Interview: Vitalik Buterin, creator of Ethereum

Vitalik Buterin is one of the most well-known and best-loved figures in the crypto/blockchain world — well-known because Ethereum, the blockchain platform he co-created (with Gavin Wood) has become the platform for the entire web3 world, and best-loved because he’s very clearly just a smart, friendly guy who just wants to build cool stuff and not rip anybody off. In addition to being one of the faces of crypto, Vitalik maintains a fun Twitter account and a blog where he offers highly intelligent and original commentary on a variety of subjects.

Ethereum, which powers most of the smart contracts and other complex structures and products in the crypto world, is undergoing an epochal transformation as we speak. In a process known as the Merge that is scheduled to be completed in just two weeks, Ethereum is switching the way it validates transactions from proof-of-work to proof-of-stake. This will allow it to decrease its energy usage and its carbon emissions dramatically.

In the interview that follows, I talked with Vitalik about proof-of-work vs. proof-of-stake, the recent crash in crypto markets, cryptocurrency security, decentralized governance, “startup societies”, and more!

N.S.: So, I guess we should start out with some current events. Pretty much everything in crypto has crashed pretty hard in recent months. Why do you think that happened? And will this have any effect on the long-term future of the crypto/blockchain ecosystem?

V.B.: Actually I was surprised that the crash did not happen earlier. Normally crypto bubbles last around 6-9 months after surpassing the previous top, after which the rapid drop comes pretty quickly. This time, the bull market lasted nearly one and a half years. People seemed to adjust into the mentality that the higher prices are a new normal. The whole time, I knew that eventually the bull market will end and we’re going to get the drop, but I just did not know when. Today, it feels like people are reading too much into what is ultimately cyclical dynamics that crypto has always had and probably will continue to have for a long time. When the prices are rising, lots of people say that it's the new paradigm and the future, and when prices are falling people say that it's doomed and fundamentally flawed. The reality is always a more complicated picture somewhere between the two extremes.

I do think that price drops are good at revealing problems that were always there from the beginning. Unsustainable business models tend to succeed during booms, because everything is going up, so the money people have at their disposal is going up, and so things can be temporarily propped up by a constant influx of new dollars. During crashes, as we saw with Terra, this model no longer works. This is most true in extreme situations like high leverage and ponzis (veterans of 2017 will remember "BIT-CONNE-E-E-E-ECT!!!"), but it's also true in more subtle ways like how protocol development is easy to sustain during bull markets but when prices crash the often newly expanded teams are hard to financially sustain. I don't claim to have a cure for these dynamics, except my usual advice that people should remember the history of the space and take the long view of things.

N.S.: Makes sense. Now, I want to get to the interesting tech stuff, and we will in a bit...but first, just a little more about the finance aspect. With Bitcoin -- the most widely held and traded crypto -- we've seen this pattern where it has repeated and fairly regular bubbles and busts, but the percentage return from each boom is lower than the one before it. To me this looks like an adoption curve -- as more of the populace holds some crypto, the financial gains from onboarding new users get smaller. Do we reach a stage where Bitcoin adoption gets saturated and returns fall to the level of, say, gold?

V.B.: I definitely think that in the medium-term future cryptocurrencies will settle down and be only about as volatile as gold or the stock market. The main question is just what level the prices will settle down at. In my view, a lot of the volatility early on had to do with existential uncertainty: in 2011, when Bitcoin dropped from $31 to $2 over six months, people really didn't know whether or not Bitcoin was just a one-time fad that would then collapse for good. In 2014, this uncertainty was less than before, but it still existed. And then after 2017 the uncertainty moved over to whether or not it would gain the levels of mainstream legitimacy needed to support a higher price level, which is still roughly where we are in 2022, though we've come a long way. Over time, these existential questions are going to become more and more settled. If, in 2040, cryptocurrency has made its way robustly into a few niches: it replaces gold's store of value component, it becomes a sort of "Linux of finance", an always-available alternative financial layer that ends up being the backend of really important stuff but doesn't quite take over from the mainstream, then the chance that it's going to either disappear or take over the world completely in 2042 is going to be much smaller, and individual events are going to have much less of a bearing on that possibility.

The math nerd way of putting it would be: the price of crypto is stuck in a bounded range (between zero and all the world's wealth), and crypto can only stay highly volatile within that range for so long until repeatedly buying high and selling low becomes a mathematically almost-surely-guaranteed winning arbitrage strategy.

