Tokenizing securities with Polymath (POLY)

Tokenizing securities with Polymath (POLY)

As you are probably well aware by now, there's a lot of regulations related to securities in the United States. Because the United States represent the biggest market to get funding, these regulations also affect other countries. What is a security? A security is simply a tradable financial asset. Equities, debt and derivatives represent the three major types of instruments composing the global securities market. In 2016, these three markets had a total notional value of more than $1.3 quadrillion.

On the other hand, regulations related to blockchain and cryptocurrencies are not set in stone yet. Most cryptocurrencies in circulation are not considered as securities, but if it would be the case, it would have massive implications. For example, if tokens issued during ICOs would be considered as securities, only accredited investors would be able to participate. Right now, most tokens issued during ICOs are viewed as utility tokens. These tokens allow the holders to access certain services and functionalities. Since regulations are not clear yet, a lot of ICOs prefer to avoid giving access to investors living in the United States.

Regulations related to blockchain and cryptocurrencies are not set in stone yet but if some cryptocurrencies in circulation would be viewed as securities, it would have big implications. For now, most tokens issued during ICOs are viewed as utility tokens. These tokens allow the holders to access certain services and functionalities.

ICOs represent an alternative to the very costly alternative of issuing securities. These costs usually represent 5% to 10% of the amount raised. Indeed, the finance world is full of third parties making the process of raising capital and exchanging securities not efficient at all.

Polymath

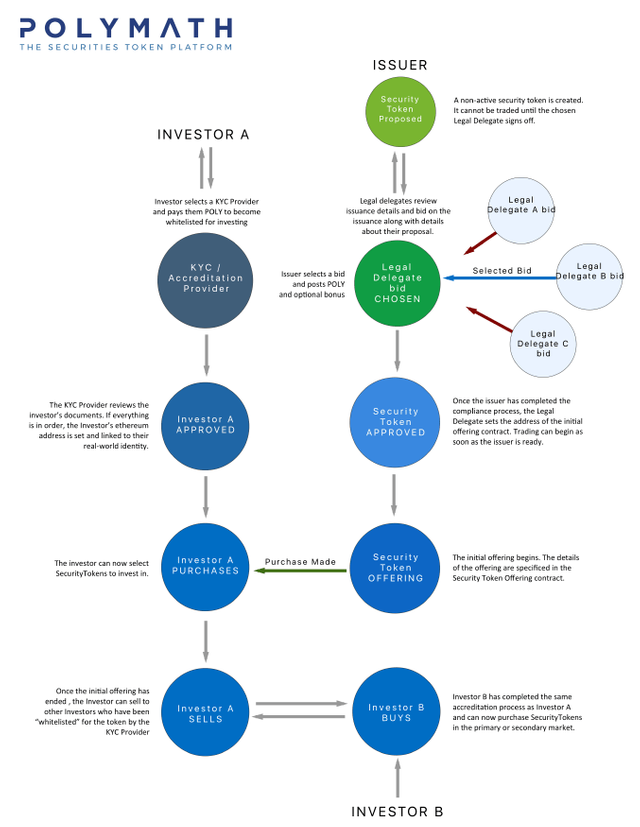

Polymath (POLY) wants to solve this problem by creating a protocol on the blockchain allowing different parties to interact in order to raise capital and trade legally compliant securities. This should help to reduce transaction costs over time.

Polymath is built on Ethereum but it could be deployed on other platforms as well.

The parties involved are the following:

- Issuers

- Developers

- KYC providers

- Investors

- Legal delegates

The whole process is explained below. (taken from their whitepaper)

Incentives

No matter what the cryptocurrency is, it is always a good idea to ask yourself if there are any incentives to hold the tokens. In the case of Polymath, the POLY token serves to transact on the Polymath marketplace. The different markets are the following:

- KYC provider marketplace

- Legal delegate marketplace

- Developer marketplace

If we assume that the whole system and marketplace will be succesful, then we can assume that the value created within the ecosystem should have a positive effect on the network value, thus increasing the tokens' price.

Posted from my blog with SteemPress : https://satoshi.blog/2018/06/29/tokenizing-securities-polymath-poly/

Hi I gave you an upvote on your post! Please give me a follow and I will give you a follow in return and possible future votes!

Thank you in advance!