What does DEFI insurance really mean, and does InsurAce serve the said purpose?

[Till date of publishing this, InsurAce has announced an initial token launch using Balancer Liquidity Bootstrapping Pool. It's strongly advised for everyone to stay patient and conscious of strategy to purchase this. Further details please refer https://medium.com/insurace/insurace-initial-token-launch-ea7ac31cc3c1 ]

YEAR 2020 is where the 'DEFI BOOM' started, prospered and still growing now. DeFi development covers a vast range of areas including decentralized transactions, lending, stablecoin derivatives synthesis, fixed staking, asset aggregators, etc, it has become a phenomenon that is just too diversified and far-reaching to be unseen by anyone, esp those in the blockchain area. The total lock-up volume of the DeFi market has also increased by 30 times in the past year, and has reached the level of US$50 billion.

Alongside the prosperity, however, smart contract security issues that have been exposed by projects such as bZx and Harvest are also becoming more frequent. According to draft statistics gathered from SlowMist Technology, there were 54 smart contract and token security incidents throughout 2020, and the losses incurred are often in the great dimension of dollar value (in range of millions USD), and the total loss incurred is more than 250 million U.S. dollars. The security issue can be seen as Achille's heel of DeFi development.

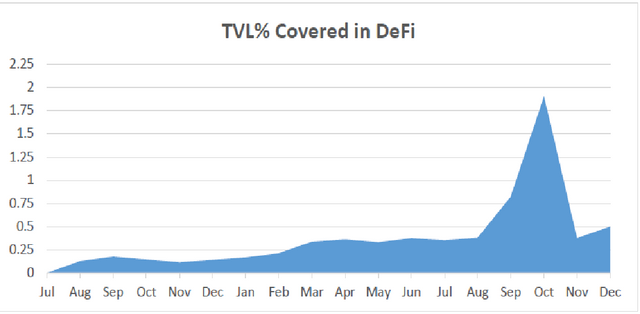

Therefore, the necessity and demand for DeFi insurance become prominent on the horizon. Comparing it with conventional insurance in the mainstream financial market, DeFi insurance is in a very early stage of development - the total insurance policies of the two star projects of NXM and Cover are only 30 million U.S. dollars. The funds covered by the policy were only US$1 billion until the beginning of March, which is still less than 2% of the entire DeFi market.

It's just small step to start the giant leap, and the DeFi world needs strong insurance services to escort it. InsurAce, the first DeFi insurance product operated by professional insurance and financial team, is one of its potential candidate to pioneer the market.

SO, WHAT IS INSURACE?

InsurAce is a decentralized DeFi insurance protocol that aims to provide DeFi users with reliable, robust and worry-free DeFi insurance services. Its distinctive advantages include extremely low premiums, stable income, rich product lines, and low barriers to entry. Provide DeFi users with guaranteed and profitable insurance services.

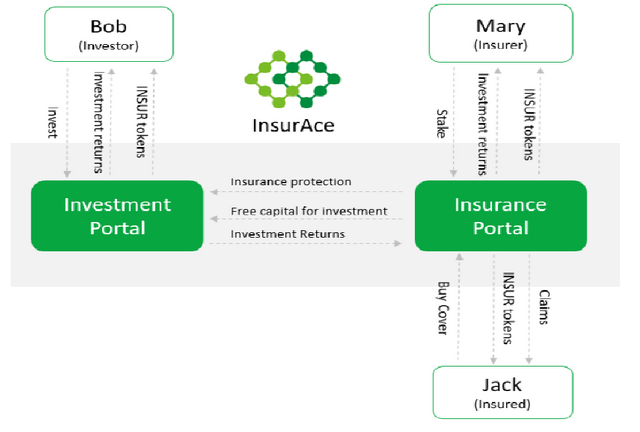

As a community-driven decentralized open insurance platform, InsurAce has fully mobilized the three parties i.e. policy holders, insurers and investors - all of them can obtain platform governance tokens by providing liquidity (participating in SCR liquidity mining, detailed below) to therefore maximizing capital utilization.

