EOS simply explained — too late to buy?

EOS is a blockchain-based cryptocurrency token, which was launched on June 1, 2017 and is currently one of the hottest projects in 2018. In principle, it is similar to Ethereum a decentralized computer, a smart contract platform for the deployment of decentralized applications. EOS aims to conduct virtually unlimited scalability and claims to eliminate transaction fees for users, which allows different apps to run parallel to each other.

EOS was started by CTO Daniel Larimer, a serial entrepreneur who has been in the crypto-ecosystem since 2010. He also launched Steemit (a decentralized social media platform) and Bitshares (a decentralized crypto exchange). The company around EOS called ‘Block.one’ has also a very impressive team. They definitely have the 3 H’s together that a startup needs to get started — the hacker, the hustler, the hipster.

In today’s coin description, EOS is analyzed in comparison to Ethereum and upsides and downsides are shown with numbers, dates, and facts. In the end, I will look a bit in the future and tell you if it is too late to get into EOS right now.

Blockchain Economics

First, let me briefly turn to Blockchain Economics, which is about how to create decentralization on a blockchain. In other words, the creation of consensus. What happened and what did not happen? There is a general discrepancy between decentralization and centralization because, by definition, decentralization is always slower, more expensive and inefficient, contrary to centralization, which is cheaper and faster, but has the inherent problem of trust.

How is consensus created at Bitcoin and Ethereum?

At the moment, both use Proof of Work (PoW) as an algorithm, unlike Bitcoin, Ethereum with the Casper Protocol wants to deploy Proof of Stake (PoS) in the future. The downside with a PoS model is that you need to be online for a certain time in order to vote. This is where EOS comes in and tries to get the best out of both algorithms. Whether this really makes sense, you will learn in the following comparison with Ethereum.

