Why @dollarvigillante is wrong about the dollar and inflation

This is a response to the tinfoil hat stuff that @dollarvigilante has been publishing.

Lets start with the dollar

Here is a graph of the US dollar against an index of the world's currencies:

source tradingeconomics.com

As you can see, it starts to fall when President Nixon took the US dollar off the gold standard, it had a brief surge in value in the mid 1980's when Paul Volcker was putting up interest rates to squeeze inflation out of the system, but then resumed falling. It bottomed out under George W Bush. But since then it has formed a double bottom and is on an upwards trajectory. It is higher than where it was in 1975, and has further to go, helped by the fact that the American economy is the strongest in the world.

The dollar vigilantes were right from 1985 to 2008 - but now they are fighting the last war. They've missed that we're at the start of a dollar bull run. That double bottom that formed from 2008 to 2011 is screaming it out loud.

Lets talk about oil

A big driver of inflation in the 1970's was the OPEC price hike followed by the Iranian revolution. But then the price started to moderate as western govts implemented policies to cut the amount of oil consumed. Britain for example consumes less oil than it did in the 1970's despite having 20 million more people - fuel taxes brought in by the Thatcher govt and continued by every govt since have forced people into smaller more fuel efficient cars. This story is replicated in other countries.

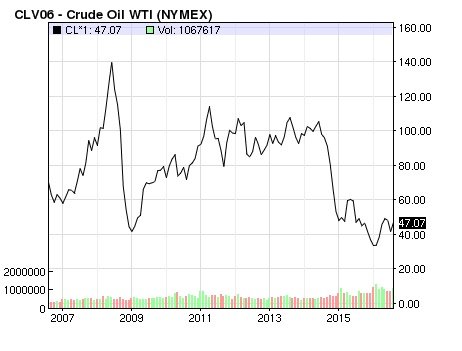

Here is a chart of the oil price over the last decade:

Souce: Nasdaq

What we see is speculation based on China's prospects (they were supposed to become voracious consumers of oil) until the 2008 financial crash brought some reality into the situation. The global recession cut demand, like it always does. However, in 2011 there was a black swan event - the Fukushima disaster caused by a Tsunami. As a precaution Japan closed down all it's nuclear reactions till they checked them all for safety, and began to burn oil to generate their electricity. In 2014 they switched the nuclear reactors back on, cutting demand for oil. At the same time frackers started to drill the Permian Basin in the USA, increasing supply. Meanwhile, western economies got even more fuel efficient during the period 2011 to 2014.

Unsurprisingly the oil price collapsed back down again. No economy is going to reverse it's fuel efficiency gains. The frackers arn't going to give up. Reduced demand in China as their economy slows is also playing a part. We're going to have an oil price that is less than half it was in 2014 for a long time. This means a key driver of inflation - the price of oil - is going to stay suppressed.

Lets talk about Iron Ore

Iron ore is a core component in manufacturing - we literally couldn't have the modern world without it. So when it's price goes up, you get inflation.

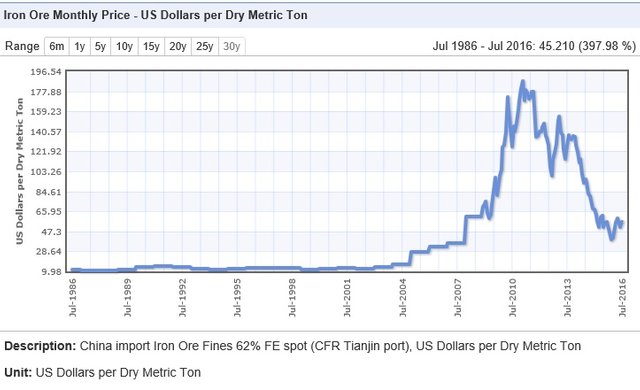

Here is a chart of iron ore prices since 1986:

Source: Indexmundi

Notice the similarity with the oil chart? There is a speculative hike from 2004 onwards as commodity traders convinced themselves that China was going to be the next thing and suck in a lot of iron ore and build a super economy and replace the USA. The Chinese tried to encourage this by borrowing to build their ghost cities and their surplus manufacturing. But, reality has caught up with them.

Once again, western economies adapted to recycle and use less, so when the Chinese demand stopped, the whole thing collapsed. Those efficiencies aren't going to be reversed just because the price is down. And the price has a lot further to fall as the Chinese economy shrinks.

Lets talk about Gold

Source: bullionvault

See that double top in the chart in 2011-2012? That signalled the top of a 30 year bull market. We're now in a bear market - there will be a few spikes when @dollarvigilante and his fellow gurus try to scare people into buying (so some other people can offload their holdings?) but the trend is down.

Gold is a hedge against inflation. But as we have seen with the oil and iron ore charts (which are replicated in many commodities), prices are falling. We're in a global deflationary cycle. This is exacerbated by aging populations. Japan's population is in outright decline, and while China's population grew by 7 million last year, the figures disguised that the working age population had fallen by 3 million and the pensioner population had risen by 10 million. Older people don't spend as much, and their falling demand is the key driver to deflation. The demographic problem exists in Europe and South America too. Only the middle east is exempt - but they are controlling their population through war.

Conclusion

Notice the double top in the gold chart? It mirrors the double bottom in the dollar chart with a slight delay. What it means is the 30 year bull run for gold and the 30 year bear run for the dollar are over. We're at the start of a great dollar bull run. But gurus tend to miss signals like this, partly because they are gold bag-holders and that is clouding their judgement and partly because they are so busy fighting the last war...