At the same time, InsurAce refers to the business model of traditional insurance companies, builds a DeFi investment sector based on insurance, uses insurance to escort investment, and uses investment income to cover insurance services, and finally builds a two-pronged positive cycle model of insurance + investment to create a safe DeFi portal, and continue to create revenue for users.

Therefore, InsurAce is not just a single platform for providing insurance business, but also a comprehensive platform with investment and financial management functions.

WHAT IS THE UNIQUE SELLING POINT OF INSURACE?

A) Portfolio-based, "unified-package" insurance products

The biggest feature of InsurAce is Portfolio-based unified-package offering of products. Unlike traditional single insurance products, InsurAce can support a "unified-package" of insurance products. Users no longer need to purchase a single insurance product multiple times one by one, but buy it all at once with comprehensive coverage.

Because different from the relative independence of insurance objects in traditional insurance, the various agreement products in the DeFi world often share benefits and risks due to their composability. For example, the security incident of bZx in February 2020, it directly involves the mutual contract calls between 5 DeFi products (dYdX, Compound, bZx, Uniswap, kyber).

Therefore, this "package" insurance product is more in line with the actual insurance needs of the DeFi world-users can flexibly purchase insurance products with a "package" price at one time based on their risk exposure in multiple DeFi agreements. It is especially suitable for users who use contract assets for Farming.

This innovative design not only greatly enriches the product line and enhances the user experience, but also effectively reduces insurance costs, improves capital efficiency, expands DeFi insurance coverage, and achieves sustainable return on investment.

B) SCR (Solvency Capital Requirement) Mining Mode

In addition, InsurAce has also pioneered the SCR (Solvency Capital Requirement) mining model, whereby policy holders, underwriters and investors can participate in SCR liquidity mining to obtain platform governance tokens by participating in InsurAce's insurance and investment business.

In this case, users can inject sufficient liquidity into the insurance fund pool through pledged assets, and obtain platform tokens as rewards, thereby providing greater insurance capacity and higher returns.

Therefore, the innovation of the SCR mining model will greatly increase the fund pool, underwriting capacity, investable fund pool, and reduce insurance premiums at the same time.

C) Two-prong mode of insurance + investment

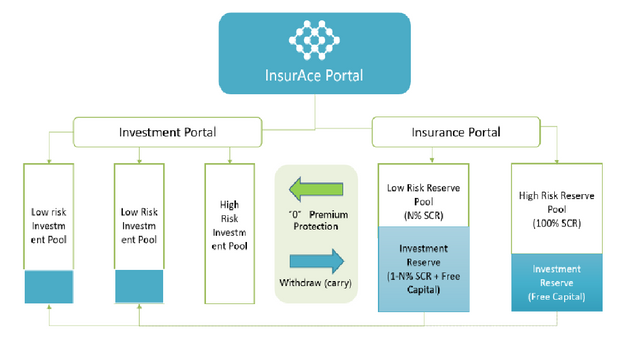

In addition to providing insurance products, users can also choose investment products in InsurAce. Investment products are divided into low-risk investments and high-risk investments:

- Low-risk investment is that the platform uses the idle part of insurance funds to make some sound investments;

- High-risk investment means that users can choose to purchase investment products;

The income of the two investment products will be used to subsidize the premiums of users. All investment products have insurance to provide security. The insurance sector and the investment sector are linked, complementary, and mutually guaranteeing dynamic relationships:-

i) The low-risk safe funds in the insurance fund pool can enter the investment sector fund pool to obtain higher returns, while the insurance sector provides security guarantees for users' investment behavior. Investment and wealth management products are protected by insurance, while investment and wealth management income subsidizes user premiums

ii) InsurAce will conduct strict risk assessment and division of the investment and financial management and insurance funds provided, which improves the utilization rate of funds and also guarantees risk control

iii) The InsurAce platform obtains a stable and sustainable income model through insurance premiums and investment income, which will be used for operation and maintenance/development expenses, token repurchase, community incentives, ecosystem construction, etc., thus forming a virtuous circle of dynamics Economic model and ecosystem

And compared to the peer-to-peer insurance model (binary option design such as COVER), InsurAce eliminates the hidden dangers of funds security brought to users by the "bet-to-play" model, truly returning DeFi insurance to the nature of insurance, and is the only one on the market that can effectively reduce premium, and let users to enjoy a "0" insurance premium DeFi insurance platform.

