Ethereum is going to the moon. ETH wilĺ cross the bitcoin in 2025.

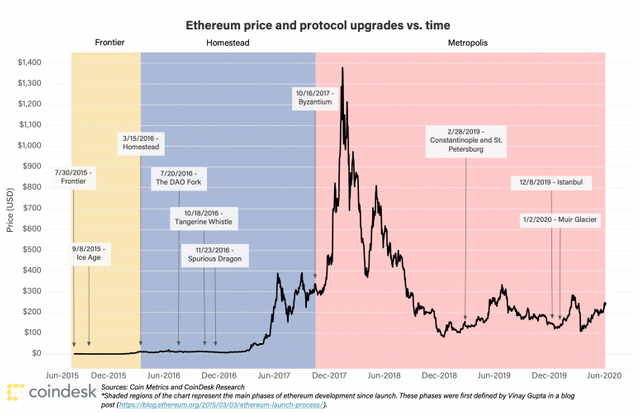

The initial Ethereum team consisted of Vitalik Buterin, Anthony Di Iorio, Bitcoin Magazine co-founder Mihai Alisie, Amir Chetrit and Charles Hoskinson. The team printed black Ethereum t-shirts and started working on the Ethereum Blockchain in 2013. Later, they added three more co-founders Joseph Lubin, Gavin Wood, and Jeff Wilcke. They didn’t know each other very well or have a detail plan of what they would finally create. But they had a vision. They wanted to create a “world computer” that would transform not just money, but allow anyone to write smart contracts, decentralized applications and create their own arbitrary rules for asset ownership. Ethereum went live on 30 July 2015, with 72 million coins minted. That was five years ago. Today, stablecoins and DeFi, have turned Ethererum into the most used blockchain.

When you look at Ethereum’s price and market cap, Ethereum has failed to reclaim much of its lost ground, as Bitcoin has taken over the broader cryptocurrency market. Ethereum’s market cap stands at $41 billion, only one-fifth that of Bitcoin.

But, since the 2017 ICO craze, when Ethereum exploded and hit an all-time high of $1,200 in January 2018, a lot has happened. Ethereum has made huge progress, powering more than 2,000 decentralized applications and dominating the fastest industry segments: Stablecoins and DeFi.

ETH price rising fast

The Ethereum price has surged this year, with Ether now trading around $400, up almost 200% from $130 in January. Bitcoin’s price is left in the dust by Ethereum, as its only up around 30% so far this year,

120,000 wallets ready for staking

As Ethereum is preparing for the transition ETH 2.0 (proof-of-stake consensus algorithm), the number of Ethereum wallets with 32 or more ETHs has reached a historic high. Almost 120,000 Ethereum wallets are ready for staking. Staking nodes, which will replace the miners, must own 32 ETHs to receive rewards as validators under the 2.0 system. However, holders who own less than the specified amount can still participate in staking via pools.

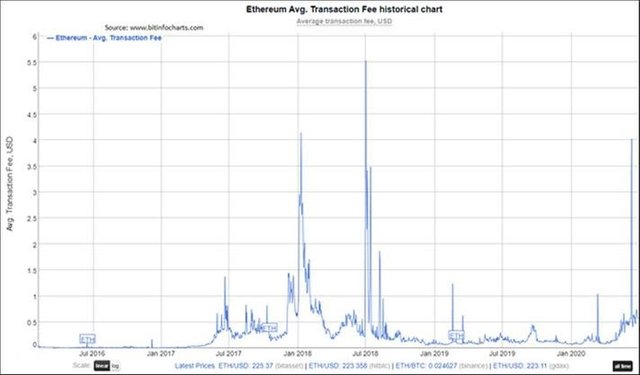

One million transactions a day

Ethereum transactions have set a 17-month high, by surpassing 1 million mark on June 28, according to etherscan.io. Ethereum’s all time high for daily transactions was 1.3 million set in January 2018. As we can see in the graph, the number of transactions has been on a consistent uptrend throughout 2020, despite slowing down in the second half of 2019.

Active addresses on Ethereum grow 160%

Data from analytics firm Messari shows a 128% increase in the number of active addresses in the Ethereum network. This is in comparison to the number of active BTC wallets, which also increased, but only by 38%. The data that counts all active addresses discounted the fact that some users have multiple Ethereum addresses. To find the number of unique users, website Bitinfocharts looked at transactions that go to and from unique ETH addresses. It found out that unique active ETH addresses rose by 160% since the beginning of the year.

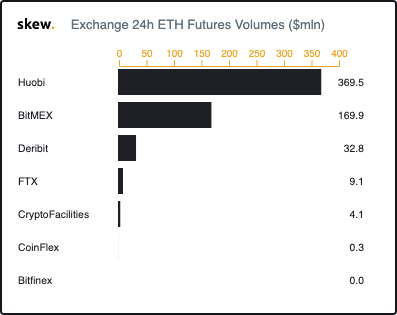

Dollar value of ETH and its tokens overtake Bitcoin

Ethereum accounts for more than 65% of all stablecoins issued, and more than 85% of stablecoin transaction value. Stablecoin transactions have settled over $508 billion in transactions in 2020. Data from Messari shows that Ethereum has just surpassed Bitcoin, settling the most value every day. The dollar value on the transactions of both Ether and its tokens is now higher than that of Bitcoin.

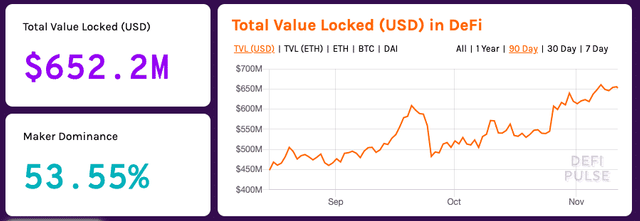

Ethereum’s DeFi boom

DeFi is one of the biggest drivers of Ethereum growth. The rise of DeFi apps on Ethereum drove the blockchain’s total number of unique addresses to over 100 million in early June. DeFi applications account for over 97% of all decentralized app volume on Ethereum. In Q2 2020, Ethereum doubled its amount of active dApp users, from 637,278 in the first quarter to 1,258,527 (out of a total active dApp users 2,808,050). Over $4.3 billion is locked in Ethereum dApps. The transaction volume of ETH DeFi dApps reached $5.7 billion USD in June, and accounted for 97.5% of the whole dApp volume of the Ethereum network.

Bitcoin on Ethereum

Research by Dune Analytics showed that almost $60 million worth of Bitcoins moved to Ethereum during June. Wrapped Bitcoin, the oldest tokenized bitcoin protocol on Ethereum accounted for roughly 75% of that growth after moving more than 4,800 BTC to Ethereum. Currently $132 million worth of Bitcoin is on Ethereum.

Summing it up, since Ethereum’s initial launch in 2015, Ethereum has seen an incredible ride and sits at the center of the cryptocurrency world, right along with Bitcoin. The DeFi boom and anticipation for ETH2.0 has fueled its resurgence. Stablecoins and growth within the DeFi market will likely continue to drive transaction volume and settlement value on Ethereum.

Ethereum is great at creating tokens that represent fractional ownership shares, vested interests, controlling votes, access and permissions, the ability to share control over assets with people you may not trust. A couple of years ago, ICOs were the primary driver for Ethereum’s value. While regulators, pounded ICOs, Ethereum kept ticking. Governments, may put restrictions on cryptocurrencies, including Ether, but they they can’t stop a platform that provides tangible value and an opportunity to build financial infrastructure that is open to everybody. That’s why it did not take long for Ethereum to find its next killer apps. With DeFi and ETH2.0, the future only looks bright.

.jpeg)