EOS vs. Ethereum: 7 points in comparison

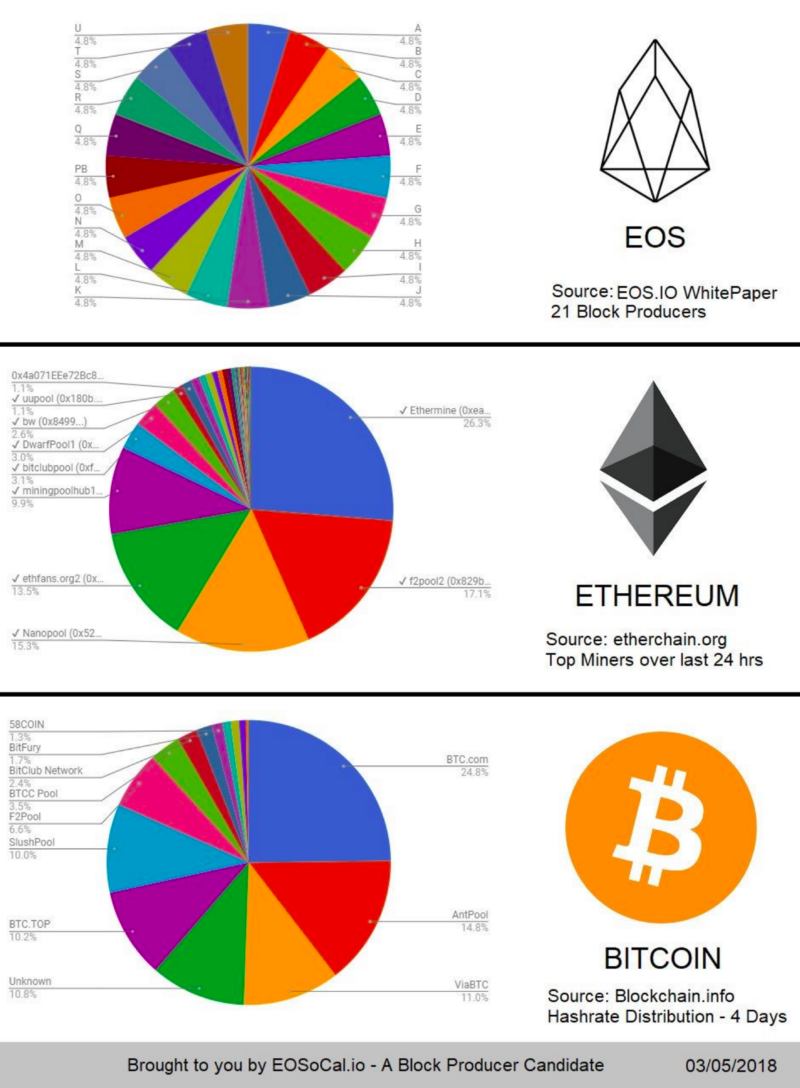

1) Consensus algorithm

The concept of EOS is a DPOS (Delegated Proof of Stake) and works in a similar way to political elections. A majority of people elect for a smaller group of 21 so-called block producers who create the consensus. The smaller this consensus-creating group is, the more centralized and riskier is the basic structure. The big question is how do you make sure that these parties do not collude or start censorship? The answer from EOS is that there is a big incentive mechanism to stay one of those 21 block producers and if one starts cheating or being bad, this person will not get reelected and lose the valuable position. The problem is a so-called plutocracy and what this means is what you can imagine from a game theoretical perspective and this is one of the reasons why it is highly illegal to pay people to vote for you. These parties will start paying people to vote for them so they stay in and can misuse this economics. There will be a balance on how much they can cheat versus their cost to pay for the votes. On the one hand, this is a big criticism and on the other hand a big chance because the more centralized you are the nimbler you are as a Blockchain and the agiler you are, the easier you can adapt. The challenge in my opinion that EOS is going to have is the trade-off between centralization efficiency and decentralization trust. I am not sure if the most basic layer of a Blockchain should be used for the efficiency. I personally believe that the second layer solutions are the way to go and the fundamentals of the Blockchain have to be as neutral and decentralized as possible to have a fall back plan if there is a screw-up.

Ethereum has a decentralized basic structure. They are working on second layer solutions like Plasma or Raidon and a shift to PoS. The Proof of Work Algorithm currently employs about 18,000 miners to create consensus.

2) Scalability

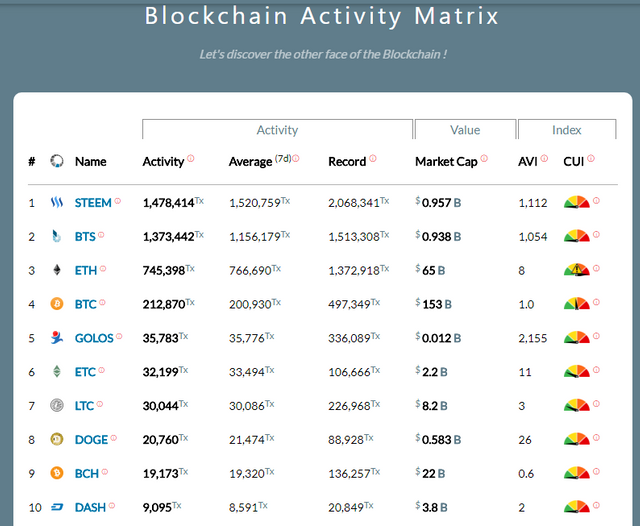

One goal of EOS is to solve Ethereum’s scalability problem by using multithreading so that multiple applications can run parallel to each other. That means not everyone has to mine everything, but rather blocks can be separated into strings which get connected. The big question is if we are actually having a scalability problem right now on any of the Blockchains? We had one at Bitcoin and Ethereum for some time, but scalability is not a permanent problem.

At Ethereum everything runs on the mainchain, which is still a problem. For example, the first blockchain-based game “CryptoKitties” was released at the end of last year and used up almost all of Ethereum’s computing power.

3) Fees

EOS has an annual inflation of 5%, which is distributed over the block producers and thus enables the possibility to offer free transactions for users. A disadvantage of this is that all control is left to the block producers in the hope that no black sheep is among them. Also, the spamming problem is not solved.

At Ethereum, the user pays a small transaction fee called “Gas” so that miners can create consensus and, on the other hand, prevent spamming. The advantage here is that if a transaction costs something, it is not possible to send an infinite number of them into the network.

4) Usernames and Passwords

At EOS, there is the possibility to create a username and passwords for a private key. For example, EOS can be sent to the address “Julian Hosp”. This feature is easy to use and facilitates mass adaptation as users are already familiar with it.

Ethereum has a similar feature through the Ethereum Name Service (ENS). Other blockchains could also integrate this non-EOS-specific feature.

5) Account Recovery

If the private key is lost or the account owner dies, EOS may allow the person or legitimate descendants to recover the account. Ethereum does not have this feature yet.

6) Developer Community

The EOS founders team is very strong, but there are still a lot of experienced people missing who need to be acquired. The Mainnet is not live, the ICO phase runs until June 2018 and is expected to raise $ 1 billion. It is incredible that EOS is currently more valuable than Litecoin, Cardano, or even SpaceX by Elon Musk.

The founder team around Vitalik Buterin of Ethereum is also very strong, has really good developers and also one of the biggest and longest existing blockchains, which is live.

7) Usage

Since EOS is not live, there is still no secondary industry and apps. In addition, EOS is not yet listed on Exchanges and untested.

Ethereum can score points in usage, as many companies and apps use Ethereum as a decentralized platform. Here it is worth mentioning that liquidity attracts other liquidity and that it is easier for an existing system to attract new things than new people for a new system.

Conclusion

From the 7 differences, especially the first difference in how consensus is created, is important and fundamental. My personal opinion is that the basic structure must be as neutral and decentralized as possible.

What are RED FLAGS from EOS?

The basic structure is pretty central, what can lead to many problems, censorship and to a loss of trust.

Many big investors at the ICO, aiming at $ 1 billion and running for over a year.

Audit is unknown, therefore there is a risk of money laundering.