D) InsurAce compensation and governance mechanism

Nexus Mutual (NXM), the originator of DeFi insurance, belongs to the "blockchainization" of traditional insurance-adopting the co-insurance model of traditional insurance, and the actuary sets a premium rate ( In view of the security of the project's own contract), the funds of policy holders are collected, and members form a community to share risks and share premium income.

As a community-driven insurance project, InsurAce also adopts the concept of mutual insurance fund pool, but through the original insurance sector and investment sector linkage mode, targeted professional-level innovation and optimization-with With the continuous growth of business, the scale of InsurAce's insurance fund pool will continue to increase, which will fundamentally solve the problem of the ability to pay users.

On this basis, InsurAce's insurance compensation and governance mechanism has truly democratized the community, and the compensation process will be highly dependent on community governance. When InsurAce receives a compensation application, the InsurAce claims advisory team will investigate and verify the application, and Initiate a reference proposal to the community.

After the proposal is submitted to the community, the process is as follows:

i) Community members have pledged INSUR tokens to become claim assessors (Claim Assessor), and vote on whether to settle claims based on the investigation proposal of the claims advisory group. The voting period is 36 hours. If the voting fails to produce a valid result within 36 hours, it will be extended to 72 hours;

ii) If the vote reaches the minimum number of votes (Quorum) and there is a clear result, it will enter the feedback time (24 hours). If within this period, there are community users who have objections to this claim, they can appeal. At this time, a third-party independent arbitration institution will enter to form the final settlement resolution;

iii) If within the feedback time window, community users have no feedback on the settlement result, the settlement will be processed according to the voting result;

iv) For the claims judges participating in the voting, INSUR tokens will be obtained as an incentive;

And the InsurAce governance mechanism will adopt the DAO governance mechanism widely used in DeFi projects at present, and the INSUR token will be used as the governance token for voting and incentives. The principles of the InsurAce governance mechanism include:

- Ensuring the safety of user funds is the highest principle of the platform. Any use, transfer, investment, etc. of user funds will be determined by the community;

- Encourage community participation to the greatest extent on major issues such as commercial design, product launch/offline, function addition/offline, technical evolution, version change, etc.;

- If community governance fails, the platform will also initiate emergency measures to ensure the normal operation of the platform and ensure the safety of user funds.

E) $INSUR tokenomics

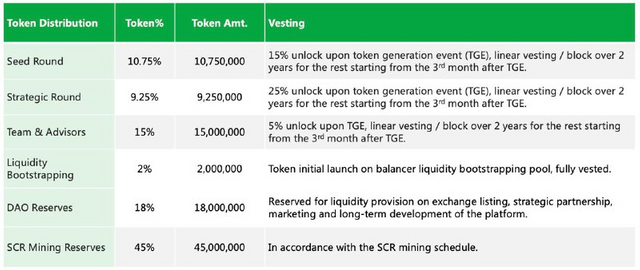

The InsurAce platform will issue standard ERC20 tokens INSUR as governance tokens to incentivize participants in the ecosystem.

The main purpose of INSUR currently includes representation of voting rights in community governance, such as participation in claims evaluation, proposal voting, and strategic decision-making. And vote on mining incentives to support the liquidity of insurance risk underwriting, capital reserves and investment products in the insurance asset pool. In addition, INSUR holders are also eligible to share the benefits generated by the InsurAce agreement by participating in project construction, community contribution and governance.