N.S.: Also, estimates of Bitcoin's energy usage suggest that the network's energy consumption is pretty closely connected to the price of Bitcoin. This isn't true for, say, stocks, or houses, or gold -- none of those other assets require increasing energy use to support higher prices. That seems to represent a force that will push down on Bitcoin's price in the long run, doesn't it?

V.B.: I generally look at the interaction of Bitcoin's demand and supply curves and the question of how the supply is generated as two separate issues. Difficulty adjustment ensures that the number of bitcoins printed is fixed according to a schedule: 6.25 per 10 minutes today, 3.125 per 10 minutes starting around 2024, and so on. This schedule holds regardless of total mining hashpower or price. So from an economics point of view, it does not matter whether the protocol hands these coins out to miners or core developers or rabbit breeders. This is why I disagree with the mindset that mining somehow supports Bitcoin’s value.

A consensus system that needlessly costs huge amounts of electricity is not just bad for the environment, it also requires issuing hundreds of thousands of BTC or ETH every year. Eventually, of course, the issuance will decrease to near-zero, at which point that will stop being an issue, but then Bitcoin will start to deal with another issue: how to make sure that it stays secure....

And these security motivations are also a really important driver behind Ethereum’s move to proof of stake.

N.S.: Let’s talk about those security issues. A lot of people seem to think that if a token is called "crypto", the protocol that determines transfer and ownership of that token must be secure -- that someone, somewhere has taken care of that aspect of things. But from your last answer, it seems like you're more worried about security, at least in terms of Bitcoin. Can you unpack that a bit?

V.B.: Efficiency and security are not separate problems. The question is always: how much security can you buy for every dollar per year that you spend on paying for it? If a system has too little security, you can add security at the cost of printing more coins, and at that point you've regained security by sacrificing on efficiency. There are some deep economic reasons that I go to in this post for why proof of stake can buy something like 20 times more security for the same cost. Basically, participating as a proof of work miner has medium ongoing costs and medium entry costs, but being a proof of stake validator has low ongoing costs and high entry costs. It turns out that how secure you are depends on just the entry costs, as that's what an attacker has to pay to attack. And so you want your consensus system to have low ongoing costs and high entry costs, which PoS is great at. Additionally, there are differences in what options the two give you to respond to an attack: in PoW, you can only respond by changing the PoW algorithm, which effectively burns all existing mining hardware, good and bad, but in PoS you can have the protocol burn the assets of only the attacker, so the attacker pays a lot but the ecosystem quickly recovers.

In the case of Bitcoin, I'm worried for two reasons. First, in the long term, Bitcoin security is going to come entirely from fees, and Bitcoin is just not succeeding at getting the level of fee revenue required to secure what could be a multi-trillion-dollar system. Bitcoin fees are about $300,000 per day and haven't really grown that much over the last five years. Ethereum is much more successful at this, because the Ethereum blockchain is much more designed to support usage and applications. Second, proof of work provides much less security per dollar spent on transaction fees than proof of stake, and Bitcoin migrating away from proof of work seems to be politically infeasible. What would a future look like when there's $5 trillion of Bitcoin, but it only takes $5 billion to attack the chain? Of course, if Bitcoin actually gets attacked, I do expect that the political will to switch to at least hybrid proof of stake will quickly appear, but I expect that to be a painful transition.

N.S.: Anyway, your argument about the security per dollar afforded by proof-of-stake makes total sense; Bitcoin's high energy costs are actually high security costs. But let's talk about the political problems that have made Bitcoiners reluctant to embrace any alternative to the proof-of-work system. Is the idea that proof-of-stake allows big stakeholders to modify the network's protocol to their own advantage and the expense of small network users? Is it the fact that proof-of-work creates a large miner class with an incentive to protect their ongoing revenues even though these represent ongoing costs to users?

V.B.: There's a few pro- proof of work arguments. In my view the strongest argument is the "costless simulation" issue. Basically, the idea is that in a proof of stake chain, an attacker could reach out to the owners of the coins at some point many years ago, buy up their old keys for a very low price (because those coins have since been moved to addresses controlled by different keys), and use those coins to create a different chain that forks off from that point and, in a vacuum, looks like a valid history. A node that knows only the protocol rules, connecting to the network from scratch, would not be able to tell the difference between the actual chain and this simulated chain provided by an attacker. In PoW, on the other hand, creating such a simulated alternate chain requires redoing an equal amount of proof of work.

In PoS, this is solved by adding a weak subjectivity period: nodes are required to connect to the internet once in a while (eg. once per month), and a node syncing for the first time may need to ask some sources they trust (doesn't need to be centralized; it could be a friend) what the valid chain is. Stakers are required to keep their coins locked up for that period of time, and if anyone sees stakers supporting two conflicting chains they can send a transaction which "slashes" them, burning most or all of their money. Within the model, this is all completely sound. But PoW proponents are not comfortable with the weak subjectivity period; they prefer a purist approach that you should need nothing but the protocol rules.

My perspective on their argument is that I don't think the purist approach actually delivers in practice. You need trusted sources anyway to give you the protocol rules, especially considering that you get software updates to improve efficiency or fix bugs once in a while. And I just don't think the attack that purists are afraid of is realistic: you would have to convince a whole bunch of people that everyone who says they saw some recent block hash is wrong, and some other hash that no one except the attacker ever saw before is correct. Once you start looking into the details, it just doesn't seem remotely feasible.

There are also people who try to claim that PoS allows big stakeholders to control the protocol, but I think those arguments are just plain wrong. They rest on a misconception that PoW and PoS are governance mechanisms, when in reality they are consensus mechanisms. All they do is help the network agree on the right chain. A block that violates the protocol rules (eg. if it tries to print more coins than the protocol rules allow) will not be accepted by the network, no matter how many miners or stakers support it. Governance is a completely separate process, involving users freely choosing to download software, and BIPs and EIPs and all core devs calls and other bureaucracy to coordinate which changes get proposed. The funny thing is that bitcoiners (who tend to be the most pro-PoW) should understand this well, as the Bitcoin civil wars in 2017 demonstrated really well that miners are quite powerless in the governance process. In PoS, it's exactly the same; stakers don't choose the rules, they just execute the rules and help order transactions.

There is a possible argument that PoS has stronger centralization pressures than PoW because the digital nature of stake makes it easier to concentrate, or because optimal PoW mining involves exploiting local limited-scale opportunities to get electricity cheaply. These are definitely things that I worry about, though I think people overstate them. Particularly, ethereum proof of stake today does not yet have the ability to withdraw your ETH. This creates pressure to join a pool, because if you stake in a pool, whenever you want to get your money back you can just sell your shares to someone else, and so pooling offers a large competitive advantage in access to liquidity. But this will stop being true next year when deposits are enabled. Another issue with staking today is that pooled stakers can’t easily switch pools (or switch to solo staking) because of the same lack of withdrawal ability, but next year they will be able to. And as for mining decentralization, I’m just skeptical that these highly dispersed small-scale mining opportunities are even that significant. Mining is a highly industrial activity, and the big mining farms that are outside of the US (which is ~35% of global hashpower) seem to be close to various governments, so the censorship resistance story of PoW is highly contingent in the future. The highly democratized early proof of work era was a beautiful thing, and it helped tremendously in making cryptocurrency ownership more egalitarian, but it’s unsustainable and it’s not coming back.

N.S.: Let's actually talk about governance. To me, governance has always seemed like the most promising and interesting thing about blockchain technology -- a potential way to sidestep the cumbersome process of business formation and create fluid, ad-hoc economic collaborations, especially across international borders. I'm a big fan of the sci-fi book Rainbows End, where much of the economy is based on that sort of collaboration. But in practice, it seems like there are lots of problems with the ways people have tried to implement this so far -- in fact, you have a whole series of blog posts criticizing rigid blockchain governance systems that try to eliminate all human judgement and trust from the equation. Can you give me a quick sketch of your own vision of how blockchain governance should work?

V.B.: One reason why blockchains are interesting is that they have a lot of properties in common with many things that we are already familiar with, but are not exactly like any one of them. Like a corporation, a blockchain has a token that you can buy and hopefully it goes up. But unlike a corporation, and more like a country, a blockchain doesn't rely on an external authority to resolve internal disputes. Rather, a blockchain is its own "root" of adjudication; you might even say, it's trying to be a "sovereign" (sure, blockchains are not truly independent of existing nation state infrastructure, but come on, most nation states are not truly independent either). Like what democracies aspire to be, a blockchain is highly open and transparent, and anyone can verify that the rules are being followed. Blockchains often spawn what look like religions, in the kind of long-lasting and devout fervor that they inspire among their followers, but they have far more sophisticated economic ingredients than religions typically do. A blockchain is like an open source software project, both in its egalitarian ideals and even more importantly in the freedom to fork: if the "official" version of the protocol goes astray and violates what some portion of the community consider to be their core values, they can coordinate around their own chain that splits off and continues from there, and they can then compete with the original for legitimacy in the court of public opinion. But a blockchain is not quite like an open source software project: in a blockchain, there's billions of dollars of capital at stake, and the costs of a split gone wrong are so much higher. If the cost of forking gets too high, as some argue it already has, its role in governance becomes more like nuclear deterrence than like a regular part of the process that is intended to actually happen.

