How the next recession may unfold

Having experienced the dot-com boom and bust, and the housing crisis, you would think people who lived through them would be more sensitive to signs of a looming recession. But it’s a characteristic of bubbles that irrational exuberance rules the day. So I wanted to counterbalance some of that exuberance with musings—I wouldn’t call them predictions—of how the next recession may unfold:

Like the housing market, the automobile market is about implode

If you thought subprime lending was done, think again: it’s just shifted from housing to cars. And delinquency rates are rising. This is worsened by declining used car prices. And with self-driving cars just a few years away, many people will give up owning cars, further driving down prices, making it harder for people to repay loans.

Retail jobs are disappearing with shift to ecommerce

There are 170,000 fewer retail jobs in the US in 2017, in part due to ecommerce and automation. And it’s not just retail jobs affected, but retailers with physical stores, who are massively in debt. That debt starts coming due primarily between 2019 and 2025, likely meaning more bankruptcies and fewer retail jobs. If those retailers go bankrupt, people may not pay their retail credit cards, which exposes banks to the carnage.

As AI eats white collar jobs, it will further erode commercial real estate values

If jobs shift from physical spaces to the brains of data centers, why have all those offices? Just as the retail debt comes due, the need for commercial real estate will decline, exacerbating declining demand for commercial real estate.

Transportation jobs that kept many people afloat will disappear with self-driving vehicles

GM is shooting for a 2019 launch of a self-driving taxi service, and there’s lots of competition. Many companies are also working to automate truck driving.

Meanwhile, corporate profits continue to rise, with new incentives to automate work, and less tax to support social welfare

The recently introduced US tax bill allows companies to write off the full value of automation equipment immediately, which makes it more economically attractive to replace people with machines.

People are betting on the stock market (and Bitcoin) to save them

But the stock market is at bubble levels. A lot of people are going to get burned. (I’ll leave aside the question of Bitcoin’s valuation as it’s a topic in and of itself.)

So, I don’t have the timeline exactly, but at some point soon the economy will go off a cliff: people are over-leveraged, possess assets of declining value, and could soon lose access to many employment opportunities. Meanwhile, tax cuts and existing low interest rates will minimize the government’s ability to soften the blow. Perhaps this will be the spark that ultimately ignites the movement to a basic income.

What do you think? Did I miss anything? Am I being too pessimistic? I’d like to expand on some of these ideas, so if you have suggestions, please post them in the comments.

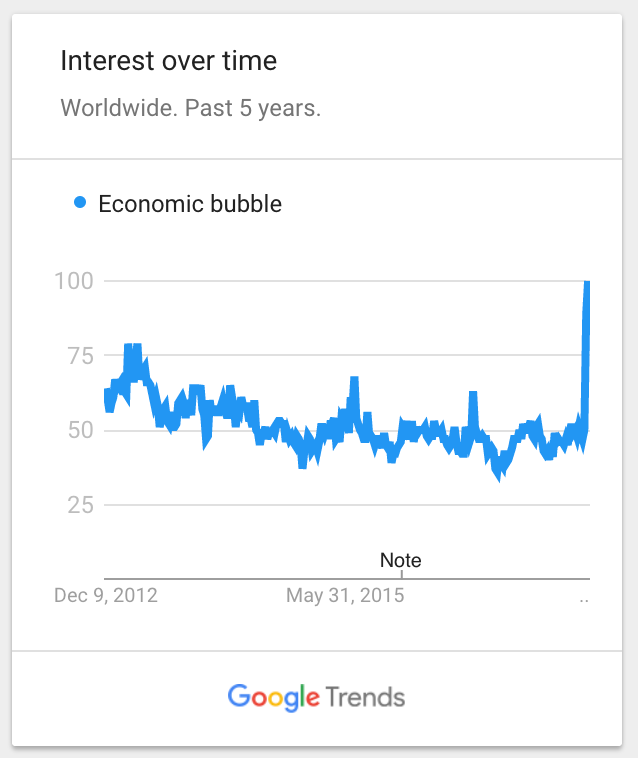

Update: Updated formatting on December 9, 2017 and added Google Trends image.

I think your predictions are dead on. The introduction of universal basic income is a must if social stability is to be maintained. Some people think that new types of jobs will emerge to replace the lost ones. To some extent that will happen. But the term jobless recovery was already coined in the 1990's. That tendency will only accelerate as AI continues to make inroads into an increasing number of industries.

Thanks. Good to hear I'm not crazy—sometimes I just feel like a total pessimist! What's interesting to me is that the quantitative data is supported by qualitative evidence, as probably 25% of commercial real estate in my neighbourhood has a "for lease" sign up. Yet I don't think people are properly weighting the risk of a looming recession, despite seeing signs everywhere (literally) that something is happening.

I would also like to add that the implementation of universal basic income presupposes that the government retain the ability to collect taxes. Cryptocurrency-enabled tax evasion is not conducive to that. While we all cheer when the adoption rate of cryptocurrencies goes up, growing income inequality can be made worse than it already is by them. The distribution of Bitcoin ownership is hugely unequal with 1000 addresses holding half of all bitcoins.

At the current rate of job destruction, the libertarian ideal of low or no taxation is completely dead in the water. The only thing it will lead to is serious social unrest and ultimately fascism. In the Trump phenomenon, the USA has already experienced a smattering of it, although the Trump presidency has also demonstrated the how effectively checks and balances in the US government have worked to contain his excesses. But much worse can be expected if the national unemployment rate becomes too high.

I've already stated that I'm a proponent of universal basic income. But I think the government should mostly stay of out the way. Regulation is necessary in minimizing negative externalities. But this precisely where distributed ledger technologies have great potential to reduce both fraud and the necessity to combat fraud and other negative externalities through government regulation.

I haven't explored the intersection of basic income and cryptocurrencies much, but now I'm curious. I love the idea of decentralizing wealth without an intermediary, but I don't think many existing cryptocurrencies—and especially Bitcoin—have really lived up to the hype here, given how much they rely on exchanges, large mining operations and, as you pointed out, a small group of large owners. If I had to choose between a government and a cryptocurrency for basic income, at least right now, I'd still vote for government. But I might change my mind as I learn more about this.

PS: I didn't mean to upvote myself, but got a scary warning when I tried to remove it.

Your're in Toronto? Isn't Toronto, along with Vancouver, one of the two Canadian cities worst affected by the real estate boom? I have relatives in Vancouver and they told me that quite ordinary houses in the Vancouver Metropolitan Area cost seven figures at present. We also have Love it or List it Vancouver on television here. The situation is making it impossible for the young generation to stay in Vancouver once they graduate from college. I have seven second cousins there, in high school, in college or recently graduated. All the independent ones have moved out. One lives in Montreal, another is in the petroleum industry in Alberta and one is a geology major, and probably will relocate to another province, too.

Yes, housing prices are very high. Fortunately, we bought into the market a few years ago, and own our home. I'm often tempted to sell it, semi-retire, and move my family to a small town. But we're quite settled here, with our families nearby, so it's a no go... for now.

If I were you, I wouldn't move unless I had to. Uprooting yourself and your family and moving elsewhere (outside the commuting area) is no small matter. But if you, say, became seriously ill and unable to work, the possibility of cashing in on the house would be an option.

Sounds like you speak from experience. Noted.

That's true. My wife and I had to move two hours away from the city that I grew up in because she couldn't find work any closer. This is not a bad place to live. But I didn't enjoy the transition at all. If a few million euros fell on my lap, I'd seriously consider moving back despite my wife having little to no job prospects in her profession up there.

Congratulations @simonsmith! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP