We're always told that human resources are a company’s most expensive asset and I don't doubt that. With that said, if we're in an inflationary environment, then why don't wages ever "inflate"?

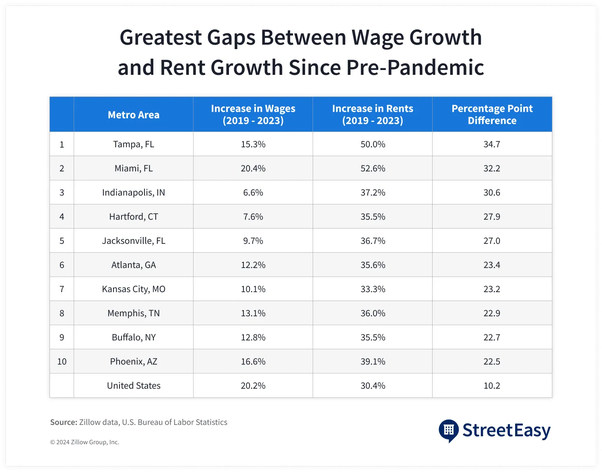

Wages do inflate. However, whenever incomes rise so do housing prices and rents and in the best case scenario they rise in the same proportion to the income increases over the long run. During the pandemic nominal wages rose 20.2% between 2019 and 2023. This seems like a lot until you realize that those workers who earned that much more over 4 years also have to pay rent, especially if they earn in the bottom two quintiles of the income distribution. During that same period rents rose 30.4% so purchasing power actually declined for workers at the bottom half of the income distribution and the disparity between wage growth and rent hikes is nearly exclusive to major cities with exceptions such as Teton County, WY. Since 2019, rent hikes have outpaced wage growth in 44 out of the 50 largest cities.

This is not a new phenomenon. For the better part of the 21st century they have risen faster than wages which means the actual purchasing power of those wages has declined. Household income in general has not kept pace with housing costs (for renters) over the past 2 decades. According to Moody Analytics, between 1999 and 2022, rents increased at an absolute rate of 135% while household income only grew only 77% in comparison. Renter households in particular have fared even worse. As I pointed out in Re-Discovering the Law of Rent, between 2000 and 2016 median annual renter income actually declined while adjusted median rental payments rose >17%.:

“Rent distributions have shifted upward in the nation and most metropolitan areas, while income distributions have improved very little. For example, since 2000, the median rental payment nationwide increased by 17.2 percent (in 2016 dollars) while the median annual income of renters has actually declined slightly, from $38,468 to $37,500 (-2.5 percent).”

And this trend has been going on for several decades. As I pointed out in Rack-rents since 1960 the proportion of renter households that are rent burden (i.e. pay more than 30% of income in rent) rose from 24% in 1960 to 38% in 2000 before climbing above 50% in 2010. Stratified by income distribution a full 60% of renters with household incomes in the second lowest quintile were rent burdened in 2010 compared to only 25% in 1960.