All of these things mean that blockchains are a powerful basic substrate that could be used to host the governance logic of other applications, but also a complicated thing that requires a new and different form of governance in itself. We've seen both Bitcoin and Ethereum have "constitutional crises" of various forms, most notably the Ethereum DAO fork and the Bitcoin block size debate. In both cases, there were groups on both sides who had strong and differing beliefs about what values the project should embody, and both ended up resolving in a chain split. What is interesting is that Bitcoin and Ethereum both eschew formal governance; there is no specific person or council or voting mechanism that has an established legitimate right to decide on which protocol changes become official. There is the All Core Devs call, but even there the rules for what counts as a sufficient objection are ill-defined, and for anything truly controversial the core devs often step back and listen to community input.

Of course, there are often people who come along and say that this quasi-anarchic design looks ugly, and it needs to be replaced by a more "proper" formalized system. But they pretty much never succeed. In my opinion, there's actually a lot of wisdom in our current "tyranny of structurelessness". Particularly, it does a good job at capturing the idea that a relatively small group of core devs should be able to independently decide on detailed technical decisions that don't really affect the core vision, but you need a much deeper buy-in for something philosophically major like a hard fork to rescue coins, or a switch to proof of stake.

Governance of applications on top of blockchains is a different challenge. Here, there's also a divide of how "forkable" the application is: is it like ENS, where if governance breaks down you could just make a fork with different rules and convince all the infrastructure to move to it, or is it like the DAI stablecoin, which depends on reserves held in other assets like ETH, so you can't safely fork DAI at all without forking everything else? If an application is forkable, that's good; it gives you that extra backstop and you want to take advantage of it (as Hive did). If an application is not forkable, then you do need some fully formalized governance that you can trust.

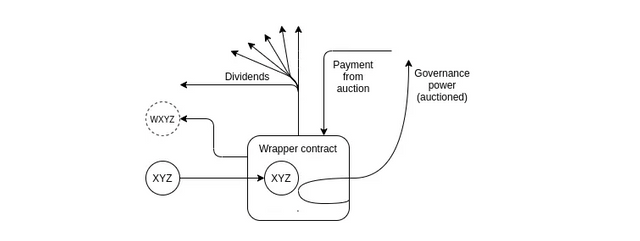

My main theme on this topic has for a long time been that the currently popular technique of coin-driven governance, where governance is done by coin holders voting, is really broken and we need to move to something better, and specifically something less "financialized". Coin-driven governance naturally favors the wealthy, and there's all kinds of long-term ways in which it can easily break down. In my post on this last year, I described an example of a smart contract that would in a very user-friendly way let coin holders automatically accept bribes to vote in a particular way from the highest bidder:

This would turn every governance decision into an auction, which would lead to only the wealthiest participants having any kind of say at all. At best, this leads to soulless profit maximization, at worst, this leads to high-speed extraction followed by the project quickly collapsing.

My preferred alternative to coin-holder governance is some kind of multi-stakeholder governance that tries to formally represent people, and not just coins. Optimism is doing this with the concept of "citizenships", which are intended to be allocated to contributors and ecosystem participants and are deliberately non-transferable. But we're still in very early stages of figuring out how such a thing would work.

N.S.: Let's talk more about the alternative forms of human organization that blockchains might enable. I really loved your thoughtful review of Balaji Srinivasan's The Network State. Have there been any promising attempts so far to create "startup societies" with crypto as an integral part?

V.B.: I think one reason why this hasn't really happened so far is that there's a fundamental difference between a blockchain ecosystem and a full-on startup society. A blockchain ecosystem economically survives by convincing lots of people to become a little bit involved or at most medium involved. You only need a few core developers, and even they don't necessarily have to make large personal sacrifices. They keep living in a “normal” city, and generally it just looks like any other change of jobs. But a startup society, on the other hand, is a much deeper thing. You need people to take the plunge and move to a particular place, and likely an unconventional place that comes with big downsides that can only be overcome by upsides created by the community itself. Balaji is right that getting people to do such a thing requires deep moral narratives.

