The Ultimate Guide to Cryptocurrency for Beginners. Here's everything you need to know!!

Let me guess, you heard of cryptocurrency from your friends and colleagues a few years ago but you didn't understand this tech stuff. You thought it's a gamble and you might end up losing your money in crypto. But now everyone around you is rolling in it and making fortunes. Now you are thinking of diving in too but Ah! This tech stuff is too complicated. Isn't it?

That's where I come in, my friend, your personal guide to take you up the ladder with me. I'll teach you everything you need to know from what is a cryptocurrency to how you can invest in it and hit the jackpot. By the end of this article, I guarantee that you will understand everything you need to know about cryptocurrency.

I'll break it down for you in the simplest possible terms so you can understand it completely. If you are planning to invest in crypto, you must know the ins and outs of it. Let's start with the basics.

What is Cryptocurrency?

"Cryptocurrency is a digital currency." Just as we have dollars and pounds, cryptocurrency is a virtual currency. You might be thinking, Okay! I get it, it's a currency but where is it, who is controlling it, how it is managed? All these questions arose in my mind when I first heard about it but that's the fun part, there is no physical form of cryptocurrency. You can't buy bitcoin and stack it under your mattress like conventional money. It's all on the computers. Isn't it amazing?

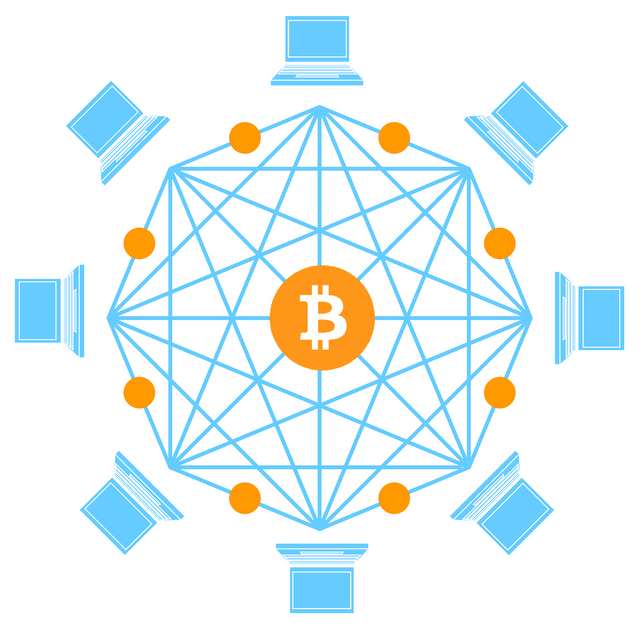

"Cryptocurrency is decentralised." What does that mean? Let me explain it with an example. You have a 10 dollars and you want pounds in exchange for them. You go to a bank, give them your dollars and get pounds in exchange. How many pounds you'll get for your 10 dollars? It's managed by the government and the banks. All the conventional currencies are regulated by the stock market and the banks. But there is no bank or government to regulate the cryptocurrency. No country or government can control the value of cryptocurrency. This makes it a decentralised currency. Fascinating, right?

How Cryptocurrency works

You may be thinking, Okay Sameer, I get it. It's nothing tangible, all in the air. No one controls it. But then how does it operate? Is it even safe to invest in it? Hold on, pal. Take a deep breath and let's dive in together.

"Cryptocurrency uses cryptography for encrypted secure transactions recorded on a ledger." A few decades back, all the account information, transactions and deposits were recorded in books called ledgers. Similarly, cryptocurrency records all the transactions and deposits in a single digital ledger distributed across all crypto users. Even you can download this crypto ledger on your computer. This ledger has a record of all transactions and deposits starting from the first-ever crypto exchange back in 2009.

Now, you know about the ledger, let's move onto the blockchain before we start connecting all the dots.

What is a BlockChain

Crypto exchanges are recorded on a blockchain. Blockchain technology secures and verifies any transaction or deposit. Remember the ledger? A blockchain, in the case of cryptocurrency, is a huge ledger that records all crypto exchanges on the planet. It builds trust by preventing any false transaction. Consider a book on which all transactions are recorded. Each page(block) has a single transaction. The pages are all connected together to make a book(blockchain). In cryptocurrency, each block corresponds to a page. All the blocks are connected to make a blockchain. Everyone who uses cryptocurrency has a copy of blockchain simultaneously updated as new transactions are performed. Remember! It's all digital. There are no actual blocks or chains. All transactions are recorded in the form of unique digits and codes.

