What you need to know about cryptocurrency mining

Cryptographic money news has been hot recently, thanks in no little part to the soaring costs of Bitcoin and Ethereum, the two biggest digital currencies at the present time. Litecoin and different cryptographic forms of money are likewise up in esteem, and given the costs on illustrations cards that should be helpful for gaming, some of you will unavoidably ponder: would it be advisable for me to get into the mining business?

That is a major, open-finished inquiry, and the appropriate response relies upon many elements. I'm not going to attempt and cover each angle, since Google is your companion, yet we should rapidly go over the nuts and bolts of what you would need to begin, and I'll incorporate some unpleasant appraisals of how much cash you can make toward the end.

Blockchains and the square reward

The center of mining is piece rewards. For most coins, these are given to the individual/aggregate that finds a legitimate answer for the cryptographic hashing calculation. This arrangement is a scientific count that uses the aftereffects of past square arrangements, so there's no real way to pre-figure answers for a future piece without knowing the answer for the past square. This history of piece arrangements and exchanges constitutes the blockchain, a kind of open record.

What is a square, however? A solitary square contains cryptographic marks for the piece and the exchanges inside the piece. The exchanges are gathered from the system, ordinarily with a little expense joined, which likewise turns out to be a piece of the square reward. There's a trouble esteem connected to the answer for a square too, which can scale up/down after some time, the objective being to keep the rate of era of new pieces generally consistent.

For Bitcoin, the objective is to create a piece arrangement at regular intervals overall. For Ethereum, square arrangements should come at regular intervals. That is clearly an immense contrast in approach, and the shorter piece time is one reason a few people support Ethereum (however there are others I won't get into). Straightforwardly, the number arrangement must be not as much as some esteem, and with 256-piece numbers that gives a colossal scope of potential outcomes. The arrangement incorporates the wallet address for the fathoming framework, which at that point gets all the exchange expenses alongside the square reward, and the piece gets written to the blockchain of every single taking an interest framework.

Consider it prospecting in a stream—you may luck out and locate a colossal gold chunk, you may wind up with heaps of chips of clean, or you may discover nothing. On the off chance that the stream is in a decent area, you profit all the more rapidly. The distinction is that with cryptographic forms of money, the 'great area' angle is supplanted by 'great equipment.'

Setting up the product

There are numerous alternatives for cryptographic money mining. A few calculations can even now be run pretty much "adequately" on CPUs (eg, Cryptonight), others work best on GPUs (Ethereum, Zcash, Vertcoin), and still others are the area of custom ASICs (Bitcoin, Litecoin). Be that as it may, other than having the equipment, there are different strides to bring to begin with mining.

In the beginning of Bitcoin and some different digital forms of money, you could viably solo-mine the calculations. That implied downloading (or notwithstanding gathering) the wallet for a specific coin and the right mining programming. At that point arrange the mining programming to join the digital money system of your picking, and devote your CPU/GPU/ASIC to the undertaking of running estimations. The expectation was to locate a substantial piece arrangement before any other individual. Each time a piece is discovered, the estimations restart, so having equipment that can look potential arrangements all the more rapidly is gainful.

Nowadays, many people forego running the wallet programming. It consumes up circle room, organize data transmission, and isn't required for mining. Simply downloading the full Bitcoin blockchain presently requires more than 45GB of circle space, and it can require a long time to get matched up. There are sites that deal with that piece of things, expecting you put stock in the host.

In principle, after some time the theory of probability becomes possibly the most important factor. On the off chance that you give one percent of the aggregate computational power for a coin, you ought to regularly discover one percent of all squares. Be that as it may, as Bitcoin and its relatives expanded in notoriety, trouble shot up, and in the long run solo-mining turned into an unfeasible attempt. When you're just ready to give 0.00001 percent of the mining power, and that esteem continues diminishing after some time, your shot of finding a legitimate piece arrangement turns out to be successfully zero. Enter the mining pools.

Join our mining society!

On the off chance that performance mining resembles solo gaming in a MMO, piece rewards have turned into the space of substantial mining societies, called mining pools. For blockchain security reasons, you don't need any single gathering—a mining pool or a person—to control more than 50 percent of the computational power (hashrate) for the coin arrange, yet to mine motivations, being in a greater pool is quite often better.