I think crypto does have deep moral narratives, and they were very central to the ecosystem in the 2009-2014 era, back when people had no idea whether or not crypto as a sector would even survive, the average crypto person had pretty much no offline crypto social circle, and even legal issues were still uncertain. The conception of crypto as a continuation of a grand cyber-libertarian movement and a spiritual successor or sibling of PGP, BitTorrent, Tor, Assange, Snowden, etc was very strong, and these strong ideals served as the ideological and moral glue that allowed people to make big sacrifices and risks for the space. More recently, the industry has matured, and with that maturity came some degree of dilution. This dilution is good for mainstream adoption, and indeed the newer blockchain projects are often intentionally downplaying the weirdness with the goal of targeting mass adoption. NFTs are broadening the appeal of crypto to groups even further from its original user base.

But at this point, this growth has also made existing blockchains too "thin" to be good network states. Ethereum has so many different communities of users, and many of these communities deeply disagree with each other (there’s definitely “woke” and “anti-woke” Ethereans, for example, not to mention international divides). There's a strong overriding point of agreement around defending the integrity and operation of the chain, as we've seen with the recent community solidarity around preventing on-chain censorship, but not enough solidarity to form something like a country.

Also, the attempts at forming local crypto communities intentionally so far have sucked. The problem I see is basically that they all use some form of "low taxes" as a primary pitch, and while low taxes are a lovely benefit from the point of view of an individual, they are a terrible filter if your goal is to attract people who are actually interesting. The kinds of communities you get when low taxes are the primary reason to come are just really boring and lame. Network effects are about quality, not just quantity. I do think that there is a room for some kind of startup society right now; there's a lot of demand for a physical community oriented around particular values, providing an outlet to express those values constructively and not just through zero-sum twitter warfare, and that combines with a pragmatic need to escape the high living costs of the US and the increasingly in-your-face and not just theoretical authoritarianism of many other large countries. But the projects I have seen so far are not doing this well.

One meta-point on this answer is that most of it is about culture; whether or not we have an on-chain land registry and smart contract property rights and Harberger taxes or whatever is of secondary importance. I do think that a startup society should experiment with very different ideas from what we're used to. For example, I would try to greatly de-emphasize the idea of absolute ownership of specific pieces of land and houses and apartments, and emphasize economic alignment with the community through things like city coins. But I think the value of innovations like this is more for the long term, and that alone is not enough of a glue to attract people in the short term. At the beginning, alignment with cryptocurrency and blockchain technology would be primarily symbolic, and it would evolve into a more practical thing over time.

N.S.: And another question: In that post, you disagree with Balaji's focus on the importance of a single central leader for an online startup society. Do you think your role as the founder and "face" of Ethereum is overemphasized by the press and by crypto enthusiasts in general?

V.B.: I definitely have been wishing since the beginning for Ethereum to grow into something where my influence can decrease just because so many other amazing voices start to grow and express themselves. And I actually think that over the last two years, this has been happening! In 2015, I was basically doing 80% of the "research" in Ethereum, and I was even doing a large chunk of the Python coding. In 2017, I was doing much less of the coding, and maybe 70% of the research. By 2020, I was doing perhaps only a third of the research, and very little coding. But I was still doing most of the "high-level theorizing". But over the last two years, even the high-level theorizing is something that has been slowly but surely slipping away from me. We have lots of great new Ethereum influencers like Polynya, who has been doing a lot of thought leadership around layer-two scalability. The Flashbots team has been responsible for spearheading the whole space of MEV research. People like Barry Whitehat and Brian Gu have taken the mantle of zero knowledge proof technology, and Justin and Dankrad, originally hired as researchers, have been asserting themselves more and more as thought leaders too.

And this is all a great thing! I don't think that the public perception has quite caught up to this yet, but I expect that over time it will.

N.S.: OK, time for my traditional final question: What projects are you working on these days that most excite you?

V.B.: I would say what excites me most isn't any single project, but the way that a whole ecosystem of many interesting ideas is coming together. This is true on the technological level, where Ethereum is approaching its merge, and large improvements in blockchain scalability, usability and privacy are all soon to come after that. It's also true on the level of social and political ideas, where a lot of thought around decentralized organizations, radical economic and democratic mechanisms, internet communities, and much more is all maturing at around the same time. On the further-from-crypto science front, the progress in biotech and AI has been amazing - in the latter case, some might say, perhaps a little too amazing. We're starting to understand what both the politics and the technology of the 21st century is going to look like, and how each of the pieces of what we're working on are going to fit into the picture. In 2022, crypto finally feels meaningfully useful; lots of mainstream organizations and even governments are using it as a way to send and receive payments, and I suspect other applications are soon to come. The future still feels less uncertain, but we have much more of a view than before as to how it's all going to play out.