How Blockchain makes Cryptocurrency secure

"In cryptocurrency, each block contains information about a single transaction and the one preceding it." Suppose Sameer buys 5 bitcoins from Sam. It will be recorded on a block plus the previous transaction that occurred. Now when John buys bitcoin from Sally, it'll be written on the next block along with Sameer's purchase which is also documented in the previous block. If a hacker adds a fake purchase of bitcoin, he or she would also have to change the purchase on all the preceding blocks which is impossible. With blockchain technology, it's impossible to add a false transaction. See! I'm sure now you know it's very difficult to fabricate the records and get away with someone else's money.

Consensus Model

To understand a consensus model, let's assume a huge hospital. You are the one managing the records department. You keep records of all the patients, payments and medical reports. You can alter the files or change the medical records but there is the owner and the hospital management who supervise everything. But, no owner or manager controls the blockchain. That's where the consensus model comes in. Hundreds of thousands of users participate in the network so it functions properly. There are two widely used consensus models. i.e.Proof of Work and Proof of Stake. We'll get into them too.

How new blocks are added to the blockchain

We have established that cryptocurrency is decentralized with no one managing or controlling the currency. Then who adds the new blocks to the chain? This is the first question that arises after understanding the blockchain. The answer is "Proof of Work" and "Proof of Stake". Huh, another complicated term. Hold on a little more, we are almost there.

Proof of work(PoW) requires solving difficult computational puzzles but once done they can be easily verified. Computers race to solve this puzzle called 'Miners'. It requires powerful computers. Once that complicated puzzle is solved, other computers verify it. In this way, a new block is added and the miner gets a rewarding cryptocurrency. Adding a new fake block would require 51% of computing power, which is a billion-dollar investment and the return will not be the same as the effort. Bitcoin uses this consensus model to verify transactions.

Proof of stake(PoS) algorithm doesn't have miners. Instead, there are validators. A single node is selected to verify the transaction called the 'Validator'. In PoW, all miners race to solve the puzzle but only one gets the prize. It results in energy wastage. It is solved by PoS. A single validator is selected to solve the problem, verify the transaction and then rewarded. The validator has to deposit more money in a virtual locker to qualify. In case, the validator verifies a wrong transaction, the locker money would be confiscated. He or she has more money at stake than what they would get by verifying a false transaction and hence the name 'Proof of Stake'.

How to Invest in Cryptocurrency

You can buy cryptocurrency from various brokers. Some cryptocurrencies like bitcoin and ethereum can be purchased with real money. Others can be bought by exchanging them with another cryptocurrency. In order to invest in a cryptocurrency, you will need a 'wallet'. A wallet stores your cryptocurrency. There are several brokers on the internet where you can purchase a wallet as well as cryptocurrencies. Coinbase, eToro, Robinhood are some popular names.

How to Not Lose Money in Cryptocurrency

People are indeed making a killing in cryptocurrency. Bitcoins, ethereum, dogecoins, everything seems fascinating once you get it. But after all, they are coins and there are always two sides to a coin. Now that you know about how it all works, let me tell you a few things that you must avoid at all costs to make a successful business out of cryptocurrency.

- Don't invest a huge chunk of your income in cryptocurrency. You may read a hundred more blogs on investing and trading but believe me, you can't understand until you enter the market. Always start small.

- Invest what you can afford to lose. There is always a chance that things will go downhill. Never invest what you'll be needing in the next 6-7 months. Always invest money that you will not feel sad to lose.

- Don't let greed take over. This market is highly volatile. Never let your emotions control the sails. Always make decisions wisely. Take all factors into consideration.

- Always select a trusted platform for buying and selling cryptocurrency. You may find many platforms out there with cheap offers but most of them are scams. Your money is at the stake so don't be rash and do your homework before making any investment.

- Be realistic. Cryptocurrencies have performed incredibly well in the past. But there were times when the graph went down. Don't expect to build mansions overnight. Have a logical and practical approach towards the market.

Our brain works on visuals. Cryptocurrency has no physical value. We are unable to see or hold it. That's why many people find it frightening. But, it can not be denied that cryptocurrency is the future. It can possibly replace conventional money and become the new normal. So, the earlier our brain accepts it, the better it will be for our future.