Crypto Chaos Explained - Bitcoin Crashes As 'Cash' Tops Ether For First Time

Content adapted from this Zerohedge.com article : Source

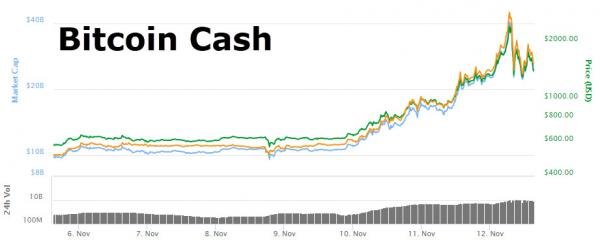

Bitcoin collapsed overnight, trading as low as $5555 - down 30% from its highs - before bouncing back above $6000, as Bitcoin Cash soared to as high as $2450 (4 times its price on Friday), overtaking Ethereum briefly as the second largest market cap cryptocurrency.

image courtesy of CoinTelegraph

Bitcoin has lost around $30 billion in market cap, but found buying interest as it ripped below $6000 and has stabilized this morning

Bitcoin Cash exploded in thje last two days - quadrupling in price at one point to over $2400 as Bitcoin crashed.

As Coin Telegraph reports,the sharp rise in Bitcoin Cash's price has come at the expense of Bitcoin. Bitcoin's price has been on a steady downtrend ever since the Segwit2X fork was cancelled. A lot of people had bought Bitcoins in the expectation that they would get free Segwit2x coins after the fork. While market observers had expected some of this hot money to flow into altcoins once the Segwit2X fork happened/got cancelled, Bitcoin Cash seems to have been the main, but not only, beneficiary. The combined price of Bitcoin and Bitcoin Cash is over $8,000, which is not very different from the price on Friday.

That surge in Bitcoin Cash pushed its market cap above Ethereum for a brief time...

All of this chaos has left many wondering what is going on. Arjun Balaji provides some much-needed context for what is occurring in the crypto space...

1/August, Bitcoin forks, spawning off a fork that's supported by a minority of miners. It's self sustaining though the rate at which Bitcoin blocks are mined is variable and the price tanks. It was initially trading on the futures market prior to the fork between 0.05 and 0.07BTC. The motivations for the initial minority fork are complicated and nuanced, but they were largely driven by the incentives of trading on the futures market prior to the fork between 0.05 and 0.07BTC. The motivations for the initial minority fork are complicated and nuanced, but they were largely driven by the incentives of Chinese mining and Bitcoin businesses whose operation depended on the low transaction fees in the network (given Bitcoin txn fees were approaching $10).

2/ When Bitcoin Cash (BCH) tokens were finally accessible, there was a rush to go liquidate the tokens on an exchange. With really thin orderbooks, price shot up to 0.26 on the BTC:BCH pair, but had a slow decline over the next 2 months, bottoming out around 0.05ish. This is all the while Bitcoin continued it's meteoric rise to $8k+.

3/ However, "Segwit2X" (B2X), another long schemed fork was still planned. This fork had even less popularity, reflected on the futures market, but had a lot of support from many mainstream Bitcoin businesses. It had ideological overlap with Bitcoin Cash: increase the block size to lower transaction costs on the Bitcoin network. Many users of Bitcoin who were worried about the merits of the technical block size increase were vocal about avoiding these forks and still maintain conviction that lowering transaction costs through the Bitcoin network is possible through some recent upgrades.

4/ As the date for B2X fork grew closer, Bitcoin Cash eventually bottomed out. The market's assumption here was that there is no need for 2 forks with ideological overlap to exist.

4a/ However, in a sudden move, there was a cancellation of the fork on November 8th, with much of the support of the 2X crowd going into Bitcoin Cash. This started a fantastic price spike--in USD, from $400-500 up to $2800 (as of last night) and in Bitcoin, even higher, with orders executing between 0.4-0.5BTC. As of now, it seems to be stable at low volume —0.3BTC.

5/ Many long-time holders and significant Bitcoin "whales" noted online how they are planning on selling BTC and buying BCH. Most notably, Roger Ver moved long-time cold storage Bitcoin holdings totaling over $250M to Bitfinex. Not sure if this has been executed upon or not, but the presumption is that he is either buying BCH or selling BTC for USD. The goal of this (IMO) is to generate momentum and the reflexivity needed to create a "flip" between BTC and BCH.

