On Tether: #1 A Tale of Two Firms - Enron, Tether, and FUD

Coming from an Economics background, I have a few thoughts about the evolving discussion over the legitimacy of Tether (USDT). I shall be writing more about this in the next few posts.

On Tether and FUD

- Comments questioning Bitfinex ability to defend the 1:1 parity between USDT and USD are not just FUD. There is reason to be worried about it.

- By this, I mean that these are not accusations intended to spark panic.

- One should differentiate between groundless fearmongering, which are value-less and mercenary, and legitimate concerns that holds the company accountable.

It's all FUD. It's all FUD. It's all FUD. - Case in point: Think back to the Enron accounting scandal. If Bitfinex is indeed shady like Enron was, we should be glad that there are people pointing fingers at Bitfinex even at this stage. The party can go on as long as people are willing to turn a blind eye and go on believing in the value of Tether, but the longer it goes on, the more painful the correction will be, and the more money innocent people will lose.

Let's Recap:

On the way up to the peak share price of $90.75 in August 2000, Enron executives was the darling of Wall Street. Hardly anyone dared to question where all this miraculous profits came from. Those that did were obviously FUDers.

But he [Jeffrey Skilling, President of Enron] disliked criticism: when, during a conference call, one analyst dared to ask a pointed question, Mr Skilling snapped that he was an “asshole”.

The Economist

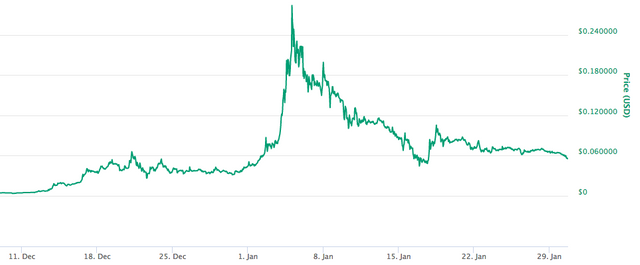

Bethany McLean was the journalist who first broke the story on Enron, and she did so in the article, "Is Enron Overpriced", published in Fortune. By 2 December 2001, Enron had declared bankruptcy and its share was worth almost nothing:

Anyway, I have digressed terribly.

Coming up next, I'll be writing on how Bitfinex is actually trying to act as a currency board, and what currency crises like the Asian Financial Crisis can tell us about that.

Lastly, just who in the world is paying UDS to Bitfinex in exchange (pun intended) for USDT? And no, that's not a rhetorical question.

My Recent Posts:

- (Cryptos) Coincheck Hacking: Why Bitcoin's and Other Cryptocurrencies' Prices Fell Today and Why this will be a NON-EVENT.

- (Opinion) Remember Trump’s Wall? Well, Trump does and he wants to trade DACA for it.

- (Blog) Peace and Contentment in the British Countryside - Seven Sisters Cliffs

- (Blog) A Vision from the Future - Gardens by the Bay, Singapore / 新加坡海滨花园

- (Blog) The Meaning of Chinese New Year / 春节