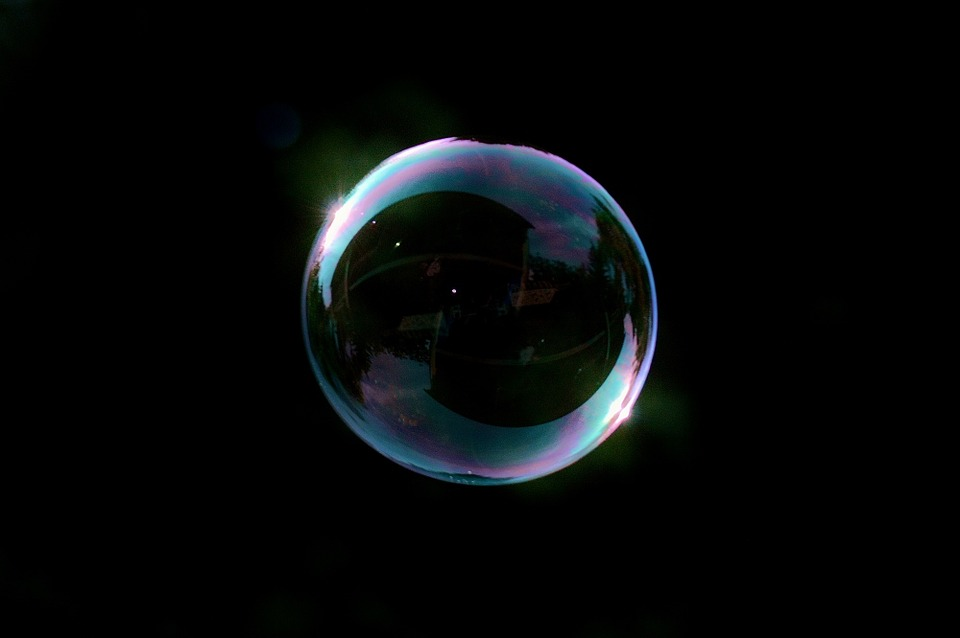

Bubble-Like ICO Market – Investors Dive In For Short-Term Profit

Recently, Pieter Levels, the founder of popular web and mobile-based platforms such as Nomad List, offered insights into the growing bubble-like ICO market.

Levels revealed that he was personally contacted by five developers that pitched an idea for an initial coin offering (ICO) for his most successful product Nomad List, which provides detailed guides to the best cities for digital nomads based on various factors such as cost of living and internet speed.

A message received by Levels read:

“Hey, why not create NomadCoin, a digital currency for nomads. People would be able to pay for co-workings, coffee, hostels etc. I can help you. You can even raise funds through an ICO / crowdsale.”

The above mentioned tasks such as buying coffee and paying rent can already be done with existing products and technologies such as cash and bitcoin. Thus, the ICO of such a project will not solve any existing problems and is not necessary to the industry. In response, Levels explained:

"Ethereum/blockchain-based pump and dump scam: launching coins that don’t solve any problem but getting your audience to buy in. This is the 5th person who pitched this to me including Ethereum’s ex co-founder. It’s another dark internet scam robbing people of their money.”

For the most part, Levels is accurate in that the vast majority of ICOs and tokens being launched on top of the Ethereum protocol have minimal use cases and purposes. More to that, most blockchain-based products that are raising millions of dollars at extreme valuations don’t even have actual user bases and completed products; only untested code and pre-alpha software.

However, like most analysts, Levels understands that not all ICOs are “modern-day ponzi schemes.” Some projects that ran ICO campaigns have demonstrated working products that can be utilized to solve real problems such as bringing liquidity to the cryptocurrency sector.

For instance, upon the completion its ICO, TenX was criticized for lacking a viable product. Today, the company released a video of a TenX digital currency credit card user purchasing products at stores such as McDonalds with cryptocurrencies including Dash.

Bancor, the second most successful ICO to date that raised more than $150 million in its ICO, was criticized by bitcoin and security expert Andreas Antonopoulos and Augur co-founder Joey Krug for its 40 lines of code and untested software. Krug wrote:

“Dear God the free market just gave $150M to something we found out didn’t work in practice in the Augur beta.”

In essence, the Bancor Protocol offers a liquidation method for investors and traders looking to buy into ICO tokens. It balances buy and sell volumes and standardized the ICO market. However, some criticisms toward the Bancor Protocol were in relation to the establishment of yet another intermediary between the Ethereum protocol and ICOs because traders can simply utilize Ethereum’s native token Ether to purchase ICO tokens directly without the necessity of ICO tokens.

The Bancor Network itself and its liquidation platform is useful and wanted by the ICO market. The only issue with the ICO is that it the Bancor platform does not really need its own native token to function.

The same can be said for TenX. Its cryptocurrency-based credit card brings a high level of liquidity to cryptocurrency users that are aiming to use digital currencies to cover day-to-day expenses. Still, there exists no purpose for the distribution of TenX native tokens to fuel its network and product.

Despite the claims of most companies running ICO campaigns, admittedly, the ICO market has transformed into a bubble. Every startup and blockchain project are trying to run ICO campaigns to secure capital, often times more capital than they even need to take advantage of the growing market.

Happy Steeming...

nice 😍