Investor Decision Making - A Psychological View ------ Chapter 1

Hello folks, good morning, everyone.

As I said in a previous post, I am a psychologist from UFJF. During my undergraduate studies, I thoroughly studied the issue of asset selection, both fixed and variable income.

With that, I wrote my undergraduate article on investor decision making, using behavioral finance studies.

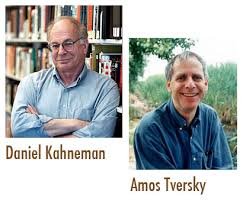

The studies published by the cognitive psychologists Daniel Kahneman and Amos Tversky were used mainly, being these the proponents of the theory of the prospect, that gave rise to the behavioral finances. Other cognitive and social psychologists were approached, as well as professionals in the area of administration, economics and finance in general.

I do not know if you have already read the quick and slow book of these two authors, Daniel Kahneman and Amos Tversky. It is a book that I fully recommend to understand how the decision-making process works for anything in life. In this case, it was very much applied to financial matters.

The posts I will set up will address the investor's decision-making, showing the individual's cognitive and social biases, influencing how they build an investment portfolio, in order to reduce their errors in the choice of financial asset portfolio, and show the importance of long-term focus to maximize the effect of compound interest on the portfolio, increasing it exponentially.

Therefore, it is a work done to make the investor understand how his emotional part influences both his decision making and the maintenance of good or bad assets within his portfolio.

I will make the posts in the form of chapters to make reading more interesting and practical.

With it, if someone becomes an investor someday, you can understand quite how your mind works when dealing with investments, because it is not enough to just understand companies and select a good action. If the person is very anxious and follow the "herd", concept that will see later, may have a good portfolio, but will tend to sell all stocks if the market is low.

In the next post, I'll talk about how these studies came about, and the psychologists Daniel Kahneman and Amos Tversky, who are the forerunners of this kind of psychology study of behavioral finance.

I hope you like these chapters, because I studied for years to do my tcc and I keep on studying this subject.

Thank you all and until the next post.

Good Morning!!!!

Learning to exclude emotions from investing can be a little hard to do as doing otherwise can be tempting but it's still the best way to go, Nice job

thank you man!

hi sir @julisavio wow this is a very good review in my opinion .., hopefully the next chapter is fast in post. thanks.

now i follow you sir @julisavio

thank you man!

You are welcome

@julisavio

Congratulations @julisavio! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

To support your work, I also upvoted your post!

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPI love psychology and I studied it in school. It sure does help.