In the future, the value of INSUR tokens will be further enriched with the development of the InsurAce protocol.

At present, the official has published the economic model of INSUR token, as follows:

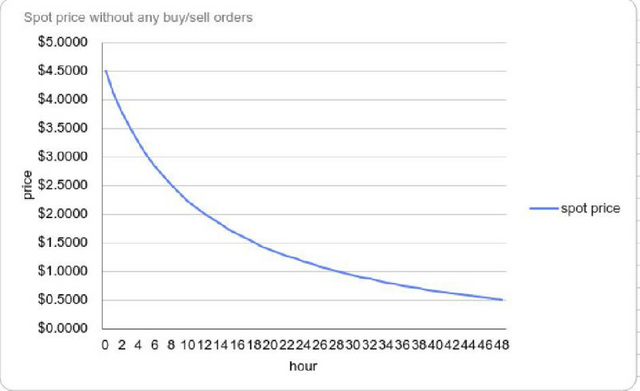

InsurAce plans to conduct a public offering of tokens through the Liquidity Guidance Pool (LBP) on the Balancer at 22:00 on March 15th, UTC +8. The activity will last for 48 hours, and the sale of tokens will be 2% of the total supply (2 million INSUR ). The starting price of INSUR is set to US$4.50, the initial weight of INSUR to USDC is set to 90:10, and the ending ratio is 50:50.

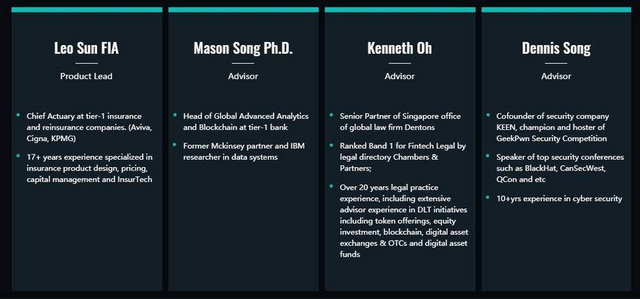

F) Development team, investment and development roadmap

As people say, leave it to the professional hands - the InsurAce team includes insurance industry (Aviva, Cigna) veterans, former McKinsey partners, IBM blockchain experts, exchange CTOs, corporate security experts, and other professionals, marking the emergence of the crypto market The first professional insurance and financial team to manage the design and framework construction of DeFi insurance products.

At the same time, InsurAce is also favored by institutions in terms of investment background. Once launched, well-known investment institutions such as DeFiance Capital, ParaFi Capital, Huobi DeFiLabs, #Hasded, Signum and LuneX have "voted with their feet".

On March 4th, InsurAce officially announced the latest round of US$3 million in financing, which also received large investments from Alameda Research and Hashkey Capital. Seed investors DeFiance Capital, ParaFi Capital, Hashed, and Signum Capital continued to follow suit.

Other well-known investment institutions involved include IOSG Ventures, ImToken Ventures, LongHash Ventures, Hash Global, Tembusu Partners, BlockArk, Factorial Ventures, and angel investors Maple Leaf Capital, Wang Qiao, Kerman Kohli, etc.

Till date of publishing this, InsurAce has announced an initial token launch using Balancer Liquidity Bootstrapping Pool. It's strongly advised for everyone to stay patient and conscious of strategy to purchase this. Further details please refer https://medium.com/insurace/insurace-initial-token-launch-ea7ac31cc3c1

Up to now, in the DeFi world where the total lock-up volume has exceeded US$50 billion, the DeFi insurance track is mainly based on the mutual insurance type represented by NXM and the binary option type represented by Cover. In terms of type or coverage, it is far from meeting the needs of DeFi's current and subsequent development.

The complex and multi-level decentralized financial market with such volume is increasingly in need of abundant corresponding insurance services to escort it. InsurAce's revolutionary original design is also a useful supplement to the innovation and improvement of the DeFi insurance track.