The Utility Value of Ethereum.

In my prior post, I discussed about the long term drivers of cryptocurrency prices, which you can read: here.

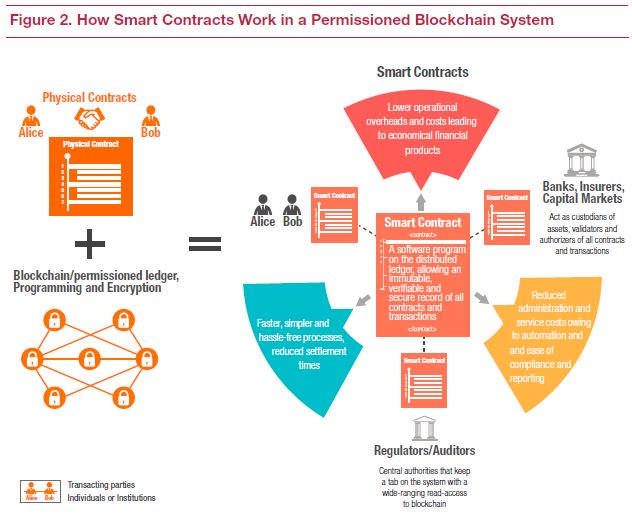

As the Byzantium update was just successfully implemented, I thought I would dedicate one post into the utility value the Ethereum Protocol has; and how its derivative contract function can be used. In my prior post I talked about Ethereum being useful to facilitate certain types of transaction; derivative contracts, where it specializes in higher value transactions, I shall explain that in more detail here:

a) Uploading data

Ethereum lets you upload a data feed to its blockchain, that can then be referenced by future transactions in its programming language. So something you could do is have a neutral and trusted third-party set up a feed that uploads the market price of oranges once a day. In the future, I expect that many data providers will hook into the blockchain, and I expect it'll be a good business because they'll be natural monopolies once they've established dominance.

b) Writing Smart Contracts with the data feed.

Ethereum lets you use its programming language to write "smart contracts" that reference values in its blockchain, and create transactions based on changes in those values. For example, suppose I'm a speculator and I'm trying to sell insurance to my friend, John, who grows apples . We could go to a bank and have them write up an insurance contract, or we could create an insurance contract on the Ethereum blockchain as follows:

Suppose the price of apples today is $1 each.

Suppose John is growing 100,000 apples.

I put $50,000 worth of Ethereum tokens into my Ethereum account today as collateral for the contract.

Using Ethereum's programming language, I write a simple contract that does the following:

Wait six months.

After six months have passed, check the market price of apples.

Create a transaction that sends (market price - $1) from John to me . If the amount is negative, then I pay him. This gives John a fixed price for his apples six months from now of precisely $1.

If the price of apples ever goes below $.50, immediately send John the entire $50,000 worth of tokens in my wallet to cover the difference between the initial price, and the current market price.

This prevents a situation in which my account is insolvent at the six-month maturity date. If I have to cover before the maturity date,John can just make a new contract with someone else.

This is actually a contract for difference , and you can write arbitrarily complex derivatives like this without any need to go through a trusted financial intermediary. That's pretty amazing, and it's why Ethereum's gotten so much hype throughout this year.

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by cryptochindian from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, theprophet0, someguy123, neoxian, followbtcnews/crimsonclad, and netuoso. The goal is to help Steemit grow by supporting Minnows and creating a social network. Please find us in the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

This post has received a 0.39 % upvote from @drotto thanks to: @banjo.