Communication and marketing is breaking into hype, bringing newcomers and fanboy behavior to the market.

What are RED FLAGS from Ethereum?

Centralization around Vitalik Buterin, what he does does the community

ICO not legally clean set up

Consensus Proof of Work

Many innovations are not possible.

What would a proof of stake look like with Kasper?Scaling

Not essential at the moment, but what happens when Ethereum does not manage to scale from their base level to second-layer technologies to enable Raiden, Plasma, COMIT, …

False Accusations

1. Why does Block.one not build its own blockchain?

The EOS Token is not allowed to derive value from the company’s work. For this reason, Block.one provides the tools, but EOS has to manage to build the blockchain itself.

2. Why is it not clear whether the ERC20 token creates the mainnet token?

It cannot be promised that the ERC20 token is allowed to be swapped into a real mainnet token in the beginning of June. The reason this right cannot be promised is also because of legal terms. It would make EOS straight away a security token, instead of remaining a utility token.

3. 5% token inflation per year is bad?

No one knows if deflationary or inflationary cryptocurrencies do better. Everyone has this idea of inflation being bad just because main governments are doing a crap job on it, but it still does not mean that it is a bad idea.

Looking forward

My personal opinion is that we see an unbelievable pump from EOS at the moment, which causes many newbies and traders to jump on due to the hype. The question is, is EOS currently really more valuable than other big blockchains that already have a use case, or is it for example more valuable than SpaceX?

In the coming weeks, the price is likely to fall, as large investors, who bought the token early, want to sell it, because of some uncertainties. On June 2, 2018, the ERC20 tokens will be frozen and can not longer be moved unless they have been previously registered for the token swap to the Mainnet token.

The launch of EOS’s Mainnet is expected to be successful on June 20, yet many questions remain unanswered, e.g. how many different chains and forks are there? What about Airdrops? Which Coin is listed where and how does trading work? Everything has to start from scratch, the developers, the entire decentralized apps, the main chain. In addition, the token needs to be listed, not the ERC20, the new token needs to be listed on exchanges. This is why I think the mainchain is going to struggle in the beginning.

There is one major factor called idea execution distortion. As long as something is only an idea it can be hyped and you can dream about it. As soon as there is a product it gets discounted massively. As soon as the mainchain is there, we will see what actually is there.

What would I do?

I cannot give you any recommendations and ask you not to invest blindly. I cannot tell you if it is too late to invest or if it is worse to invest nor if you should get in.

I can only tell you what I am doing and what I am doing is I have never held EOS and I am not planning on holding EOS. I might revisit my decision if EOS is executing and looking quite straight forward.

It is not about following me blindly, it is about thinking and being rational about these things that I have just told you.

If you think EOS might have a chance — great and if it does not, it does not.

Where to buy EOS?

If you are interested, you can currently buy EOS as ERC20 token on most of the exchanges and store it on many wallets like MyCrypto.com, MyEtherWallet.com. Do not forget to register for the token swap before June 2nd, if you buy the token from the ICO. Here is a reddit link how it works: https://www.reddit.com/r/eos/comments/7jarzj/how_to_registerclaim_your_eos_tokens_before_june/

My wish for the development of EOS is that they adopt innovations and create consensus much more decentralized.

What do you think about this? Let me know what if you agree or disagree and especially why?

Did you get value out of this? Please share it with people of Ethereum and EOS and connect with us on the community on Facebook, Reddit, Instagram and everywhere else.

New to cryptocurrencies? You might want to read this book first! http://cryptofit.community/cryptobook

Watch my video to this topic:

Great post with very useful information as always (following you ob youtube more than a year).

Great to hear that you are going to be more active on steem!

Nice in depth comparison Julian. Personally I have a lot more belief in Eos and I think it's going to bring crypto to the mainstream. Ethereum have been promising upgrades for a long time and not really delivered, meaning many applications built on top of it have failed to gain real world usage

I know you're not technically new here...but just found out about you.

So, welcome.

I'm likely not heading over seas until season 3, but it would be awesome to have you as a guest on my steemit show Hots or Shots.

he's totally worth the interview.

good crypto portfoilio.

i would love him on hots and shots, thanks

Great video! I'll pick up some more EOS right away!

Too hyped if you ask me. i would not buy it.

It's a pleasure to see a person of great caliber and a great influencer in the cryptocurrency on steemit :)

Very awesome video Julian. Love your content!

very useful information. i heard a lot about eos lately and i usually am lazy to do my own research. i just follow the advice of some expert like yourself. so, thanks again for this info.

I'm not sure I follow when you say that "scalability is not a permanent problem" when speaking about Ethereum. Each time I look at blocktivity I see the Ethereum mainnet maxxed out at 100% with tens of thousands of unconfirmed transactions ....

They have raised way too much money (ETH 18 Mio.$ vs EOS 2100 Mio.$). There might be a good buying opportunity a couple of weeks after mainnet launch in June. But I guess it has a niche and seems to be a good project overall... just a little too expensive right now.