You are viewing a single comment's thread from:

RE: EOS Technical Analysis with Target $46.12

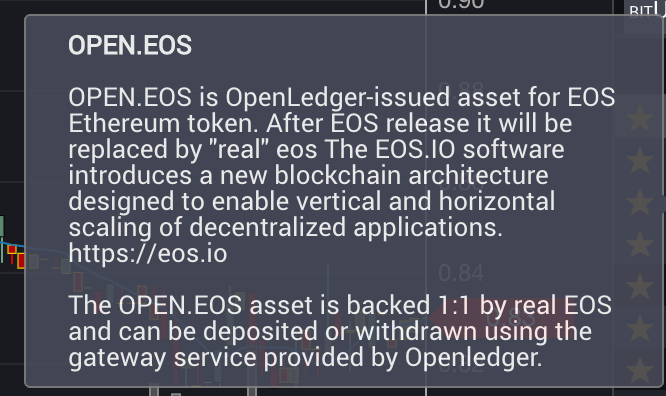

Does anybody know about holding the representative tokens on either Exodus or BitShares? The BitShares exchange says the following:

But I am wondering if people feel comfortable with that or what they suppose is the most secure way to guarantee proper delivery of the actual token.

Exodus, afaik, doesn't deal in any kind of representative tokens... it's holding the actual token. But I note that Exodus is a closed source wallet, so how comfortable are you with trusting it with your coins? (Fwiw, I use and like Exodus, but I don't trust it for long-term/bulk storage; really wish it were open source)

The counterparty risk on OPEN.EOS is not significantly different from the risk in depositing your tokens to Binance or any other centralized exchange: you're trading your actual coins, controlled by your keys, for an IOU. On centralized exchanges, the IOU is just a number on a website; on BitShares/OpenLedger, the IOU is itself a cryptocurrency. Technically you're a bit better off with OPEN.EOS than with centralized exchanges, since the IOU is itself secured by blockchain technology rather than web technology.

Now hopefully you're not holding tokens on exchanges long-term, so holding OPEN.EOS long-term is like trusting a centralized exchange with your balance. That's not ideal, so you may want to withdraw the OPEN.EOS to real EOS as soon as you're done trading and want to hold.

Bitshares is a decentralized exchange.

Yes, and open.eos is a user issued asset on that exchange, meaning someone else is holding the real coins for you.

Don't risk it. There may ultimately be many EOS.IO blockchains created. Having your own keys in your own possession is critical. Think about all those BTC forks that various exchanges decided not to support...