How ETNA can modernize the world of lending

Introduction

Crypto lending offers powerful advantages when compared with the status quo, including more competitive interest rates and flexible terms.

Lending has been around in some form for thousands of years — dating back to ancient civilizations where farmers would borrow seeds and use crops as repayment.

The arrival of fiat currencies transformed the way economies were run back then. Indeed, you could argue that we’re seeing such a seismic shift now as cryptocurrencies become a larger and more influential part of the world’s financial ecosystem.

When done right, crypto lending has the potential to level the playing field — giving consumers a type of flexibility that they may otherwise have been unaccustomed to. For several years now, the rates offered by banks have been tepid to say the least. In some countries, even the most generous savings accounts will only pay less than 1% interest — even if funds are locked up for several years.

Given how inflation has been rising sharply recently, in part because of the money printing performed in response to the coronavirus pandemic, signing up for one of these accounts means a saver’s money would actually command less spending power down the line.

Crypto lending offers three powerful advantages compared with the status quo. First, it is possible to find more competitive deals that ensure capital actually grows — with interest sometimes paid on a weekly or a monthly basis. Second, many platforms offer a much-needed degree of flexibility to lenders, meaning that they won’t be forced to lock up their money for long periods of time and can withdraw their funds at will. And third, it can act as a powerful incentive when markets are behaving rather erratically.

That’s before we’ve even discussed the fact that crypto as collateral can be far more practical from a lender’s point of view than real estate — an asset that is rather illiquid and can be rather time consuming to sell.

It isn’t just lenders who benefit

Of course, all of this sounds like a good deal for lenders — the people who have capital to spare. But it can also be beneficial for borrowers, too. In the current financial ecosystem, where a single blemish on an otherwise impeccable credit history can deny a responsible consumer access to the best interest rates, crypto platforms can offer an invaluable lifeline.

Banks often have an opaque list of requirements when it comes to finding the people they are willing to extend credit to. And, in a world where ever-increasing numbers of consumers are self-employed, otherwise creditworthy applicants can end up being excluded from the market simply because they don’t have a traditional nine-to-five job — irrespective of whether they actually earn more money in their current arrangement.

The crypto world can help to foster inclusivity here, but there are challenges. A number of lenders in this space are offshore and unregulated — something that can make them less appealing to everyday consumers. This also restricts the number of partnerships that crypto platforms can enter into with fintech firms.

A new approach?

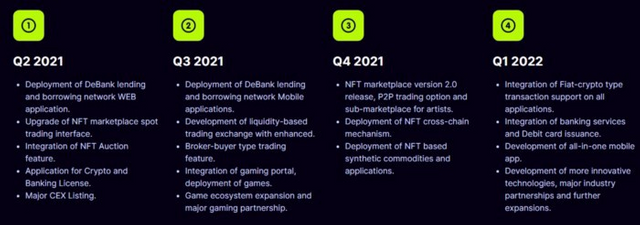

One platform that is aiming to shake up the world of lending ETNA brings a new way of facilitating a gaming ecosystem leveraging the NFT assets and conventional games onto the blockchain platform. As a DeFi project amalgamating the functions of yield farming and NFTs, Etna now ventures into Lending and borrowing via cryptocurrency networks.

ETNA Lending and Borrowing Functions

The trading platform that also includes lending and borrowing sequences is named ETNA. This dedicated platform runs on the tenets of the Binance Smart Chain and aims to support the adoption of the DeFi technologies. ETNA's adoption of the DeFi technology is done to deliver customer-centric solutions.

Lending and Borrowing on ETNA is programmed to be simpler and supports a larger extent of use cases. On ETNA, the users can secure a loan against NFTs as a collateral. So, any NFT owner can provide their NFT to the lenders and get a loan. For users staking the native ETNA tokens as collateral for the loans, no interest rates are charged.

When it comes to the DeFi-oriented aspects of the platform, users can now lend and borrow, transact in the marketplace, and engage in regular contests to earn rewards.

Comprehensive Market-Ready Functions

The marketplace proffered by the platform represents a mix of DEX trading and Broker-Buyer functions which is an improvement from the existing system with a similar approach. The marketplace, which is also called a Hephaestus workshop, works as a comprehensive marketplace.

The Hybrid Marketplace has integrated gateways and can be used to trade products. These multiple gateways will allow the users to transact in different cryptocurrencies. The payment gateways are built in a manner that any user can make payments without owning multiple payment wallets.

ETNA Tokenomics

The total supply of ETNA tokens is 100 million. The entire token supply is divided into various aspects that include staking, the marketplace, presale, liquidity, partnership, development fund, team, and foundational. The team allocation, partnership & development funds, plus the foundational allocation fund, is locked for a fixed period. For the presale, it is scheduled to happen on the 21st of March, 2021.

Utilization of the ETNA Tokens

The ETNA tokens are native to the financial platform. It has four central use cases, which includes Lending transactions, NFT Market transactions, BBT Marketplace, and Game Asset Value.

For the lending transactions, the ETNA tokens can be used to submit the collateral and get interest-free loans. ETNA tokens will be the preferred currency in the NFT market and required to gain its membership.

Since the marketplace works on a hybrid model, the brokers need to become a member for facilitating the transactions. The membership fee has to be paid in ETNA tokens. The last use case of ETNA is with reference to the Game Asset valuation, where the token is used as a store of value for buying the game-related assets.

OxBull's Role in the Partnership

Oxbull is an incubator helping platforms like ETNA gain awareness, attention, customer base, and market.

About ETNA

ETNA's reward-generation features and functions lets the users engage with the platform in multiple ways. The users can get a loan based on some collateral from the lenders who are also present on the same platform.

By keeping the ETNA coins as collateral, the users can get interest-free loans and others can get lower-interest loans.

Media Contact

Website: https://www.etna.network/

Whitepaper: https://www.etna.network/assets/ETNA.pdf

Twitter: https://twitter.com/EtnaNetwork

Telegram group: https://t.me/EtnaNetwork

Telegram channel: https://t.me/EtnaChannel

Discord: https://discord.com/invite/dbuEXdm

Youtube: https://www.youtube.com/channel/UCgkP_qjdYSZ8iesrz5kK0YQ

Author

User Name : kahnsin

BTT profile : https://bitcointalk.org/index.php?action=profile;u=2776686

BSC Wallet : 0x6048e0363667b14bb30f1946585800c2Bd10Ca15