6a/ It seems like 1) miners incentives are aligned with BCH for now but it's unclear if it's just because of the volatile difficulty or if it is permanent;

6b/ 2) money is dumping out of BTC into BCH. When/if BCH becomes more profitable, miners will follow -- at that point, do businesses like Coinbase recognize Bitcoin Cash as the canonical Bitcoin? No idea, but it'll be interesting to see play out.

7/ Bitcoin Cash has a planned hard fork on Nov 13th to adjust the volatile difficulty of mining. It remains to be seen whether (at a stable price), post-fork, miner incentives will remain as strong as before. If they are anticipating a large increase in price or have spent the last couple of months accumulating BCH at a low price like many have hypothesized, that could play a role as well.

Arjun concludes, net-net, this is a mess for most mainstream users (e.g. my dad), who have no idea what's happening and potentially don't own Bitcoin Cash.

The end of Bitcoin (BTC) and rise of Bitcoin Cash could hurt these users, who potentially bought Bitcoin on Coinbase in August and don't know about these risks. This puts the emerging futures and ETFs in an interesting picture.

The various factions within the crypto space are increasing their rhetoric... (as CoinDesk reports)

When asked about the move Jiang Zhuoer, founder of bitcoin mining pool BTC.Top, said simply that "2x fans" are moving both funds and mining hardware to bitcoin cash.

"BTC is going to die," Zhuoer said. Hapio Yang, CEO of mining pool operator ViaBTC, responded similarly, indicating he believes that businesses and investors are now migrating funds to bitcoin cash.

"I think more and more bitcoin holders are starting to understand what is the real bitcoin," he said via WeChat.

"I think a positive feedback loop has been created. This is waking people up to the shaky foundations BTC is built on," he said.

However, as CoinDesk notes, there remains a great deal of skepticism over cash...

Jack Liao, the CEO of Hong Kong-based mining firm LightningASIC, for instance, sought to frame the idea that the bitcoin cash price increase represented any real uptick in interest in the project as "total bullshit."

For those following the scaling debate, Bitmain's conduct has been one of the larger contentious narrative points, and Liao (like others) believes the explosion seen in the bitcoin cash market value is nothing more than an orchestrated bid by the firm (and its supporters) to prop up the market.

"Many, many investors just see the change in hash rate," he said. "But they cannot support such a big bitcoin cash price."

Beijing-based over-the-counter Zhao Dong reported a similar sentiment in some circles, crediting the price to manipulation by miners and investors who have supported Segwit2x and bitcoin cash in the past. Bitmain and Ver were both signatories of the agreement that sparked the 2x software.

"They have money, they have hash power, they have everything need to pump the bitcoin cash price," he said.

Finally, to clarify, Willy Woo, recently named one of CoinDesk's Top 5 Token Analysts of 2017, sees the price move as perhaps one to watch. In contrast to other alternative cryptocurrencies that he said may lack value propositions, he went so far as to color bitcoin cash as a more nuanced option.

"It's backed by a lot of money from China controlling its price and supporting its network. If you buy bitcoin cash, you are betting that China wants it to dominate. That's a strategic and geopolitical bet," he told CoinDesk.

The question is can BCH even become the "money". Even if it is faster than BTC, does it have the ability to scale up to hundreds of thousands of transactions per second?

This is the major challenge for anything wanting to be the money of the internet. To me, LTC is quickly moving in that direction. Ultimately, the BTC will provide stability...even if it is slow moving. Look for things such as government documents put on the bitcoin blockchain as compared to transactions for a cup of coffee.

No it doesn't because their proponent fundamentally reject all innovation but a blocksize increase.

No Segwit (maleability fix)

No RBF

No Lightning network

ect.

I agree. BCH, for all the propaganda, does not solve the transmission problem. This is the core issue with the bitcoin blockchain. Hence, BCH is nothing more than a wish.

There is a pattern on the market, when btc goes down bch goes up

Thanks for sharing the information

Chaos creates opportunity, the continual chaos of crypto will take traders to the moon.

it was a case of one dumping the BTC for Bitcoin cash, many people were looking to make a quick kill and they sold their BTC for BTCcash. it was a weekend of active trade for bitcoin cash . to a point they pushed etherrium to third place

The BTC Vs BCH battle isn't really a political one and shouldn't be made into one. I've discussed this many times over and over including here:https://steemit.com/cryptocurrency/@vimukthi/bitcoin-fees-triple-under-a-week-while-dash-makes-itself-10-times-cheaper-my-discovery-of-a-secret-device-to-store-the-entire

The problem is a utilitarian one. What is more useful. BCH is objectively more useful and therefor become more dominant in a free market. The only reason BTC is #1 is the speculation and dumb money that went into it.

correction will be deep in the area 4000/3500/3000