The reason is that, not at all like square rewards where everything goes to the triumphant framework, mining pools cooperate and circulate the prizes among all members, typically in view of a level of the mining pool hashrate. Your equipment gets littler segments of work from the pool, and presents those as offers of work. Regardless of the possibility that you just contribute 0.00001 percent of the hashrate, despite everything you get that level of each square the pool fathoms.

To give a particular case, assume a coin has an aggregate system hashrate of 1Phash/s (peta-hash), yet you just give 0.1Ghash/s. Your possibility of mining a square solo is about on a par with your shot of winning the lottery. On the off chance that you join a pool that does 25 percent of the system hashrate, the pool should discover 25 percent of pieces, and you'll wind up with 0.00004 percent of the square rewards. On the off chance that a square is worth 50 coins, that is 0.0002 coins from each piece the pool finds—frequently less a little (1-3) rate for the pool administrators. That may seem like a wage, yet when coins are worth hundreds or even a great many dollars, it can include rapidly.

There are many spots that will give adding machines to cryptographic forms of money, so you can perceive the amount you could possibly acquire from mining. At the end of the day, you'll need to join a mining pool. As a side note, I'd prescribe utilizing another email address for such purposes, and after that I'd make a novel watchword for each pool you happen to join—since digital money robberies are unreasonably normal in case you're careless with passwords. #experience

On the off chance that you need to in reality gather a coin, as Ethereum, you'll have to make the extra strides of downloading the Ethereum customer, matching up to the blockchain, and setting up the mining pool to pay out to your wallet. It's conceivable to have pools store specifically to a wallet address at a cryptographic money trade, yet once more, there are hazards there and long haul I wouldn't suggest putting away things on another person's servers/drives.

On the off chance that this sounds tedious, it can be—and the general population who are truly into cryptographic money frequently make this as a full-time showing with regards to. What's more, the genuine cash regularly winds up in the hands of the pool administrators and trades, however I diverge.

Doing the real mining

You have your equipment, you've joined a mining pool, and you're prepared to shake the digital currency world. All that is required now is to download the proper programming, give it the right settings for your equipment and the pool, and after that away you go. Kind of.

Most pools will give essential guidelines on the best way to get set up for mining, including where to download the product. However, all product isn't made equivalent, and even things like drivers, firmware modifications, and memory clockspeeds can influence your mining speed. So in case you're not kidding about mining, get well disposed with scouring places like Bitcointalk, Github, and different gatherings.

The least demanding path to mine a coin is to simply point all you're mining rigs at the fitting pool and load up the fundamental programming. The issue is that the "best" coin for mining is frequently a short lived, ethereal thing—Ethereum's genuine esteem came in light of the fact that other market strengths drove it from $5-$10 per ETH up to $200+ per ETH amid the previous a while. Preceding that, it was just a single of many coins that were possibly productive to mine. Be that as it may, exchanging between coins can take a considerable measure of time, so other programming will help offload some of that unpredictability.

One well known arrangement is Nicehash, which will rent hashing energy to others that will pay for it in Bitcoin. As a result, it exchanges the occupation of making sense of which coin/calculation to mine to others, however again there are expenses included and the going rates on Nicehash are lower than mining coins straightforwardly. The advantage is that you don't wind up holding a bundle of some coin that has turned out to be useless.

A more intricate arrangement is to set up multi-calculation mining programming without anyone else. To do this, you would regularly have represents every one of the coins you're keen on mining, and after that make guidelines to figure out which coin is best at any given time. Locales like WhatToMine can help make sense of what the as of now best paying choice is, yet normally others would be seeing similar information.

Primary concern—what's it fetched and what would you be able to pick up?

The thing you have to know with cryptographic money mining is that past the underlying expense of the equipment, influence and equipment life span are continuous concerns. The lower your energy costs, the simpler it is to make mining a productive attempt. Then again, in the event that you live in a region with generally costly power costs, mining can appear like a frightful thought.

