How Does the Current Rally Stack Up?

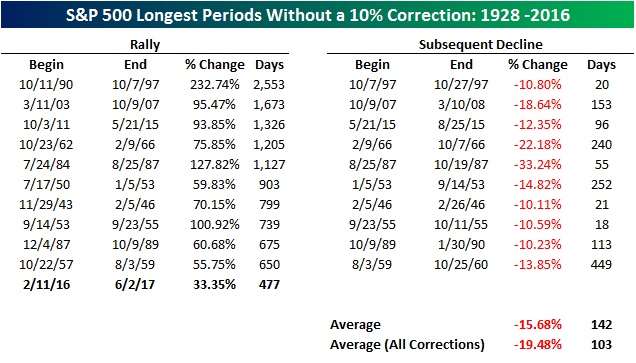

Ever since last February’s “Dimon Bottom” where JP Morgan CEO Jamie Dimon’s purchase of stock in his bank has come to symbolize the low of the late 2015/early 2016 market sell-off, US equities have been on a practically uninterrupted run higher. While there have been bumps along the way, the S&P 500 hasn’t seen a 10% correction at any time in the last 16 months, rallying more than 33%. With the current rally lasting 477 calendar days, it ranks as the eleventh longest run in the S&P 500 without a 10% correction since 1928. In the table below, we list each of the ten longest rallies without a correction as well as how much the S&P 500 declined in the following correction.

If the current rally is going to crack the top ten, it has a lot of work to do on the upside. At 477 days, the S&P 500 would need to go another 173 days before reaching a short-term peak. That would take the current run past Thanksgiving! Another thing to note is that just as the ten prior rallies lasted much longer, they were also considerably stronger. In fact, the average and median gain during the ten prior rallies that went longer without a correction was more than 90%! Looking ahead, you would think that the harder they run, the harder they fall. In actuality, though, the average decline in the correction that followed the ten prior rallies was a decline of 15.7% over 142 days. Compared to all corrections since 1928 where the average decline was 19.5%, these corrections may have lasted longer but their intensity was not as strong.

Finally, how overdue are we for a correction? Since 1928, there have been 95 10%+ corrections for the S&P 500. While corrections tend to come at irregular intervals, that works out to about one every eleven months. That would make the S&P 500 currently about six months overdue for a correction.

https://www.bespokepremium.com/think-big-blog/how-does-the-current-rally-stack-up/