Yield Farming: DeFiFarms' Rocket Fuel

Yield Farming solutions on DeFiFarms offer large returns and a lot of liquidity assistance for projects. They also have a lot of cool features thanks to the NFTs protocol. What is Yield Farming, and how does it work?

Providing liquidity for Defi protocols (Decentralized Finance – Decentralized Finance) is called Yield Farming or Profit Farming.

Akin to putting money in the bank, Yield Farming works similarly. Instead of currency, you deposit cryptocurrencies into exchanges or Defi protocols, respectively. The Smart Contract secures this cost.

Agriculture and the Automated Market Maker (AMM) paradigm are closely linked. The Uniswap, Mooniswap, and Balancer are popular AMM models.

Liquidity Providers contribute to the Yield Farming protocol's pools. A liquidity pool is a smart contract that holds money. Users can borrow, lend, and trade tokens in these pools.

When end-users take, lend, or exchange tokens, Liquidity Pool collects the transaction fee. Liquidity providers will receive a share of the revenue generated from the pool.

This is known as Liquidity Mining.

How Yield Farming has evolved

When the Yield Farming concept debuted on Compound's peer-to-peer lending platform in 2017, it became an instant smash! The compound became the market leader in Defi because of growing token demand.

Aside from that, Compound has gained popularity and appeal to crypto investors. In the years thereafter, additional Defi ventures have devised new ways to attract liquidity to their ecosystems.

Yield Farming's scorching heat has yet to abate. This was especially true when Compound declared in early 2020 that they wanted to decentralize the product and give users some ownership. Ownership will be represented through COMP tokens.

Another reason is that liquidity mining greatly improves agricultural yields. In return for farmer liquidity, the yield farmer obtains new tokens and income.

As smart-contract auditor Quantstamp's Richard Ma explains, "the idea is to encourage platform usage to boost token value."

Encouraging projects in terms of liquidity is also a Yield Farming feature Both lenders and borrowers gain from this platform. In the realm of Defi financing, Yield Farming opens doors to capital for all.

Because they know where to develop new payouts, Crypto users typically take Defi applications seriously. Most people agree that Yield Farming is the smartest and most realistic technique for creating new liquidity.

DeFiFarms' Yield Farming improvements

There is nothing new about Yield Farming and NFTs. Due to investor concerns about transaction security, this trend began to reverse in 2020.

This notion led to the creation of a non-fungible token (NFT). A non-fungible token (NFT) is a limited edition coin that is not a cryptocurrency.

An important part of the new digital economy produced by Blockchain is NFT. Many projects are leveraging NFT for games, digital IDs, licenses, certifications, and artwork. NFT can even provide consumers an ownership rate on high-value products, like jewelry.

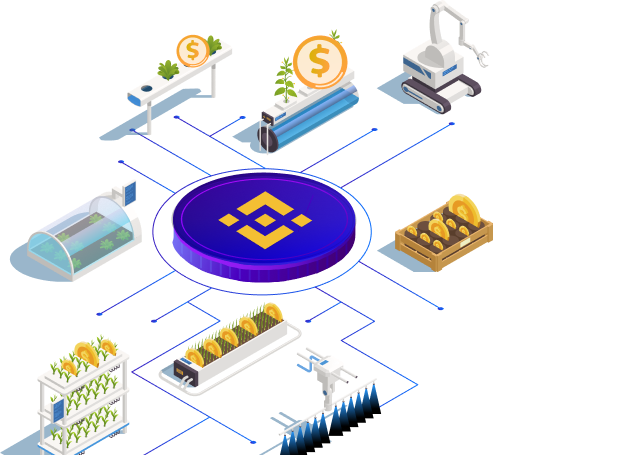

AMM Yield Farm and NFTs Protocol Powerful Automatic Liquidity Acquisition decentralized exchange based on Binance Smart Chain, DeFiFarms was created to take advantage of that opportunity.

DeFiFarms' solutions ensure that the classic Yield Farming model's security flaws are eliminated. Notably, most of them rely on Smart Contracts, which are created by small entities with low capital ratios, increasing the risk of bugging them. Even though the protocols have been audited, there may be faults and errors in the system. Like Bzrx, Curve, etc., these issues prompted money theft.

For users, DeFiFarms allows them to stake and lend crypto assets, increasing their balance. With smart contract-based liquidity pool management, DeFiFarms project yield farming helps incentivize liquidity suppliers.

“Using NFT allows DeFiFarms to make stakes more dynamic. Stakes are linked to evidence of ownership, transferable NFT, rather than a user's wallet address, DeFiFarms developers explain. By becoming a Liquidity Provider, you acquire an NFT of equal value called NFT Farming.

Profits from bounty reward pools, DeFiFarms financing liquidity pools, or other organizations will be used to calculate farming payouts. Defi Yield farming allows bitcoin holders to lock away their assets while expecting good returns. Users can also earn income by investing in the Defi market. That is, using the BSC network to farm cryptocurrency. Loans are paid back with interest in the traditional banking system. In terms of cryptocurrency, it's similar to yield farming. Using the Defi protocol, an amount is leased out rather than stored in a wallet.

DeFiFarms envies a more trustworthy and beneficial exchange to users by quickly accessing the NFT application. DeFiFarms' mission is to be a reliable Defi platform that provides consumers with security and growth.

Official Links For More Information;

Website: https://defifarms.org/

Twitter: https://twitter.com/DeFiFarmsNFTs

Telegram: https://t.me/DefifarmsNFT

Linkedin: https://www.linkedin.com/company/defifarms-ltd/

Medium: https://defifarmsnfts.medium.com/

Github: https://github.com/defifarms

Creator:

Proof Of Registration Link : https://bitcointalk.org/index.php?topic=5346604.msg57496123#msg57496123

BitcoinTalk username : jorina_006

My Bitcointalk Profile Link : https://bitcointalk.org/index.php?action=profile;u=2171158

BEP-20 Wallet Address: 0xD0A23b7E2e3ED9E03CF3d2C0c0476A0d5145119F