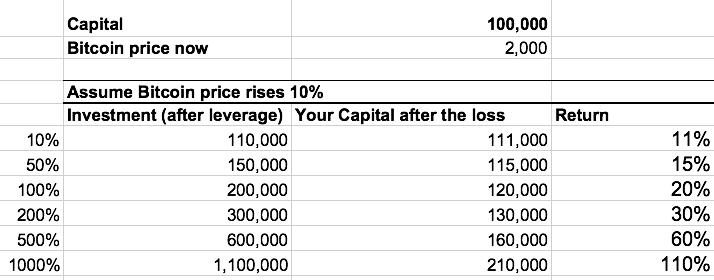

OK.. here is a more practical example, suppose today you want to invest in BTC and it could move up and down 10%.

Everyone tell me in Steemit that BTC can't go anywhere but just up.

mmm.. While I look reasonably calm, my heart actually goes like:

Since I am so hurry about not getting in to the market immediately, I decide to use margin as well, because you can't lose right? Let's get it baby.

One day past, and it rises 10%.

What leverage should I use? ARE YOU CRAZY? ofcourse you need to use 1000% (10X) of your original capital.

Now it is time to call my car dealer and buy:

OK.... making money is easy....

AND NOW let's a step back

Of course some people would ask what about it drops 10% the next day?

Well.. I could always change my face and talk to people like I embrace Warren Buffet trading method and become a long term investor... then rush to sell when it goes back to breakeven..

OR COULD YOU?

Now let's get into some maths about leveraging...

.png)

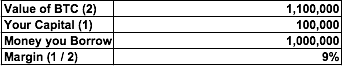

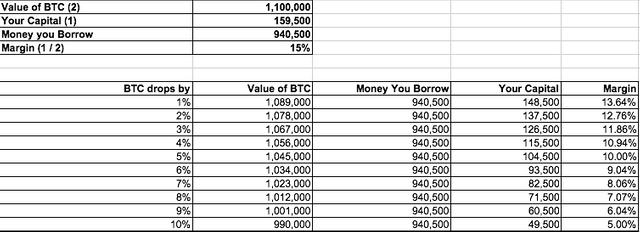

Referring back to the excel before, there are two formulas you need to know.

Margin

= Value of BTC / Your Capital

Simple enough right?

Maintenance Margin

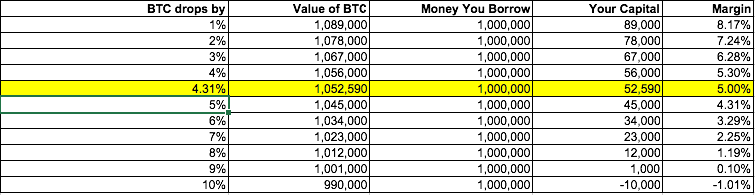

This is a very important concept and not many people aware that before placing their margin trade.

THE BROKER COULD SELL YOUR ORDER WITHOUT YOUR PERMISSION SHOULD BTC DROPS TO A PARTICULAR PRICE

In Finance, we call this margin call and this is basically why many day trader or speculator suffers from.

Let's say the broker tells you the maintenance margin is 5%.

We go back to the very easy formula above, and calculate how 1% drop in BTC would affect our margin.

and why would I highlight 4.31% in yellow? because this is where your broker will cut your order without telling you!!!!

So now I can't be the long term investor I want to be!! and now I have lost 47.41%!!!!

So a clever person will think one more step and say:

If I just want to day trade and

if I know BTC will only move up and down 10% max a day

He could calculate the optimal amount he wants to borrow and not worry about the position being taken off.

But you may ask me:

What if BTC doesn't move up and down 10% max per day and

What if I want to hold more than one day

We can do better than this.. Stay Tune. XDDDD>

Sigh, i always face such dilemma, one side i really want to get financially independent, being able to do whatever i wanted, when i wanted. But my limited in capital and limited knowledges put me in a really bad position of not being able to make those calls, especially when leveraging is involved which means i could be in serious debts if i were to fail to decide properly. But i must thank you for sharing this so bits by bits i could learn more and hopefully one day i could execute those complicated operations!!

Hello there , i am glad you find it useful, leverage could use it in a more complex investment activities like future and option trading but can also make it more simple like housing, dividend stock, bond or others. Feel free to catch me around if you have more questions :)

[EXCLUSIVE]! The Easiest and Safest way to Buy and Sell BITCOIN ...

https://steemit.com/bitcoin/@hamzaoui/exclusive-the-easiest-and-safest-way-to-buy-and-sell-bitcoin

This comment has received a 0.06 % upvote from @booster thanks to: @hamzaoui.

Honestly, I have wanted to know more about leveraging and margins, but have been at this only a year and didn't feel ready for the rekting ball possibility.

But that was super informative so thank you!

If I could make one suggestion: it seems like English isn't your first language... this didn't take away from the work for me but I think it would be cool to post it with both English and your native language. You're in a unique position to cross those language lines ;)

Thanks for the knowledge!

Many thanks for your support. Too bad i could not type chinese which is my first langauge (it is weird when we could not type in our language), but i know cn has a really powerful whale such that i should really learn how to type, quick. Thank you that you enjoy the read and i will take time to write how you could use ths information to improve your trading or investing. Your comment meant alot to me :)

Trading margin is tricky because it pulls in more emotions into your psyche when you are leveraged 5X 10 X

Definitely different people will handle emotion differently. For me i have a really small appetite towards trading volatility, so if i am trading something very volatile i will use 0 leverage and try to make my portfolio size as small as possible. But i would leverage on other assets and i will discuss that later.

Right volatility based position sizing something Wall Street doesn't want to know about and I love asymmetrical bets!! MCD LEVERAGE OK .. .Ripple NO LEVERAGE NEEDED PR BITCOIN

No doubt, it is like committing suicide if one do not know the volatility of the underlying asset and take crazy leveraged direction bet because greed take over. I really like cryptocurrency, because the upside could be very high which mean you can place small bet and ride with the volatility ans hopefully bull market lasts.

Well said going to read through your blog today so look for comments 👍

Cant wait :)

Hey wilkinshui,

Leverage is a very important concept when it comes to trading, but many of the bitcoin brokers aren't offering high leverage on their accounts because flash crash type events are still too common place.

You've given me an idea to elaborate further on your post and discuss leverage further. I've given you a follow and will be sure to link your article when I get it done.

Thank you for your support and comment. You are completely right, just take the eth as an example, eth probably is the second most trade instruments in. Crpytocurrency and i think just a few weeks ago, there was a flash crash and it dropped to like 10+ dollar, think about if the brokers were really to execute the orders....

A really good read thank you for sharing

many thanks, glad you like it!

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by wilkinshui from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, theprophet0, and someguy123. The goal is to help Steemit grow by supporting Minnows and creating a social network. Please find us in the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you like what we're doing please upvote this comment so we can continue to build the community account that's supporting all members.

Very informative. Upvoted and followed. Follow back when you can

I remembered I follow you due to a post like this, the thing is i am not that familiar with online currency, so when you come from 0% and immerse yourself in a 89% information based platform. It's a little bit confusing.