Navigating and Surviving the Crypto Storm

There has been a storm raining down on the crypto world over the past month. Total cryptocurrency market capitalization hit $120 billion on November 25, 2018. It has never been that low since September 2017. The market lost $40 billion in just 7 days. All in all, total cryptocurrency market showed -41% change over the last month, Bitcoin lost 42% of its value, ETH dived the most losing 47% and approaching $100. In fact, things are so wild at the moment that by the time we publish this article this data will most definitely change.

How can one navigate this storm and preserve one’s wealth when the market situation changes so fast? One option is to abandon the falling market, sell all cryptocurrency and wait for recovery. But doing so you may be stuck in a queue of hundreds of users who came up with the same decision. Moreover, the cost of this operation may skyrocket. Time and transaction costs may make the loss in value devastating under the condition of the consistent downtrend.

We, at Blackmoon, have developed an innovative investment opportunity that would keep your funds safe while the crypto market storm continues its fall. This option is called “Trend Protection” and works fairly easy at a first glance. Each day, an automated system evaluates the market direction and allocates available funds between crypto assets and cash (or cash equivalent that are represented by USD-pegged cryptocurrencies). The larger the part of the market is falling — the larger the part of the portfolio will be transferred to cash.

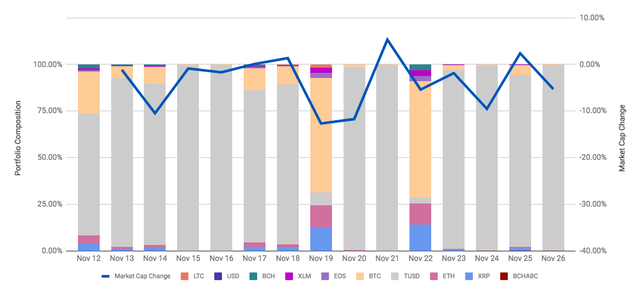

The graph below closely shows the structure of BMxDDR portfolio, over the recent most volatile days. The asset token tracks 6 cryptocurrencies with maximum capitalization and is equipped with the trend protection mechanism.

It’s easy to see that every time market capitalization decreases, TrueUSD occupies the portfolio. The larger the downside — the higher is TUSD allocation. Two days of positive correction, 18 and 21 November led to the unique events when the share of TUSD in the portfolio fell below 10% the next day after correction.

That is a very high-level logic of the trend protection feature. But what does it bring to the investor? Will it actually protect money from the downtrend, or will it only eat transaction costs that will wash out any possible benefits of relocation?

Blackmoon offers a wide range of crypto strategies. Some of them are featured with trend protection, some not. To compare apples to apples let’s take a look at how the similar strategies behave.

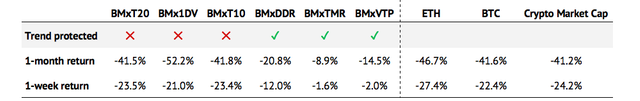

BMxT10, BMxT20 and BMxDDR all base portfolios on cryptocurrencies with the largest capitalization. They may differ by the number of coins included, portfolio rebalance periods and some other parameters, but generally, they focus on the same rule: the larger the coin, the larger the part of the portfolio it will occupy. The key difference is that BMxDDR employs trend protection mechanism. The left graph above shows that this feature allows the protected strategy to outperform rivals by nearly 40% in ETH within 1 month.

The same is true for another pair of strategies: BMx1DV and BMxVTP. Both of them focus on the coins with the highest volatility, but VTP is equipped by trend protection. The difference in returns of these strategies reaches a stunning 70%!

The table below shows USD returns of all our crypto strategies over 1-week and 1-month periods and compares them with BTC, ETH and overall market capitalization. Strategies that do not utilize trend protection feature show return around the market, while strategies with trend protection are way ahead.

Having these tokens in your portfolio will not allow you to grow your USD wealth because the crypto market does not offer investors solid ways to earn on the falling market these days, but you will definitely beat overall market. Moreover, these strategies are fully automated and will do all the work for you — all you have to do is click, invest and trade.

Feel free to utilize the full potential of the trend protected assets while the market is all red.

Do you want to find out other ways to survive and benefit any market situation? Stay with us, register your account on blackmoonplatform.com and keep an eye on new products that are coming soon.

Handy links to stay tuned to our updates:

- website: https://blackmoonplatform.com/

- telegram channel: https://t.me/blackmooncryptochannel

- info video:

DISCLAIMER

Investment in cryptocurrencies carries high degree of risk and volatility and is not suitable for every investor; therefore, you should not risk the capital you cannot afford to lose. Please consult an independent professional financial or legal advisor to ensure the product meets your objectives before you decide to invest. Regional restrictions and suitability checks apply.