Weekly XDAT Newsletter: 03 June 2019–09 June 2019

Market Analysis

Bitcoin corrected massively over the last weekend, dropping from the highs of $8800 to $7400. However, the technical indicators did indicate correction with the price moving above the Bollinger Band in the weekly chart. The price dropped over 15% in the last week and a rough head and shoulders pattern was seen forming. Bitcoin price has tested a strong support level of $7430-$7400 and rebounded from that level. To avoid any further downside, this support level is crucial and should not be broken this week. Any drop below this level could trigger a further correction in the price taking it to nearly $6800 levels followed by $6200.

Historically, BTC dominance above 56% turns out favourable for the bulls and price is pushed higher. Current dominance (at the time of writing) stands around 55.6%. Further 24 hours volume which tumbled over the past two weeks is now gathering momentum. The price movement is slow and steady which means that traders are waiting for a definitive direction to put money back in crypto space. The sentiment of the general masses surged towards Bitcoin with a new report from ConsenSys reporting that excluding a few Asian countries, 70% of all crypto related searches are for Bitcoin.

Major altcoins followed in the footsteps of Bitcoin over the week and lost both value and momentum. Mostly all the altcoins closed in red over the last week. Any upside in the major altcoins can be witnessed once Bitcoin starts moving higher.

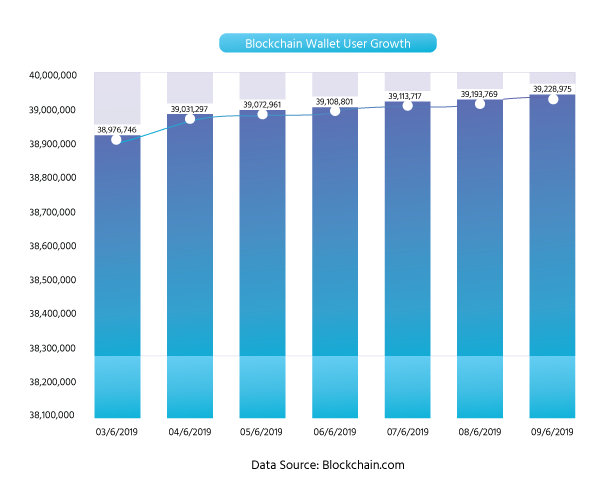

Weekly Growth Blockchain Wallet Users

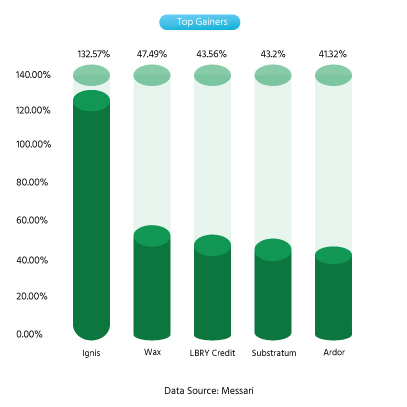

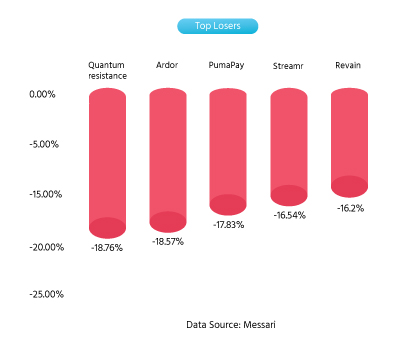

Weekly Gainers & Losers

Major Developments this Week

-> Bitcoin — A report claims that the number of reachable nodes in Bitcoin remained unchanged for almost a year now. The number of active nodesare directly proportional to the decentralization of Bitcoin.

-> Ethereum — Darma Capital, a $100 million CFTC registered Fund is bullish on Ethereum announcing sell the bubble, buy the dip strategy. In separate news, Microsoft Azure unveiled VeriSol, an open source verification tool to improve the efficiency of the smart contracts written on Solidity.

-> Ripple — Siam Commercial Bank of Thailand hinted the usage of XRP tokens last week. In a separate development, Ripple entered in partnership with SendFriend to enable XRapid powered remittance service in the Philippines. In yet another development, Ripple expanded in Switzerland with a new office in Zurich. Crypto wallet service GitHub reported that approximately $10 million in XRP was compromised after hackers got hold of nearly 100 XRP Ledger Wallets.

-> Litecoin — Hashrate has been on the rise in Litecoin with Litecoin Foundation Director Franklyn Richards believing that surge has something to do with the Antminer L5 being available for Litecoin mining.