Disagree with you on gold, but you're right about the greenback. Right now, the U.S. is the #1 superpower (arguably, empire) in the world. Accordingly, the U.S. capital markets are the most liquid in the world.

This means there are a lot of powerful people whose prosperity, power and prestige is hooked to a world that the U.S. predominates in. Until a serviceable replacement comes along, they'll do almost anything to keep the current system afloat.

One of Gary North's favorite sayings is, "You can't beat something with nothing." Paraphrasing, you can't beat the current system with a worldwide collapse.

It's easy for us readers to forget, but the Western Roman Empire did not collapse in two hundred pages or less. The system, from its peak to the time Odoacer took over as KIng of Italy, took a hundred and fifty years - two full human lifetimes - to collapse. There really is a lot of ruin in a nation.

Yes, there literally is no substitute for the dollar at the moment. The euro is a mess because the eurozone is so weak. China's economy is shrinking and they are slowly devaluing the yuan. It is likely the Fed will increase interest rates in December after the election is out of the way.

Gold tends to be a mirror of the dollar though. They are inversely correlated. Gold is also a highly manipulated market about five investment houses control it's price. Whereas the dollar is traded everywhere on earth and is harder to manipulate as a result.

Thanks for the reply. I disagree with you on gold because the chart looks to me like a post-bubble bottoming process has taken place since 2013. Gold used to mirror the greenback, but the last leg of its bull market was fueled by increasing Chinese demand (prosperity) and Indian demand (near double-digit inflation in India, plus prosperity.)

The Chinese, like Indians, still have a tradition of using gold as a long-term savings vehicle. So when times are booming, Chinese demand for gold increases. So the gold market now has a similarity to other metals markets in that they're moved by the ups and downs of the mainland Chinese economy.

(I had to learn about the "globalization of gold" the hard way, tho' not in a costly way. When I was watching the gold market from '09 to '11, I saw it climbing and climbing while I was scratching my head and wondering, "Where's the jump in inflation??" It's not the only hard lesson I had to learn after the '08 crisis.)

Good to know we see things similarly in re the greenback. Declinism is pretty durn seductive, especially to bookish people like me. :)

The Chinese make it really hard for their citzens outside Hong Kong to buy gold. They only thing they are really allowed to own is property, which is why property speculation there dwarfs even what happened in the US in the run up to 2008. If the Chinese property market collapses, a lot of wealth will get destroyed and they will be even less able to buy gold.

India is in a better situation, both with their economy and demand for gold.

Thanks.

Given the trouble China is in, and it's desperation to devalue the Yuan, I'd say they're going to try to export deflation to the whole world to get themselves out of the pickle.

In that scenario it's a no-brainer that the dollar will rise.

Or because they're trying to scare people into buying gold to prop up the price...

Well, yes... If people missed the change in 2012, they're sitting on a depreciating asset and I imagine they're quite keen to create opportunities to offload...

I started a series today on why you might want to consider gold as a hedge, even if you are NOT a "tin hat" conspiracy theorist. Someone might want to take a look: https://steemit.com/money/@thylbom/gold-a-barbarous-relic-or-does-it-have-a-place-in-our-future

I'm not saying all of your observations are wrong, but it seems like you're missing the danger of the high degree of leverage (debt) in the current system. What about the 40 year bull market in bonds that has driven rates to below zero in some places? What happens when rates go up? How do you hedge a portfolio against the possibility of inflation? At this point, no one knows if inflation or deflation will define our future, but I need a Plan B. Crazy money printing and credit expansion has generally ended with hyperinflation in past cycles. This time may be different, but how do you hedge a position in case it's not? Looking for an insurance policy, even if the sky isn't falling right now...

It's all relative. Everyone else has more debt. Also, the US budget deficit has been shrinking, thanks in part to the economy starting to grow. As that continues it should go into surplus, just like it did in the late 90's.

As for inflation - again, that is yesterday's war. We're currently in a global deflationary period and as China devalues against the dollar, while the Chinese might experience some inflation as a result, Americans should experience deflation. Gold looks very overvalued to me at the moment...

We are exporting our inflation to China, and that's something they are not happy about. They have been very successful trading products for dollars, but they are looking for ways to hedge through buying hard assets: oil, copper mines in Africa, other natural resources, airports, ports, etc. - and YES... gold. Big time. Their official reserves are understated, and they are still interested in keeping the price down as they continue to accumulate, as are the world's central banks. However, gold may play a starring role in a global re-set to save the system from a debt implosion.

Some valid and interesting points and totally right on oil. The $ is a difficult one to predict. I wouldn't be so confident that it will maintain reserve status and, therefor, it's value as much as the author believes. No mention of the debt or bonds market. One problem is that it's lost a great deal of it's manufacturing base and half the military budget is wages. Increasing student debt, household debt, where is future consumption coming from.

a few interesting points you have made i think i will have a rethink on my strategy

Explain what you think this "great dollar bull run" will look like? How should someone position themselves for this?

Hold dollars, or assets denominated in dollars, don't hold euros, yuan and other currencies.

...and get out debt!

Summary by @tldr:

But then the price started to moderate as western govts implemented policies to cut the amount of oil consumed.

Souce: Nasdaq What we see is speculation based on China's prospects (they were supposed to become voracious consumers of oil) until the 2008 financial crash brought some reality into the situation.

As a precaution Japan closed down all it's nuclear reactions till they checked them all for safety, and began to burn oil to generate their electricity.

There is a speculative hike from 2004 onwards as commodity traders convinced themselves that China was going to be the next thing and suck in a lot of iron ore and build a super economy and replace the USA.

stats: 12.4% of original contents - learn more

Long Dollar/Short Yen is my trade for the remainder of the year.