So you want to get rich from crypto investments? Be careful ...

I have the impression that majority of the people buying crypto currencies over the last year or so do it for no other reason than greed - like, they don't want to miss out should Bitcoin rise more, but have no interest in cryptocurriencies except as a speculative asset class. The cryptos they buy is held on the exchanges, as they don't care to learn how to use wallets.

Over the last half year or so I see a big shift towards the jungle of alt-coins, people buy bitcoins and want them i.e. to Binance, where they're going to buy other crypto currencies and tokens. So called High-Yield Investment Programmes (HYIPs) are also (still!) very much in the wind, some of them promise to double your bitcoin holdings within some few weeks.

Some words of advice ...

Don't invest more than you can afford to lose - and don't put all eggs in one basket

Those two basic rule applies to all kinds of investments, and they are age old - but they apply doubly up in the crypto space!

Bitcoin and other cryptos can go up ... and down! While things may have cooled down a bit over the past few months, there was a period when Bitcoin was growing rapidly due to people investing into it - and people investing into it because it was growing. That's not much sustainable, and it's a recipe for disaster - there is always the risk of a sudden dip - say, one "whale" deciding to sell his 8000 bitcoins in one bulk market order - igniting a panic frenzy where people are selling because the price is falling, and the price is falling because people are selling. Geared speculation resulting in margin calls tend to speed up such a panic.

When I say "don't keep all your eggs in one basket", I don't mean "spread your investment over as many cryptos as possible". The crypto markets as such can suddenly dip a lot, with almost all currencies falling rapidly in value and almost none growing.

There are no safety nets in the world of cryptos!

While the lack of regulation may be a positive thing, many regulations in the traditional investments markets are there to protect the investors. Investors in the crypto space need to take the full responsibility of protecting themselves. Here are some other rules of thumb:

Do your due diligence!

In well-regulated stock markets you may actually dump money over lots of stocks without doing much due diligence, but it doesn't work quite the same in cryptos.

I see far too many newcomers to the crypto space going wild on platforms like binance and buys up lots of different tokens and currencies. Yes, some few of them may bubble up to the top-five on coinmarketcap, there is always a probability of hitting the jackpot and see some investment growing some thousand-folds.

However, a significant portion of all the crypto currencies out there are simply scams, made for no other purpose than the founder(s) to get rich - and most of the other cryptos will never get to shine, always live in the shadow of other projects, they peak in value short time after they go live but then the value will just keep on dropping - and in the cases where the cryptos really do grow a thousand-fold in value, chances that you'll get in and out at the right time to actually profit is also slim.

Active trading is gambling ...

... and gambling is rarely profitable. Exceptions apply, in particular:

People that owns an exchange - the house always have an edge, doesn't it? As most of the exchanges aren't even taking part in the gambling, but just raking in fees on every trade, they will for sure earn money from people trading. (I do this locally; I trade domestically towards people whom are willing to pay a premium for quick conversion between the local fiat and crypto currencies).

People that happen to get access to some kind of very valuable and significant information that the rest of the market don't have. In stock markets, "inside trading" is generally not allowed, but in the crypto world ... there is not even a clear definition of "inside information".

People that are able to take advantage of arbitrages - there are always different market situations between the different exchanges, if you happen to hold a little bit of everything on several exchanges, and have good scripts monitoring the market situation and placing orders, you can be relatively sure to win money by selling at an exchange with high price and in the same time buying at some other exchange with low price. (I have made some scripts that I run towards some exchanges - I earned a fortune from some shitty local exchange with low volume and gullible customers, but the script is going in minus when I run it towards the bigger exchanges).

People that have the power to manipulate the markets significantly in one way or another, and going short/long just before such manipulations.

If you aren't in any of the categories above, then it's best not to trade actively - because you will for sure end up leaking money to the folks that are in the categories above.

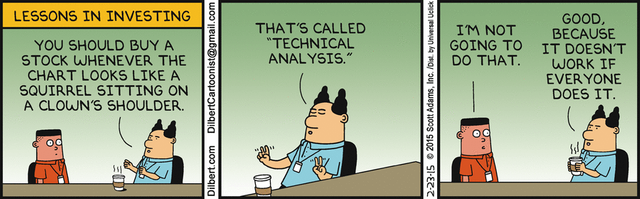

If you believe you'll be doing great through "technical analysis", then consider that you are competing with everyone else doing "technical analysis", as well as everyone in the categories listed above. Some may be lucky through this, but I believe in average people will just lose money on it.

HODL, don't trade.

Beware of the uncontrolled infinite inflation

One of the selling points of Bitcoin was that the money supply wouldn't stray away from a planned inflation, and that there would never be more than 21M of bitcoins issued. While that is true, and while most crypto currencies have similar inflation trajectories, we still have uncontrolled inflation - as there hardly is a day without some new crypto currency project being announced.

