Company Value Management. Part 20

Hello.

Conceptual framework of corporate governance.

Corporate governance and the life cycle of the organization.

I continue the theme begun in the last abstract, and today about the following dilemmas inevitably arising before the company throughout its life cycle.

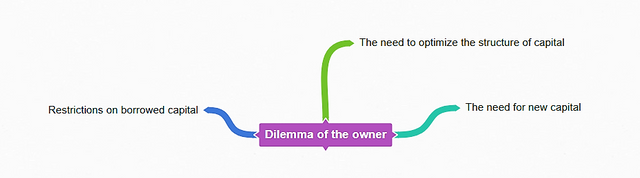

The dilemma of the owner.

This is a difficult situation, inevitably arises before any company.

Passing through the life cycle, the business grows, increases its scale, moving to the next stage of growth. The main sign of the growth stage is that the company needs to consolidate itself in the market, to win its place from other companies, to form its market share.

Without additional capital, this is almost impossible. There is a need for additional funding.

You can obtain this financing in many ways.

You can borrow money in financial markets or the owner can make an additional contribution. If the company has chosen the way of borrowing, then for an organization that is just getting on its feet, restrictions on borrowing will apply, this is a limitation of the amount of capital, higher prices for capital.

Plus, the company must maintain an optimal balance between debt and equity.

If the loan capital is too much, then the company raises the required risk return. If there is not much borrowed capital, the financial leverage of the company will be low, and the capital for the company will be more expensive.

If the company has passed through the point of optimality and has a higher financial leverage than is necessary for an optimal capital structure, this leads to an increase in the risk of default and a delay in the repayment of debt, which in turn means an increase in the cost of loans for the company and an increase in the required yield on capital.

A difficult situation arises. A low financial leverage will not be the best situation for the company, a high leverage is also not the best situation. With a high financial lever, there is a risk of deterioration or change in relations with stakeholders. Increased risk will force them to change their relationship with the company or even go into another business.

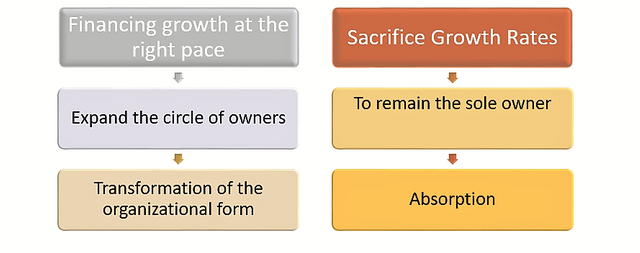

How to solve the owner's dilemma?

As I wrote above, attracting a large amount of borrowed capital creates a problem with the optimal structure of capital and raises risks.

One solution to the dilemma of the owner will be to finance growth by attracting new owners. But you can go another way. One can sacrifice growth rates if there is no desire to attract other owners, but this path has serious negative consequences, especially slowing and stopping growth, because the entrepreneur's personal funds are limited. As a result, if we talk about the dilemma of the owner, then it comes down to two possible solutions.

- Attracting new owners, increasing the growth rate of the company, but in this case, the owner will have to share power in his company with other owners, for someone this way will be unacceptable.

- The businessman does not attract other owners and remains the sole owner of himself in the company, in this case he can forget about the high growth rates of the company, the company will need to look for some narrow segments of the market, change the model of the company and in the end it can lead to the takeover of the company if it can not grow due to the decision of the owner.

The third dilemma.

The next dilemma arising on the company's life path, when the first two are already solved in one way or another, is the investor's dilemma.

What is the essence of this dilemma? The bottom line is that a businessman who is formally the owner of a company must be able to behave like an owner. He must become an owner-investor, learn the necessary skills. He should be concerned about the risks of using his capital in only one of his companies.

A businessman should realize that before him as an owner, the task of diversifying risks is. To do this, he needs to withdraw some of the funds from his company and invest them elsewhere to reduce the risk.

Thus, the businessman should have an interest in creating a working mechanism to control all the processes in the company, to stimulate business growth and, accordingly, to increase the share of personal wealth.

As a result, I want to say that for the successful passage of these three dilemmas arising in the way of the company, a mechanism of corporate governance (Governance) has been created to solve problems associated with them, and the central body of this mechanism is the board of directors.

Thank you.

Thank you for this wonderful strategy in business! Do have a lovely weekend

Thank you

%%%%^^67&)(&09*

^^%&&&**()()_JKHKJGJKG

@@@!!!@##$%&&**((()))

LLKKLLK////))((**&&^%^

@######DDFFFFFFGHHHHhh

*******((((((())))))))))))___________________

1122555222 212128506/////))))))))))

#@%^&^**())__++

###4&647yrtjhgfgv

돈 돈

돈을 벌다

나머지는 모두 말도 안돼.

예

이렇게

이렇게

그런 파슬리

및 이와 같은 딜

와 녹색 앵무새

큰 점유율