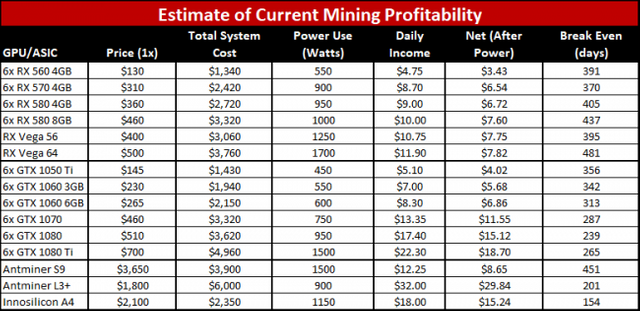

At the point when many individuals consider digital currency mining, the primary idea is to take a gander at Bitcoin itself. Presently the area of custom ASICs (Application Specific Integrated Circuits), Bitcoin does not merit mining utilizing GPUs. Where a quick CPU can do maybe 40MH/s and a decent GPU may even hit 1GH/s or more, the speediest ASICs like the Antminer S9 can do 14TH/s. Be that as it may, the Antminer S9 costs $2,100 or more, and still uses around 1350W of energy (so you have to include your own particular 1500W PSU)— and you'll net about $8 every day.

Would you be able to improve mining utilizing illustrations cards? As you may have speculated given the present costs of RX 570/580 and GTX 1060/1070, the appropriate response is yes, however not really at the as of now expanded GPU costs. In any case, we should begin with an essential framework cost. You'll require a shabby CPU, motherboard with six PCIe spaces, 4GB DDR4 RAM (perhaps 8GB on the off chance that you need), spending plan hard drive, six PCIe riser connectors, and 1350W 80 Plus Platinum PSU. For the case, you're typically best off building a mining rig utilizing wire racking and zip ties or something comparative. Include the greater part of that up and it will cost around $560 (with 4GB RAM).

The staying point is the designs cards. On the off chance that you could purchase RX 580 at the first MSRP of $230 for the 8GB card, $200 for the 4GB model, or $170 each for the RX 570 4GB—definitely, those are the real dispatch costs!— that would be $1,380, $1,200, or $1,020. With costs soaring on the RX cards, GTX 1070 turned into the following consistent focus, with costs expanding from $350 per 1070 a couple of months back to $450+ per card today.

I have uplifting news for gamers, as I've assembled a table demonstrating expected returns utilizing different types of mining, utilizing current designs card and ASIC costs. Some of these (like the Antminer L3+) are hard to discover or are still pre-arrange, yet you can some of the time pay an essentially higher cost to get one. This is what things at present resemble:

Is there still cash to be made as a digital currency mineworker? I think a considerable measure of this backpedals to what occurred with Ethereum this previous year, with the esteem going from under $10 per ETH to a pinnacle of almost $400 per ETH. Offering every one of the coins you mine can acquire cash, yet in the event that you had the foreknowledge to mine and hold ETH and sold close to the pinnacle esteem, you actually simply hit the big stake. Or, then again in the event that you incline toward mining slang, you hit the motherload.

Ethereum costs have since dropped down to $200 (plus or minus), yet there's this expectation that in the long run another air pocket will happen, driving costs up into the a large number of dollars per ETH. Seem like dream arrive? Advise that to all the Bitcoin mineworkers and financial specialists who got in for several dollars. Be that as it may, without a value spike—and with the potential at the cost to drop as opposed to going up—the above table is something of an idealistic perspective of the digital money showcase.

Cost unpredictability joined with expanding trouble could profoundly change things over the traverse of months. Rather than 200-400 days to recoup your equipment venture, it may take quite a while. Or, on the other hand it could go the other way and take 3-6 months. I wouldn't depend on most GPUs surviving day in and day out digging for quite a while, notwithstanding.

Most importantly at current GPU costs, which remain supply compelled, it's not any more a "protected" venture to put huge amounts of cash into new mining rigs. So the air pocket has blasted and things ought to be settling down once more.

Maybe far and away superior (for gamers), early gauges of mining execution utilizing the Vega Frontier Edition propose it won't be generously quicker than current AMD cards, and with higher power draw it won't be especially alluring either. Be that as it may, be cautioned that product advancements could shake things up. In the event that somebody makes sense of an approach to get double the execution out of a Vega card, it could turn into the new mining wunderkind.

Would it be advisable for you to stop gaming and begin mining, at that point? I wouldn't prescribe it—on the grounds that in the event that you haven't begun as of now, you're as of now behind the air pocket and will may wind up assuming a misfortune. In addition, playing diversions is more enjoyable, and doesn't serve to warm up your office. That sadly won't prevent diggers from proceeding to purchase designs cards, insofar as they see a potential benefit in it.

You can mine #gridcoin on a CPU and always will be able to, something nice to do while your GPUs are busy. You can even mine it while gaming, I do.