Blockchains: Hockey stick adaption or a FoMO bubble?

Before we get into discussing what this remarkable take off of crypto currencies and projects as seen on market watchers like coinmarketcap or as experienced with ICOs like the Gnosis "1 million a minute crowd sale" ("only" lasted 12 minutes, though) could mean/be, lets ensure a common ground.

Definitions:

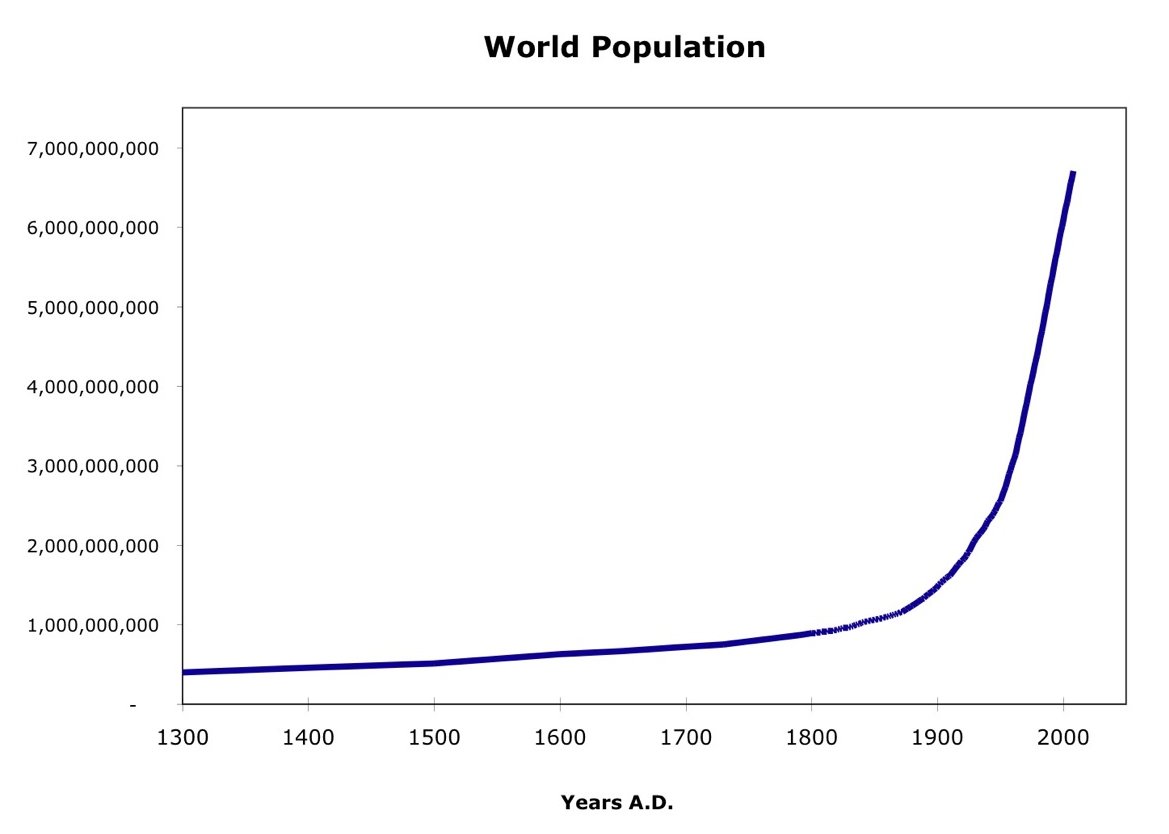

Hockey stick adaption: Here referring to the concept, that adaption of disruptive digital innovations can take the shape of a (standing) hockey stick (actually the hockey stick graph was first mentioned in climate change debate, but that's a big story by itself, right?).

*example of a hockey stick graph; found on Flickr; by Matt Lemon published with the Creative Commons license Attribution-ShareAlike 2.0 Generic (CC BY-SA 2.0)

*example of a hockey stick graph; found on Flickr; by Matt Lemon published with the Creative Commons license Attribution-ShareAlike 2.0 Generic (CC BY-SA 2.0)

FoMO: Translates to "fear of missing out" and is a concept I only heard about since I joined this craze called the crypto sphere...but, boy, did it kick in often since I heard of it ;-)

Pro hockey stick: Blockchains are kicking in on adaption

Yes, there is some kicking in, right?

Ethereum

Sidenote: While I love the idea(s) of Ethereum, e.g. the open R&D of Casper, Sharding etc. and all and the way the core team treats non Einsteins like me - let me say this very clear: it seems intransparent in its decentralization and governance status (after the famous "The DAO hack" one can say, its governance turned out to be an oligarchy or even worse into a "Vitalik as the philosopher king decides by declaration"-kind of governance) - to be honest - governance is an issue with all public blockchains - math, crypro and deducted algorithms are yet not enough to replace human debate. (please read up (not only) your Plato, ppl)

Ethereum: Is really kicking it!

Ethereum dApps in the current status as shown on EtherCasts; green dApps are live already

The public blockchain is giving birth to dApps such as EthLance and many (MANY) others - while complete dApp eco-systems such as Gnosis (prediction markets) are also launching on Ethereum.

Ethereum Enterprise logo

Ethereum Enterprise logo

And at the same time, with creating "Ethereum Enterprise" the Core team (or Consensys and the Core team) may have successfully launched the bridge to the corporate world, not only in finance, but energy and others as well.

Already JP Morgan, UBS, Microsoft, Intel, BP (anyone feel your stomach ache?) and other big brands hopped in Ethereum Enterprise - and to be honest - besides ideology (exaggerating: "decentralized good & new economics VS centralized Lehman-corps"), B2B (business-to-business transactions) cases are the most easy to create for blockchain technology, still.

