PRIVI Protocol is the next level DeFi

PRIVI Protocol is the next level DeFi project

Decentralized Finance (DeFi) becomes more popular lately as people are trying to make money online through various platforms, due to the situation which is also known as the new normal era. Available options including cryptocurrency, stock, foreign exchange, and many more. However, there are only a few options on the mobile application market for a secure online social network for the users. PRIVI is being created to cater as a safe, secured, uninterrupted and customizable community platform for the users. Using the plug and play mechanism, the community owners can choose the most relevant and useful tools for their communities out of the six available financial tools. The other advantage of PRIVI is each community owners could limit the publicity either openly make it available for public or privately used and owned by their community. This platform has six pre-built necessary financial tools to support the credibility, such as liquidity pools, credit and lending, social tokens, indexes, DAO governance, insurance, and NFT & FT swap.

The first financial tool which is the liquidity pool exists to help the community to liquidize extra money from their current available crypto pairs and Bitcoin (BTC). This tool is different from the other available pools in the market as it can utilize the ERC-20 tokens as well as non-ERC tokens, which creates it as a wider range of cryptocurrency. The liquidity provider is earning the extra money through the transaction fees, which can be withdrawn anytime.

Social token created by PRIVI is not limited to the owners inside the PRIVI community itself, it can be used and traded with other financial applications. A decentralized Autonomous Organization (DAO) needs to be settled first before the community owners can create the social tokens. The flexible usage of social tokens enables the emerging use of noncrypto users to the platform.

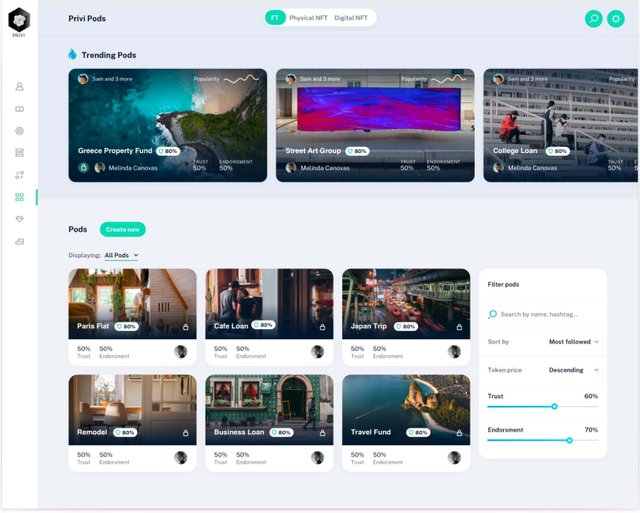

Most of the times, the non-fungible tokens’ (NFT) owners find it harder for them to liquidize their assets, due to the system of contemporary loans for the fungible tokens. The owners of NFT can liquidize their assets by creating a Pod that has been insured by the Insurance Pool, and the last step is to attract investment through advertising the social and financial space. The other interested users can start buying the NFT tokens through the available Pod. By the existence of PRIVI, the platform allows both non-fungible and fungible tokens (FT) to be used for tokenizing, insuring, and swapping within the platform for its liquidity. The Pod’s performance defines its price fluctuations.

To create a more attractive platform, PRIVI creates Insurance Pools that can provide guarantors for both NFT and FT. All owners within the pool receive extra money through pooling the money together for decentralized insurance. Once there is a claim, the pool’s members will then have a consensus to pay the claim and it can only be passed if there is a 2 out of 3 majorities. This tool can create higher yields for owners, with a riskier chance as well.

Lending and crediting are always being identified with collaterals, however, not everyone has the leisure to provide collateral for what they could offer. PRIVI solution allows their users to lend and borrow without the need of having collateral, which sets it apart from other platforms. Interested borrowers are required to pay interest, incentives, and premiums to the credit pools. The platform uses a simple mechanism where the credit pools grow with more network of borrowers, the default risk is being distributed to reduce the loss from the credit pools.

Indexes are readily available on the platform to create a more seamless and easy for the users to trade both NFTs and FTs. These indexes will help with the Robo and algorithmic mechanism which allows both traders and communities to invest and autonomously creating profit in the Pod Tokens.

The last financial tool is governance with DAO, where there will be multiples DAO within the communities and PRIVI governance to make it more proof as a credible platform for its users. Multiple DAOs makes the platform a truly decentralized finance system, where all the systems are clearer and safe.

The ultimate goal of PRIVI is to make sure the users and community can use the ecosystem freely and secured which can be accessed anytime with high transparency.

This article is not Financial Advise, Investing in crypto currencies project is High risk. You need to do your own research before you invest in some ICO. And the author is not responsible for your investment lose.

Website :

Whitepapper :

https://priviprotocol.io/whitepaper

Author

Bounty0x User Name : Hafiz1986

“A sponsored article written for a bounty reward.”