-> Ethereum Classic — Developers announced that Atlantis upgrade test code would be tested this month. With Atlantis upgrade, developers aim to enhance interoperability between the two Blockchains.

-> Bitcoin Cash — There was no major update related to the token over the past week.

-> EOS — Crypto rating firm Weiss Ratings downgraded EOS on the account of being highly Centralized.

-> TUSD — According to data from TokenAnalyst, there are currently there are 20,338 holders of TUSD.

Wider Market Update: Weekly News Analysis

-> Barclays, Credit Suisse, UBS, and MUFG bank have jointly announced the launch of Utility Settlement Coin to facilitate cross border payment at a reduced cost.

-> European Football Giant Benfica has announced that it would start receiving the payments in Bitcoin, Ethereum and UTK token.

-> Latest research from Diar suggests that China dominates the stable coin trading, clutching 50% of total trading volume worldwide.

-> Komodo cybersecurity team hacked the wallet of its own users in a bid to prevent hackers from sweeping away $13 million worth of Cryptocurrency.

-> Poloniex angered the margin lenders by levying the haircut after the crash of altcoin CLAM. After the Flash Crash that wiped out roughly $13.5 million on the exchange, Bittrex has banned the U.S.A users to trade in as many as 32 tokens on its exchange.

-> Apple has announced CryptoKit for new iOS 13, supporting cryptographic operations that are secure and efficient. Some of them being hashing, computing and comparing cryptographically secure digests, evaluating digital signatures also generating symmetric keys for message authentication and encryption.

-> Marshall Island decided to go against the International Monetary Fund, announcing sovereign Digital Currency.

-> Australia has collaborated with International J5 tax authorities to investigate the tax avoidance scheme based on cryptocurrency.

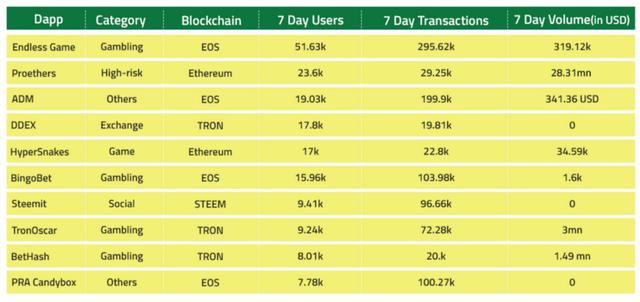

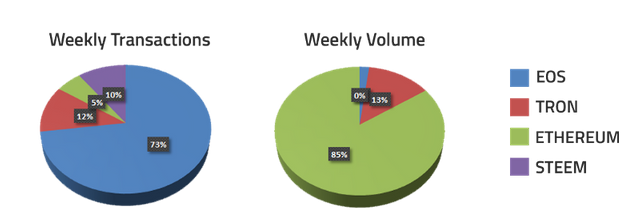

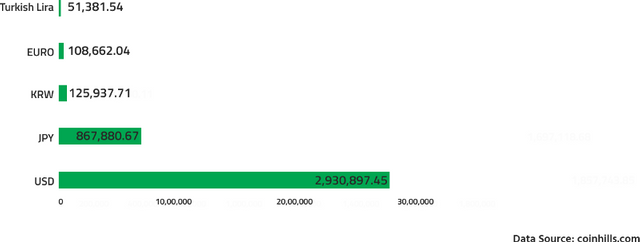

Weekly Dapp Statistics

Disclaimer

Every effort is made to provide accurate information in this newsletter. However, XDAT cannot guarantee that there will be no errors. XDAT makes no claims, promises or guarantees about the accuracy, completeness or adequacy of contents herein and liabilities for errors and omissions. Information provided in this correspondence is intended solely for information purposes and is obtained from sources believed to be reliable.

XDAT is not responsible for any losses incurred as a result of using any information contained here. No guarantee of any kind is implied or possible where projections of future conditions are attempted. Any third party opinions, links, news, research, analysis, prices, or other information contained in this newsletter are provided as such as general market commentary and do not constitute as investment advice.

None of the content published in this newsletter constitutes a recommendation that any particular cryptocurrency, portfolio of cryptocurrencies, transaction or investment strategy is suitable for any specific person. The services and content that we provide are solely for informational purposes. The generic market recommendations provided by XDAT are based solely on the judgment of its personnel and should be considered as such. You acknowledge that you shall enter into any transactions relying on your own judgment. Any market recommendations provided by us are generic only and may or may not be consistent with the market positions or intentions of our company and/or our affiliates.