I'm possibly overdoing it a bit - in fact, the top five currencies on coinmarketcap has some 75% dominance. Problem is that this dominance is fading, Bitcoin alone used to have some 80-90% market dominance until March 2017.

Beware of other scams

In the early days, the crypto community was dominated by honest people wanting to make the world a better place by promoting the usage of crypto currencies. Those people still exists, but they are outnumbered by folks driven by greed, and many of them are scammers doing whatever they can to pick digital money out of the pockets of careless people.

There are sites out there looking like legitimate exchanges, except the deposit-part doesn't work at all. There exist wallet software out there that leaks the private keys back to the scammers, enabling them to strike and grab all money from everyone who installed the wallet once the time is ripe. "Cloud mining"-operations that have no mining gear installed at all, pluss all the HYIPs out there. That's ponzi, ponzi, pyramid and ponzi. If a site promises some daily profit, it's for sure a lie - there is always risks involved with such investments, nobody can really guarantee a positive payback.

If a site promotes that a payout of 1% per day is probable, it's also telling lies, for sure the risk of getting burnt is very high, the only way to makes a 1% per day payout probable is to run some kind of ponzi scheme (possibly such profit can also be found by lending out the money to someone that will spend them buying illegal drugs cheaply, passing some country border and sell the drugs for 10x the price - but I wouldn't recommend such an "investment". Simply holding Bitcoin has yielded more than 1% per day throughout periods, but such a growth is not sustainable, it can't go on forever).

I've personally lost quite a lot by lending out bitcoins, sometimes to the completely wrong people. I even think some of them are honest people deep down, they just aren't able to pay back, or they have given up. If I had known Bitcoin would rise that much, I'd never considered anything else than HODL.

You are fully responsible for the security

The old saying in crypto is that you don't really own your coins if you hold them on an exchange - the exchange can go bankrupt at any time - but at the other hand, it takes some effort and security knowledge to make sure your private keys are safe;

You need to ensure nobody else gets access to your private keys (a paper wallet or a hardware wallet may be the safest bets - but even then there exists scam stories, "paper wallet generators" that has been leaking information back to the owners, beware that the information may be stored at the printer or at some print server, hardware wallets that have been tapered with before reaching the recipient, etc.

You need to ensure you have a backup - that the backup cannot fall in the hands of the wrong people, and that you will find your backup again when you need it.

Remember your cryptos: spread the values over lots of different coins, wallets and exchanges, and there is a significant risk that you'll simply forget about some of your assets - forever.

Be careful checking that the addresses you're sending to is correct. There are stories about QR-codes being tapered with due to malicious software, man-in-the-middle-attacks etc ... and there is always the risk of clumsy fingers, etc. I've lost quite some bitcoins up through the times myself by sending to the wrong address.

Have you made sure that your crypto belongings will be passed on to your next in kin when you die?

Other things ...

anything I have forgotten? Drop comments :-)

I totally agree with you regarding many of the new money coming into the crypto market. A lot of that money is fueled by greedy desires that want to replicate the success of Bitcoin without looking at these investments through an investment perspective. The best strategy in my opinion is to do your research, find a coin whose philosophy is well aligned with yours, accumulate, and HODL! Awesome post mate. You've got yourself a new follower.

Great advises i totaly agree with. i would say i am a veteran in crypto and there are still some advises i should follow.

anyway

I believe in bitcoin and crypto

I beieve in the tech and opportunities

I believe in its future

In bitcoin and crypto we trust!

Very useful remarks! These are congruent with my experience 💡

Made a link to your article in my new post: https://steemit.com/cryptocurrency/@ajaub1962/development-5-454-ususd-of-my-experimental-deposit-around-cryptos-2018-03-02-or-march-02-2018

Thank you for the article. I second your thought about the scams out there. From free airdrops to fake ICOs. One really needs to be careful about these. If one wants to apply to these airdrops then I think the best way is to not send any crypto to any address. Also, for the ICO's confirming the contract address in all different platforms of the project would be the best way to go.

This is a great post thank you very much for sharing it

Happy to see all the info you wrote here a lot of people do not know those kind of stuff and this can help them a lot to avoid mistakes

I'm also taking few tips from here :)

All this crypto market is based on Demand and Supply scenario.

If Demand rise, the price also rise ,if demand goes down, the price will also go down.

you Cover it really beautifully brother, nothing could be added more :)

Good points! I hope a lot of newbies will read your post. We are going to see more and more fresh people in crypto as countries are becoming positive to the market and technology behind it: https://steemit.com/cryptocurrency/@cryptohumster/germany-legalizes-bitcoin-what-is-the-current-status-in-other-countries