What Is Dego.finance? Introduction To DEGO Mining Mode

Recently, we have seen the boom in decentralized finance (DeFi). DeFi's exponential growth and FOMO sentiment have attracted many new cryptocurrency investors and developers into space, and stimulated the interest of traditional financial participants. Everyone is looking for the best investment potential and hunting for treasure in the DeFi world.

Exploration is worthwhile, but your funds, time and opportunities are limited, and you will never be able to fully grasp all investment opportunities.

However, in DEGO , the situation will be different.

DEGO adopts the modular combination design concept. Modularity refers to the combination of various elements of a product to form a subsystem with specific functions. We combine this subsystem as a general module with other modules to create a new system with multiple functions and performances.

In short, each product can be regarded as a module. After combining different modules, new products come out to achieve the effect of 1 + 1> 2. Lego bricks are the best example and inspiration for these modules. Every brick is ordinary, but when put together, there are endless possibilities.

In the DeFi world, DEGO is equal to LEGO. Each DeFi protocol is a brick, which can be stable currency (DAI), fast loan (Aave, Compound), DEX exchange (Uniswap and Balancer), derivative products (Synthetix), insurance (Nexus Mutual). Around these basic agreements, we will build a new dapp to increase the value of DeFi, create a diversified investment portfolio and bring considerable financial returns to users, and become the entrance to the future of financial services.

Two stages of DEGO DAO

Internally created in the first phase

The DEGO team members come from different backgrounds and cultures around the world. Our common interests, values and vision unite us to form a unique and stable team. In order to achieve the complete openness and transparency of the initial project decision, we will select 5 internal representatives based on the current team composition to determine the initial operation of the DEGO Protocol.

We set the governance authority of each contract to a multi-signature wallet, and make adjustments and decisions through the 3/5 decision mechanism.

The initial income will also be aggregated into this multi-signature wallet to achieve the goal of the founding team's governance.

The second stage of power transfer to the community

After the project runs normally for a period of time, the community determines the co-owners of the multi-signature wallet through proposals and voting mechanisms. DEGO DAO aims to be run by community members in a clear and transparent way. The community can vote on proposals to change system parameters and align individuals’ desire for profit with the best interests of the agreement.

The mission of GODEGO DAO is to guide the growth of the DeFi DAO ecosystem and to promote the greatest decentralization of the community.

The current popular formula for liquidity mining is:

Daily output of each user = daily output of the mining pool * number of mortgages / total number of mortgages

In this model, the whales become the biggest winners. They can easily take away almost all the liquidity rewards and unreasonably dump their profits. This is a harsh predatory game of prawns. With the rise of monoculture, whales have become the most common concern of DeFi farmers.

In order to solve this problem and move towards a sustainable DeFi ecosystem, we created? ? Liquidity mining adjusted by algorithm.

In DEGO, we use a set of deterministic algorithms for liquidity mining, convert the LP tokens pledged by users into POWER (similar to the hash rate of Bitcoin mining), and obtain revenue through them. Under this model:

- Daily output of each user = daily output of the mining pool * power / total power

- POWER = number of mortgaged LP tokens * corresponding coefficient

The calculation formula of POWER power is:

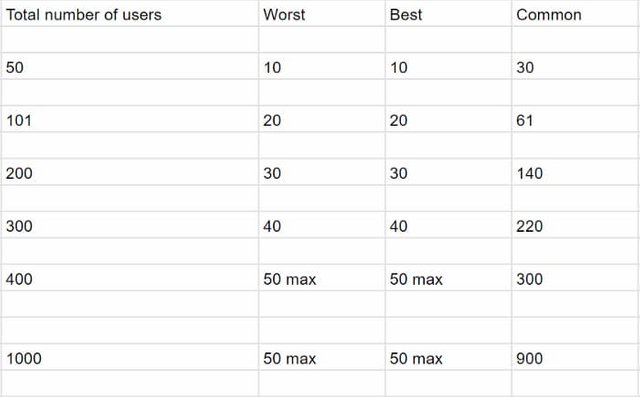

We divide users into three ranges according to the stake amount:

- Worst range: the user with the largest stake

POWER = 1 * Stakeout amount

- Optimal range: medium bet amount

POWER = 5 * The number of users bet

- Public area: the user with the smallest stake

POWER = 3 * stakeout amount

For example, user A has staked 10 LP tokens and is currently in the public range, then his POWER is 10 * 3 = 30 POWER

The numbers in the first three ranges are [10, 10, total 20] .

When the total number of users increases by 100 people, the worst range and the best range will increase by 10 slots, which can accommodate up to 50 people.

If the user bets for less than three days, 10% of the income will be deducted during the withdrawal period and then transferred to the dividend pool.

With the DEGO protocol, we can achieve a more decentralized and sustainable liquid mining ecosystem.

MORE INFORMATION

Website https://dego.finance/home

Twitter https://twitter.com/Dego_Fi

Telegram https://t.me/dego_finance

Medium https://medium.com/@Dego.finance

Author by Sinjokubhi

Address : 0x8cA7E6BA64D273001d26EE87B1f569bd9094F540