Decrypted: An Intro to Cryptocurrency

Until now I've stayed well clear of cryptocurrenies. Not only have its functions confused me, but how it evolved and how it continues to work has been a mystery.

Last week, I caught up with Justin Diclemente, who was able to shed some light on this puzzle. Diclemente began to invest in cryptocurrency just over a year ago. He has a background in trading.

While not a word for word transcript by any means, Diclemente filled me in on the following:

What is a blockchain?

This is the decentralized network upon which cryptocurrencies are built. It's powered through a large peer to peer network of computers.

Essentially, it's a database where each "block" is a transaction where records are stored, and the "chain" is how these are linked up with previous entries. It's a ledger of sorts that uses cryptography to create integrity of information.

What is a decentralized network?

This means that rather than one institution that runs the network, like Visa for credit card transactions, the network is supported by individuals using consensus mechanisms. The most common method of consensus is mining, Proof of Work (PoW).

Mining can be done by anyone who has the equipment. The majority of mining is done by mining pools that consist of many individuals and enterprises with entire warehouses dedicated to mining.

What is mining?

Mining is using a computer to solve algorithms to process transactions (blocks of information) on the blockchain.

How does mining work?

Cryptocurrency transfers, or transactions, are added to a block and these blocks have to be mined (equations must be solved) to allow the transaction to go through. For example, if your transaction is number one on the blockchain, then that block has to be mined in order for the transaction to be processed.

When this block is mined (the equation for the transaction is solved), the individual who processed this data gets a percentage of the transfer fee. It's like a credit card fee. Since it takes resources to process the transaction, we pay for this.

Why have cryptocurrency networks slowed down?

Each cryptocurrency runs on its own network. So Ethereum runs on one network, and Bitcoin on another. The speed of the network for each currency is dependent on the amount of resources allocated to mining across its respective network and also on the quantity of transactions that are taking place.

For example, if 100 computers are mining bitcoin, and 10 transactions take place, the network speed will be very high. If the number of transactions increases to 10 000, but the number of computers mining stay the same, then the network (or speed of transactions) will be very slow.

Overtime, the mining difficulty increases based on greater demands for more powerful hardware and other forms of consensus to scale the network.

Note: It's the processing power (hashrate) of the computers that counts towards network speed rather than the number of computers.

So, as a result of the increase in people using the cryptocurrency networks, they have significantly slowed down.

Are there different ways to mine?

There are different methods of mining: CPU, GPU, ASIC. For example, ASIC miners use different types of algorithms, applications and a specific circuit that is designed to mine a specific type of cryptocurrency more efficiently. Essentially it's more computation power with a smaller footprint and ease of use compared to GPU or CPU mining.

Are there downsides to mining?

Like regular mines with ore waste, cryptocurrency mining also has a waste: electricity and old/damaged hardware create a greater carbon footprint.

Mining is also a long term investment. A high end mining rig consisting of expensive equipment would need to be paid off before producing a return on investment. Mining is also subjective to local electric utility costs. If one resides in a location with very high electricity then mining may not be a profitable investment.

Other consensus mechanisms are being developed that do not have these disadvantages. One example, Proof of Stake(PoS) does not require expensive hardware, nor use great amounts of electricity. Instead a user can stake, or hold their coins in escrow of sorts to validate transactions. Blocks are forged by a user based on randomization and age of their coins being staked.

What is the difference between a token and a coin?

It's like running your own store versus running your store in a mall. Coins run on their own network, while tokens run on a network in place.

For example, lets use coin A and token B. Coin A will have it's own code and platform, while token B will run on coin A's platform. So token B is a digital asset on coin A's blockchain.

Is there an advantage to having a coin or token?

From the start-up point of view, it's easier to develop a token that runs on a pre-existing network, or blockchain.

These tokens can later move to their own network when they become more established.

Why are there so many new cryptocurrencies?

Now coins and tokens are created as new projects offer investment opportunities through initial coin offerings (ICOs).

All these new coins are like the dot com boom. Eventually, many of these will drop off and only a few will remain relevant.

What is an ICO?

I recommend this article, which does an excellent job of describing ICOs. 2018 may be the year of the ICO, but how many of these will be around in the next 5 years?

Should I invest in an ICO?

Like any investment, there are certain risks but these can be calculated.

With everyone hopping on the blockchain train, some are taking advantage of this which unfortunately has resulted in a number of ICO scams.

My recommendations are to dive into the details on any project that is initially interesting as an investment. What are its goals and timelines? Is their project relevant now? In five years? Will it only be relevant for one year? What is your timeline for a ROI (return on investment)?

Where can I learn more about cryptocurrency?

Top places to check everyday are:

reddit r/cryptocurrency and subreddits

medium.com

steemit.com

tradingview.com

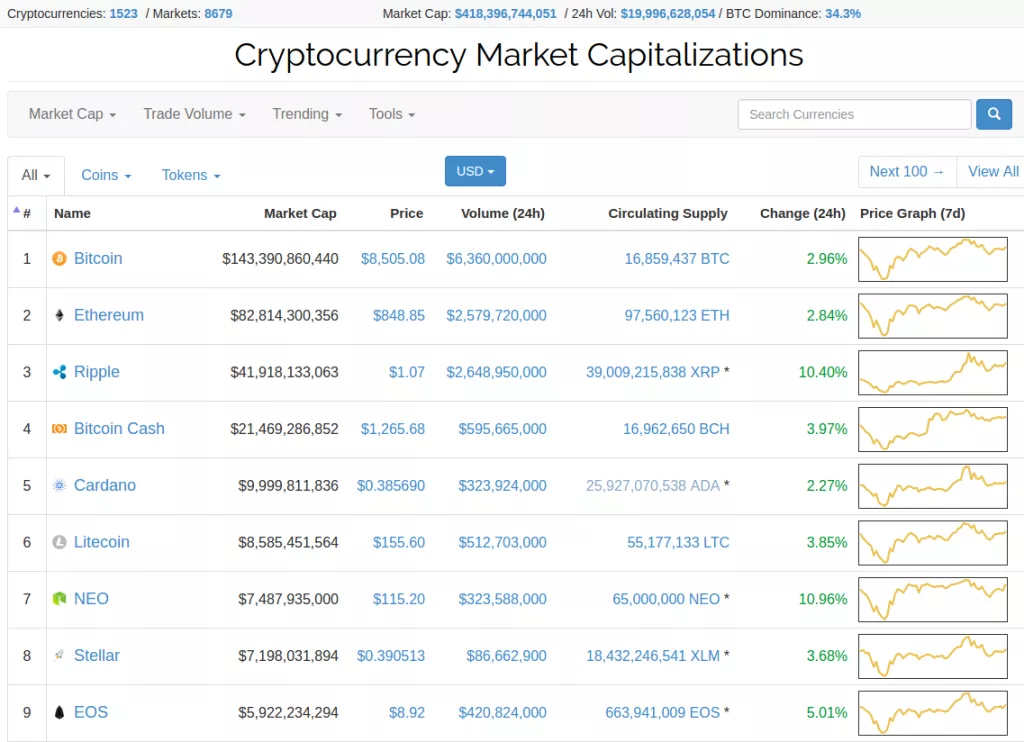

coinmarketcap.com

cryptogroups on Facebook, Telegram and Slack

Although it takes time to be a pro, after this check-in with Diclemente I made my first investments in cryptocurrency.

There's nothing quite like learning on the fly.

Please feel free to comment below with questions or additions to the post.