Fidelity could “single-handedly” solidly crypto as a new Asset Class for Investors

Source: https://www.ccn.com/experts-fidelity-could-single-handedly-solidify-crypto-as-new-asset-class/

Many people know who Fidelity Investments is in relation to entire Wall Street / 401k / investment landscape.

Fidelity manages over $7.2 Trillion in assets for Individual and Corporate America 401k’s.

To give you context. IF over the next 18 months Fidelity were to have 5% of all assets in cryptos that would equal $360 Billion dollars.

The entire crypto market now is $223 Billion. So you can understand the impact of of healthy flow of monies can be with just ONE firm.

Fidelity is just one of SEVERAL large investment companies which will place customers in ‘asset class investing’.

What is an asset class ?

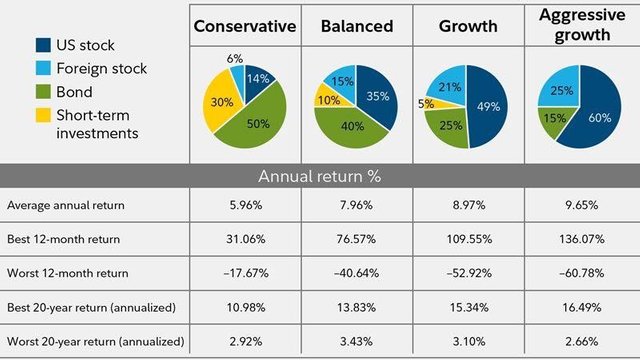

Did you know that the key to investing is “diversification” amongst ALL asset classes? This means money managers will work with wealthy investors to diversify their monies for safety and return.

An example is gold/silver to be 3% of a portfolio. Bonds to be 20-30% of a portfolio (bad time now). And then a series of different types of stocks (large, small, tech international etc...)

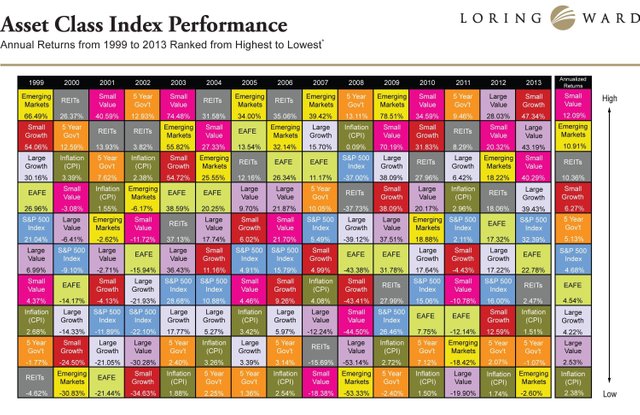

See the chart below—- see how the returns vary over time. You don’t know what will do well so you diversify across many sectors.

This is a simple view of Asset Allocation

Below is a Periodic Table which shows these fund classes over time

The bottom line is Cryptos are being viewed as a NEW Asset Class.

AND if you stocks more or less topping after a 10 yr bull market

AND if you have bonds doing BAD because interest rates are now rising

You will see investors that want exposure to something else that could give returns to help their portfolio.

This is why Fidelity will add consumer, corporate awareness.

Let’s not forget that Fidelity has over 190 office locations in the US.

Fidelity say they want to be up by 2019. I would give it some time, but I think you see what could be IF Cryptos could be considered a new asset class.

wow, here comes the big one

Just a matter of time. I heard there is 3 to 4 times the volume of Bitcoin trading daily on the OTC vs the exchanges. They don’t want to inflate the BTC price.

I like your work =)

Thank you