Other blockchain solutions

And there are others - like the amazing developments on the shoulders of the Graphene blockchain technology (DPoS/Delegated Proof of Stake): BitShares, PeerPlays and - steemit !

All of the mentioned have really sound business cases...steemit (obviously) is up and running, Bitshares as well - and PeerPlays is to start very soon with a Alpha accessible (actually there is just an ICO going on (disclaimer: I have bought some, but am not in the project other than investing a bit)).

Yet - other blockchain solutions

There are projects like Lisk, a javascript blockchain betting on the concept of sidechains, that on the paper and in my brain really could take off in an unforeseen way - just imagine how many javascript devs are out there compared to C++, Java or even Ethereums "solidity" language...and before masses can adopt - developers need adopting to new tech, right?

Or Stratis - similar idea for the blockchain as Lisk - just betting on ".NET" ... here Microsofts love for Ethereum seems a bit ... distracting, right?

And more and more people - speculating investors, tech lovers and - consultants

Yes - more and more people are hearing of the blockchain and the (possible) disruption for the real world.

And these people tell others, invest into some projects/currencies and start thinking of new ways to use the technology.

So in conclusion - one could say, adoption really may be kicking in. And it is not a bubble, but the beginning of a fun ride towards mass adaption.

Pro bubble: It's all like Uber at best (highly valued, creating losses at best) and the bubble of them all at worst

So - yes - it could be a bubble...

The currency projects

There are so many besides bitcoin...Litecoin, NEM, Ethereum Classic, Dash, Monero - down to currency projects like "PotCoin" - all trying to add/suggest either one (or a sum of) technological, governance and/or specific target market goals.

But all seem to miss the need for real life usage - and most importantly - the need to explain why one should trade the national bank for a group of crypto aristocrats.

But their appeal (measures in market caps; a dangerous metric by itself) is growing.

Yet it is all a speculation on what they could become.

An interesting thing I have noticed, is Bytecoin and Ethereum Classic surging way beyond my expectation...and how similar they sound to the 2 most important currencies/projects - Ethereum and bitcoin...maybe some of the new entrants confuse one for the other?

Also disturbing for me, is the fact, that pure copycats are gaining traction. PIVX seems to be a 1:1 copy of Dash - yet people run for it as it allows to dream the Dash dream - some lucky few bought a Dash Masternode for $100-$1,000 (USD) - today its worth $90,000-$100,000. Also - the system implemented by the Dash founders seems a great starting-package in terms of monetary incentives to hold...so...many try to copy or even enhance it.

But will that be enough? Actually such projects' early investors speculate on others FoMO - clearing out of it, once other opportunities arise.

PoW - Proof of Work, PoS - Proof of stake - all still have severe issues for public blockchains, really

PoW chains have a system immanent tendency to centralize.

That is just pure logic and bitcoin, litecoin and ethereum actually prove it (whereas Ethereum foresaw this and looked at alternatives like sharding or even a PoS system like Casper very early).

Envisioned/Concepted as a system in which all participants would share the blockchain and mine the blocks, today only big companies using so called ASICs have the potential at actually mining a bitcoin.

While there are so called "pools of miners", these pools tend to signal centralized, and "signalling" is what bitcoin deems as an appropriate mean of governance.

Additionally, software developers for miners as well as users, such as bitcoin core, can influence the signalling by implementing signals into the software (also see my older article on this here).

To make it short: If bitcoin had 4,000,000 user worldwide and 4,000 miners - that would mean actually 0,1% are actively backing the network as envisioned to be done by 100%. That is not a decentralized network as proposed by Satoshi Nakamoto's White Paper.

PoS chains have a tendency of centralizing as well, they also add a different kind of plutocratic/aristocratic element, allowing early investors to run and profit of the network. This may seem fully normal for an economical entity, but is it for money?

If you could choose 1out of 3, would you use the US dollar (1), a currency backed by Trump&friends (2) or another currency backed by Clinton&friends (3)? See? The USD looks much better, now, doesn't it?

So to conclude - almost all currency projects still face a system immanent technical issue (PoW or PoS) regarding true decentralization as envisioned/proposed by the bitcoin founder(s). Additionally, they are as transparent as milk, and at least I doubt consumers in the "developed world" will be willing to accept money run by a few unknown private people in contrast to their government.

The tech projects

The pure tech projects, focusing on the benefits the blockchain can/will bring to industries seem OK. For me it looks as if those focusing on B2B solutions may have the advantage for the moment, while consumer solutions certainly will need to solve communication issues as all seem very focused on the technology (blockchain) and less on the unique selling proposition (USP) to their potential customers.

It is to be seen if these projects really can deliver and how their adaption will be. Until now, even up and running projects like steemit actually do not produce a revenue stream and do not cater mass markets, but the crypto sphere itself. It is to be analyzed if steem inc. actually needs a revenue stream or can live off producing steem tokens and selling them off at markets - again - I have no knowledge on how steems are actually minted (steem being another DPoS solution) and how spread the network is...

My bet is this: The pure currency projects will die out sooner or later, at least those only looking for relevance in the developed world. Maybe there will be some niche solutions left, offering solutions to special target groups within the developed world, as in the dark web, for special products/services or in Libertarian regions of the United States.

Of the tech projects, some will make it to deliver outstanding B2B solutions in 2017/2018 and for the mass market, 2018/2019 seems to be more realistic to getting something profitable out on the markets. There are many use cases, how to do things better with a really decentralized approach - may it be focusing on security, transparency or immutability. Of course - there are some issues to solve, first - but its doable, I think.

The POS POW problem has been solved by VIVAcoin which is using Prove of Authority. Have a look at the whitepaper.

I will, Thanks!